Explore Navy Federal business loan options, including term loans, lines of credit, and commercial mortgages, with competitive rates and flexible repayment terms for entrepreneurs and small business owners.

As a business owner, accessing capital is crucial for growth, expansion, and navigating unexpected challenges. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers a range of business loan options tailored to meet the diverse needs of its members. With a history of serving the military community and their families, Navy Federal has expanded its services to include business financing solutions that are competitive, flexible, and designed to support the success of businesses of all sizes.

For entrepreneurs and small business owners, securing financing can be a daunting task, especially when navigating the complexities of traditional banking. Navy Federal Credit Union simplifies this process by providing straightforward, member-centric loan options that cater to various business needs. Whether it's funding for daily operations, purchasing equipment, or expanding into new markets, Navy Federal's business loans are structured to help businesses thrive. The credit union's commitment to its members is evident in its competitive rates, flexible terms, and personalized service, making it an attractive alternative to traditional banks.

The importance of choosing the right financing partner cannot be overstated. A lender that understands the unique challenges and opportunities of the business world can provide invaluable support. Navy Federal Credit Union, with its rich history and deep roots in the community, offers more than just financial products; it provides a partnership that is grounded in a deep understanding of its members' needs. By leveraging its extensive experience and knowledge, Navy Federal helps businesses make informed financial decisions, ensuring they are well-equipped to face the future with confidence.

Overview of Navy Federal Business Loans

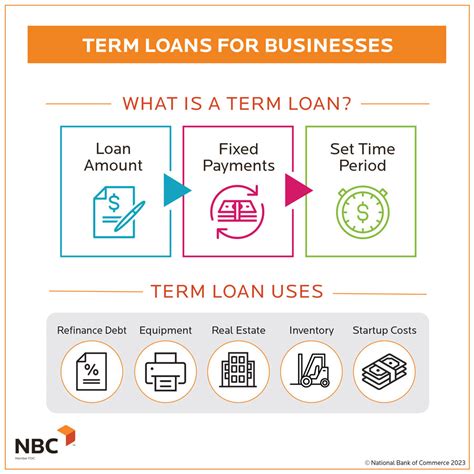

Navy Federal Credit Union offers a comprehensive suite of business loan products, each designed to address specific business requirements. From lines of credit that provide flexible access to funds for managing cash flow and covering operational expenses, to term loans that offer a lump sum for significant investments such as equipment purchases or business expansion, Navy Federal's loan options are as diverse as the businesses they serve. Additionally, the credit union provides commercial real estate loans for businesses looking to purchase, construct, or refinance property, and vehicle loans for acquiring or leasing vehicles essential to business operations.

Types of Business Loans

Navy Federal's business loan portfolio includes: - **Business Lines of Credit**: Ideal for managing day-to-day expenses, handling unexpected costs, or capitalizing on new opportunities. - **Term Loans**: Suitable for long-term investments, such as purchasing equipment, expanding operations, or consolidating debt. - **Commercial Real Estate Loans**: Designed for businesses seeking to acquire, construct, or refinance commercial property. - **Vehicle Loans**: Available for the purchase or lease of vehicles necessary for business use.Benefits of Navy Federal Business Loans

The benefits of choosing Navy Federal for business financing are multifaceted. Members enjoy competitive interest rates, which can significantly reduce the cost of borrowing. Flexible repayment terms are designed to align with the business's cash flow, reducing the strain of loan repayments. Moreover, the application process is streamlined and efficient, ensuring that businesses can access the funds they need quickly. Navy Federal's commitment to its members is also reflected in its personalized service, where experienced professionals work closely with business owners to understand their unique needs and provide tailored financial solutions.

Application Process

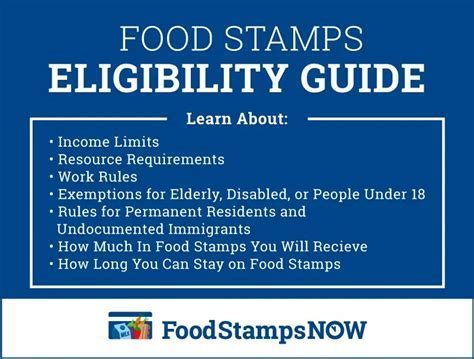

The application process for Navy Federal business loans is designed to be straightforward and efficient. Prospective borrowers can apply online, by phone, or in person at a branch. The required documentation typically includes business financial statements, tax returns, and personal financial information for the business owners. Navy Federal's team reviews each application carefully, considering the business's financial health, credit history, and loan purpose to determine eligibility and terms.Eligibility and Requirements

To be eligible for a Navy Federal business loan, applicants must be members of the credit union. Membership is open to active duty, retired, and veteran members of the U.S. military, as well as their families and certain civilian employees of the military. Businesses must also meet specific financial and operational criteria, which may include a minimum credit score, annual revenue requirements, and time in business. Navy Federal considers each application on a case-by-case basis, taking into account the business's overall financial situation and potential for growth.

Membership Benefits

Beyond the competitive loan products, Navy Federal membership offers a range of benefits designed to support business success. These include access to business checking and savings accounts, credit cards, and investment services. Members also benefit from educational resources and seminars on topics such as financial management, marketing, and business planning, further enhancing their ability to make informed decisions and drive growth.Conclusion and Next Steps

For businesses seeking a trusted financial partner, Navy Federal Credit Union's business loan options offer a compelling solution. With competitive rates, flexible terms, and a deep understanding of the business community, Navy Federal is well-positioned to support businesses at every stage of their journey. Whether you're a startup looking for initial funding or an established business seeking to expand, Navy Federal's team is dedicated to helping you achieve your goals.

Final Considerations

Before applying for a Navy Federal business loan, it's essential to carefully review your business's financial situation, ensure you meet the eligibility criteria, and choose the loan product that best aligns with your business objectives. By doing so, you can leverage Navy Federal's business loans as a powerful tool for growth, expansion, and success.Navy Federal Business Loan Image Gallery

We invite you to share your thoughts and experiences with Navy Federal business loans in the comments below. If you found this information helpful, please consider sharing it with others who may be seeking financing solutions for their businesses. Together, we can support the growth and success of businesses in our community.