Discover 5 essential Navy Federal insurance tips, including coverage options, membership benefits, and claims processing, to make informed decisions about auto, home, and life insurance policies.

As a member of Navy Federal Credit Union, you have access to a wide range of insurance products designed to protect you and your loved ones from life's uncertainties. Whether you're a military service member, veteran, or civilian, having the right insurance coverage can provide peace of mind and financial security. In this article, we'll explore five Navy Federal insurance tips to help you make informed decisions about your insurance needs.

Insurance is an essential aspect of personal finance, and it's crucial to understand the different types of coverage available to you. From auto and home insurance to life and health insurance, each type of policy serves a unique purpose. By understanding your insurance options, you can create a comprehensive protection plan that meets your individual needs and budget. In the following sections, we'll delve into the world of Navy Federal insurance, providing you with valuable tips and insights to help you navigate the complex insurance landscape.

The importance of insurance cannot be overstated. It's a safety net that protects you from financial losses due to unforeseen events, such as accidents, natural disasters, or illness. Without adequate insurance coverage, you may be left with significant out-of-pocket expenses, which can be devastating to your financial well-being. Navy Federal Credit Union offers a range of insurance products that cater to the unique needs of its members, including military personnel, veterans, and their families. By taking advantage of these insurance offerings, you can ensure that you and your loved ones are protected from life's uncertainties.

Understanding Navy Federal Insurance Options

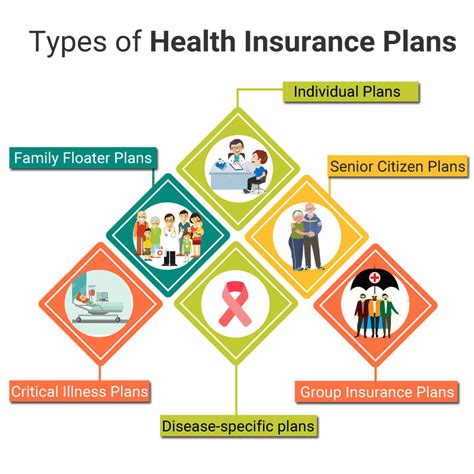

Types of Navy Federal Insurance

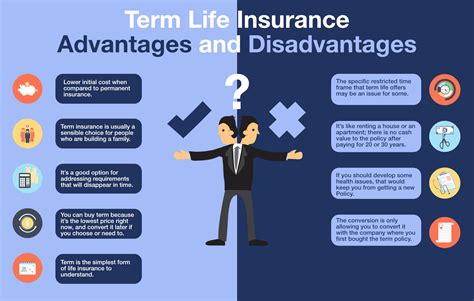

Navy Federal Credit Union offers the following types of insurance: * Auto insurance: Provides protection against financial losses due to accidents or vehicle damage. * Home insurance: Protects your home and personal belongings against damage or loss due to natural disasters, theft, or other events. * Life insurance: Provides a financial safety net for your loved ones in the event of your passing. * Health insurance: Helps cover medical expenses due to illness or injury. * Disability insurance: Provides income protection if you become unable to work due to illness or injury.Tip 1: Assess Your Insurance Needs

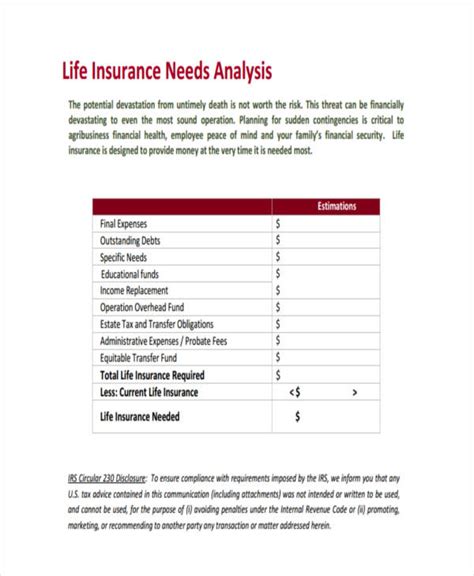

Factors to Consider When Assessing Your Insurance Needs

When assessing your insurance needs, consider the following factors: * Income: How much money do you earn, and how would your loved ones be affected if you were no longer able to work? * Expenses: What are your monthly expenses, and how would you pay for them if you were unable to work? * Debts: Do you have any outstanding debts, such as a mortgage or credit card balances? * Dependents: Do you have any dependents, such as a spouse or children, who rely on you for financial support? * Health: Do you have any pre-existing medical conditions, or are you at risk for certain health problems? * Occupation: Does your job involve any risks or hazards that could impact your income or health?Tip 2: Choose the Right Insurance Provider

Benefits of Choosing Navy Federal as Your Insurance Provider

By choosing Navy Federal as your insurance provider, you can enjoy the following benefits: * Competitive rates: Navy Federal offers competitive insurance rates that can help you save money on your premiums. * Flexible coverage options: Navy Federal provides a range of coverage options that can be tailored to your unique needs and budget. * Exceptional customer service: Navy Federal is committed to providing exceptional customer service, ensuring that you receive the support and guidance you need to make informed insurance decisions.Tip 3: Understand Your Policy

Key Components of an Insurance Policy

An insurance policy typically includes the following key components: * Premium: The amount you pay for your insurance coverage. * Deductible: The amount you must pay out-of-pocket before your insurance coverage kicks in. * Coverage limits: The maximum amount your insurance provider will pay for a claim. * Exclusions: Events or circumstances that are not covered by your insurance policy. * Conditions: Requirements you must meet to maintain your insurance coverage.Tip 4: Review and Update Your Coverage Regularly

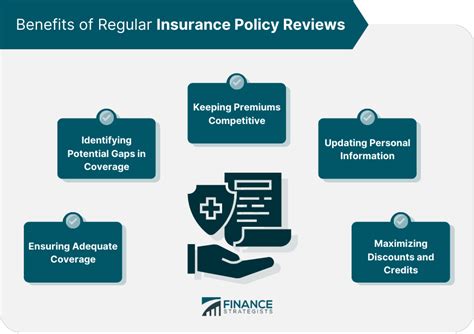

Why Reviewing and Updating Your Coverage is Important

Reviewing and updating your coverage regularly is important because: * Your insurance needs may change: As your life circumstances change, your insurance needs may also change. * New coverage options may become available: Insurance providers may introduce new coverage options or features that can better meet your needs. * You may be able to save money: Reviewing and updating your coverage can help you identify opportunities to save money on your premiums.Tip 5: Take Advantage of Discounts and Incentives

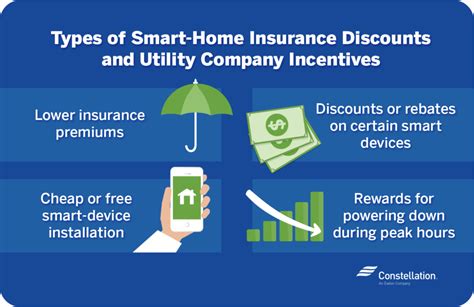

Types of Discounts and Incentives Available

Navy Federal may offer the following types of discounts and incentives: * Bundling discounts: Discounts for purchasing multiple insurance policies from the same provider. * Safe driver discounts: Discounts for having a good driving record or completing a defensive driving course. * Good credit discounts: Discounts for having a good credit score. * Loyalty discounts: Discounts for being a long-term customer or policyholder.Navy Federal Insurance Gallery

In conclusion, Navy Federal insurance offers a range of benefits and protections that can help you achieve financial security and peace of mind. By following these five tips, you can make informed decisions about your insurance needs, choose the right insurance provider, understand your policy, review and update your coverage regularly, and take advantage of discounts and incentives. Whether you're a military service member, veteran, or civilian, Navy Federal insurance can provide you with the protection and support you need to navigate life's uncertainties. We invite you to share your thoughts and experiences with Navy Federal insurance in the comments below, and to explore the various insurance options available to you. By working together, we can create a community that is informed, protected, and empowered to achieve financial success.