Discover 5 Navy Federal Certificates with competitive rates, flexible terms, and low-risk investments, offering high-yield savings, certificate dividends, and compounded interest for members.

The world of savings and investments can be overwhelming, especially for those who are new to the game. With so many options available, it can be difficult to decide where to put your money. However, for members of the Navy Federal Credit Union, there are several options that stand out from the rest. In this article, we will be discussing the 5 Navy Federal Certificates that are available to members, and how they can help you achieve your financial goals.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, with over 10 million members and $150 billion in assets. As a member-owned cooperative, Navy Federal is committed to providing its members with the best possible rates and services. One of the ways they do this is through their certificate program, which offers members a safe and secure way to grow their savings over time. Whether you're looking to save for a short-term goal or a long-term investment, Navy Federal has a certificate that can help you get there.

The certificates offered by Navy Federal are similar to CDs, or certificates of deposit, offered by traditional banks. However, because Navy Federal is a credit union, they are able to offer more competitive rates and more flexible terms. This makes them an attractive option for anyone looking to grow their savings without taking on too much risk. In the following sections, we will be discussing the 5 Navy Federal Certificates in more detail, including their rates, terms, and benefits.

Introduction to Navy Federal Certificates

Navy Federal Certificates are a type of time deposit, which means that you agree to keep your money in the account for a specified period of time in exchange for a fixed interest rate. The interest rates offered by Navy Federal are highly competitive, and the terms range from 3 months to 7 years. This makes them an attractive option for anyone looking to save for a short-term goal, such as a vacation or a down payment on a house, or a long-term investment, such as retirement.

One of the benefits of Navy Federal Certificates is that they are insured by the National Credit Union Administration (NCUA), which means that your deposits are protected up to $250,000. This makes them a very low-risk investment option, and a great way to grow your savings over time. Additionally, Navy Federal Certificates are highly liquid, which means that you can access your money if you need it, although you may face penalties for early withdrawal.

Types of Navy Federal Certificates

There are 5 different types of Navy Federal Certificates, each with its own unique benefits and features. The first type is the EasyStart Certificate, which has a minimum deposit requirement of just $50 and a term of 3 months to 5 years. This certificate is great for anyone who is just starting to save, or who wants to try out a certificate without committing to a large amount of money.

The second type is the Special EasyStart Certificate, which has a minimum deposit requirement of $50 and a term of 11 months. This certificate is similar to the EasyStart Certificate, but it offers a higher interest rate and a shorter term. The third type is the Standard Certificate, which has a minimum deposit requirement of $1,000 and a term of 3 months to 7 years. This certificate is great for anyone who wants to save a larger amount of money and earn a higher interest rate.

The fourth type is the Jumbo Certificate, which has a minimum deposit requirement of $100,000 and a term of 3 months to 7 years. This certificate is great for anyone who wants to save a very large amount of money and earn a highly competitive interest rate. Finally, the fifth type is the IRA Certificate, which has a minimum deposit requirement of $50 and a term of 3 months to 7 years. This certificate is great for anyone who wants to save for retirement and earn a tax-advantaged interest rate.

Benefits of Navy Federal Certificates

There are many benefits to using Navy Federal Certificates, including highly competitive interest rates, low-risk investment options, and high liquidity. Additionally, Navy Federal Certificates are insured by the NCUA, which means that your deposits are protected up to $250,000. This makes them a very secure way to grow your savings over time.

Another benefit of Navy Federal Certificates is that they are highly flexible, with terms ranging from 3 months to 7 years. This makes them an attractive option for anyone looking to save for a short-term goal or a long-term investment. Additionally, Navy Federal Certificates have a low minimum deposit requirement, which makes them accessible to anyone who wants to start saving.

How to Open a Navy Federal Certificate

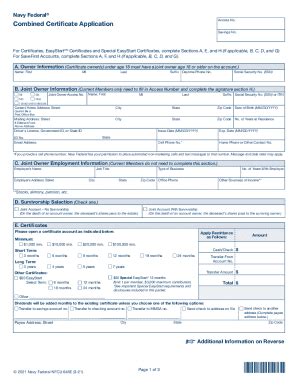

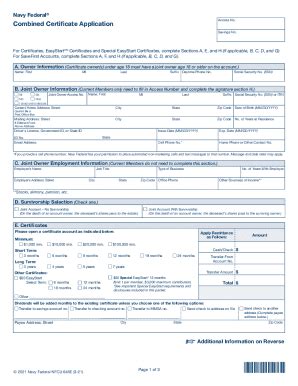

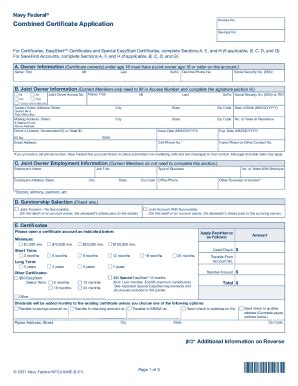

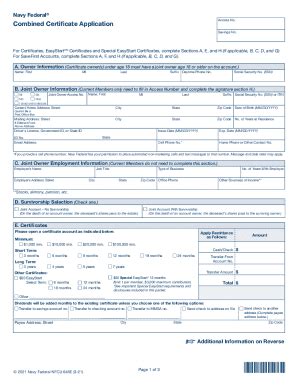

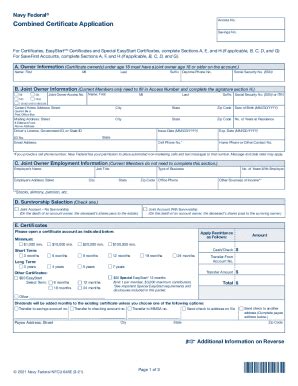

Opening a Navy Federal Certificate is a simple and straightforward process. The first step is to become a member of Navy Federal Credit Union, which you can do by visiting their website or visiting a branch in person. Once you are a member, you can open a certificate by logging into your online banking account or visiting a branch.

To open a certificate, you will need to provide some basic information, such as your name, address, and social security number. You will also need to fund your certificate with the minimum deposit requirement, which ranges from $50 to $100,000 depending on the type of certificate. Once you have opened your certificate, you can manage it online or through the Navy Federal mobile app.

Tips for Using Navy Federal Certificates

There are several tips for using Navy Federal Certificates, including starting small, taking advantage of high-yield certificates, and using laddering to maximize your returns. Starting small is a great way to get started with certificates, as it allows you to try out the product without committing to a large amount of money.

Taking advantage of high-yield certificates is another great way to maximize your returns, as they offer highly competitive interest rates. Using laddering is also a great way to maximize your returns, as it allows you to spread your risk across multiple certificates with different terms. This can help you earn a higher overall return, while also reducing your risk.

Gallery of Navy Federal Certificates

Navy Federal Certificates Image Gallery

In conclusion, Navy Federal Certificates are a great way to grow your savings over time, with highly competitive interest rates, low-risk investment options, and high liquidity. By following the tips outlined in this article, you can maximize your returns and achieve your financial goals. Whether you're looking to save for a short-term goal or a long-term investment, Navy Federal has a certificate that can help you get there. So why not start today and see the benefits of Navy Federal Certificates for yourself? We invite you to share your thoughts and experiences with Navy Federal Certificates in the comments below, and to share this article with anyone who may be interested in learning more about this great savings option.