Calculate car loan payments with Navy Federals tool, using auto loan rates, terms, and credit scores to estimate costs, refinance options, and savings, making informed financing decisions easier.

Purchasing a vehicle can be a significant investment, and understanding the financial implications is crucial. With the rise of online tools and calculators, consumers can now easily estimate their car loan costs and make informed decisions. One such tool is the Navy Federal Car Loan Calculator, designed to help members of the Navy Federal Credit Union plan their vehicle purchases. In this article, we will delve into the world of car loan calculators, exploring their importance, benefits, and how the Navy Federal Car Loan Calculator can assist in making smart financial choices.

The process of buying a car involves numerous factors, including the purchase price, interest rates, loan terms, and monthly payments. A car loan calculator is an essential tool that helps individuals navigate these variables, providing a clear picture of the total cost of ownership. By using a car loan calculator, buyers can determine how much they can afford, identify the best loan options, and avoid financial pitfalls. The Navy Federal Car Loan Calculator is a valuable resource for members of the credit union, offering a user-friendly interface and accurate calculations to simplify the car-buying process.

In today's fast-paced digital landscape, car loan calculators have become an indispensable tool for consumers. These calculators are readily available online, allowing users to input their specific details and receive instant results. The Navy Federal Car Loan Calculator is no exception, providing members with a convenient and reliable way to estimate their car loan costs. By leveraging this tool, individuals can make informed decisions, avoid costly mistakes, and drive away in their new vehicle with confidence.

Navy Federal Car Loan Calculator Features

The Navy Federal Car Loan Calculator is designed to provide members with a comprehensive overview of their car loan costs. Some of the key features of this tool include:

- Loan amount calculator: This feature allows users to determine how much they can borrow based on their income, expenses, and credit score.

- Interest rate calculator: Members can use this feature to estimate their interest rate and monthly payments.

- Loan term calculator: This feature enables users to choose from various loan terms, such as 36, 48, or 60 months, and calculate their monthly payments accordingly.

- Payment calculator: The payment calculator allows members to input their loan amount, interest rate, and loan term to determine their monthly payments.

Benefits of Using the Navy Federal Car Loan Calculator

The Navy Federal Car Loan Calculator offers numerous benefits to members, including: * Accurate calculations: The calculator provides precise estimates of car loan costs, helping members make informed decisions. * Time-saving: The tool saves members time and effort by automating calculations and providing instant results. * Financial planning: The calculator enables members to plan their finances effectively, avoiding costly mistakes and ensuring they can afford their vehicle. * Comparison of loan options: Members can use the calculator to compare different loan options and choose the best one for their needs.How to Use the Navy Federal Car Loan Calculator

Using the Navy Federal Car Loan Calculator is a straightforward process. Here's a step-by-step guide:

- Visit the Navy Federal Credit Union website and navigate to the car loan calculator page.

- Input your loan amount, interest rate, and loan term into the calculator.

- Choose your preferred loan term, such as 36, 48, or 60 months.

- Click the "Calculate" button to receive your estimated monthly payments.

- Review your results and adjust the variables as needed to find the best loan option for your needs.

Tips for Getting the Best Car Loan Rate

To get the best car loan rate, consider the following tips: * Check your credit score: A good credit score can help you qualify for lower interest rates. * Compare loan options: Research and compare different loan options from various lenders to find the best rate. * Consider a shorter loan term: While a longer loan term may result in lower monthly payments, a shorter term can save you money on interest over the life of the loan. * Make a larger down payment: A larger down payment can reduce your loan amount and lower your monthly payments.Understanding Car Loan Interest Rates

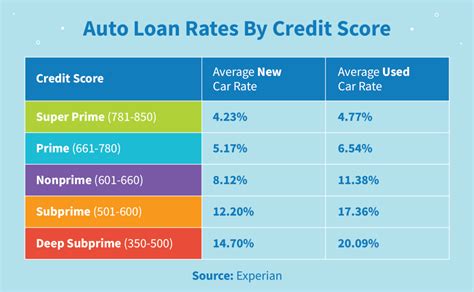

Car loan interest rates play a significant role in determining the total cost of your loan. Understanding how interest rates work can help you make informed decisions and save money on your car loan. Here are some key factors to consider:

- Fixed vs. variable interest rates: Fixed interest rates remain the same over the life of the loan, while variable rates may fluctuate.

- Interest rate types: There are two main types of interest rates: simple interest and compound interest.

- Credit score impact: Your credit score can significantly impact your interest rate, with better credit scores resulting in lower rates.

Factors That Affect Car Loan Interest Rates

Several factors can affect car loan interest rates, including: * Credit score: As mentioned earlier, your credit score plays a significant role in determining your interest rate. * Loan term: Longer loan terms often result in higher interest rates. * Loan amount: Larger loan amounts may result in higher interest rates. * Vehicle type: The type of vehicle you're purchasing can impact your interest rate, with newer vehicles often resulting in lower rates.Car Loan Calculator Tools and Resources

In addition to the Navy Federal Car Loan Calculator, there are numerous other tools and resources available to help you estimate your car loan costs. Some of these include:

- Online car loan calculators: Many websites offer car loan calculators that can provide instant estimates of your loan costs.

- Mobile apps: Several mobile apps are available that can help you calculate your car loan costs and find the best loan options.

- Financial advisors: Consulting with a financial advisor can provide personalized guidance and help you make informed decisions.

Common Car Loan Calculator Mistakes to Avoid

When using a car loan calculator, it's essential to avoid common mistakes that can impact the accuracy of your estimates. Some of these mistakes include: * Not considering all costs: Make sure to factor in all costs, including taxes, insurance, and maintenance. * Not checking your credit score: Your credit score can significantly impact your interest rate, so it's crucial to check it before applying for a loan. * Not comparing loan options: Research and compare different loan options to find the best rate and terms for your needs.Gallery of Navy Federal Car Loan Calculator Images

Navy Federal Car Loan Calculator Image Gallery

In conclusion, the Navy Federal Car Loan Calculator is a valuable tool for members of the credit union, providing accurate estimates of car loan costs and helping individuals make informed decisions. By understanding the importance of car loan calculators, the benefits of using the Navy Federal Car Loan Calculator, and how to use the tool effectively, members can navigate the car-buying process with confidence. Remember to consider all costs, check your credit score, and compare loan options to find the best rate and terms for your needs. With the Navy Federal Car Loan Calculator and a little knowledge, you can drive away in your new vehicle with a clear understanding of your financial obligations. We invite you to share your thoughts on the Navy Federal Car Loan Calculator, ask questions, or provide feedback on how we can improve our content to better serve your needs.