Learn about Navy Federal overdraft fees and CFPB regulations, including overdraft protection, fee structures, and consumer rights, to manage accounts effectively.

The importance of understanding overdraft fees cannot be overstated, especially for individuals who rely heavily on their checking accounts for daily transactions. Navy Federal, one of the largest credit unions in the world, offers a range of financial services to its members, including checking accounts. However, like many financial institutions, Navy Federal charges overdraft fees when account holders exceed their available balance. The Consumer Financial Protection Bureau (CFPB) has been actively involved in regulating overdraft practices, aiming to protect consumers from unfair and abusive practices.

Overdraft fees can be a significant source of revenue for financial institutions, but they can also be a major burden for consumers, particularly those who are living paycheck to paycheck. According to a report by the CFPB, overdraft fees can range from $25 to $35 per transaction, and some consumers may be charged multiple overdraft fees in a single day. This can lead to a cycle of debt that is difficult to escape. Navy Federal, as a member-owned credit union, has a responsibility to its members to provide fair and transparent overdraft practices.

The CFPB has taken steps to address concerns about overdraft practices, including issuing guidelines for financial institutions to follow. These guidelines emphasize the importance of clear and transparent disclosure of overdraft fees, as well as the need for financial institutions to provide consumers with options for managing their accounts and avoiding overdrafts. Navy Federal, like other financial institutions, must comply with these guidelines and ensure that its overdraft practices are fair and consumer-friendly.

Navy Federal Overdraft Fees

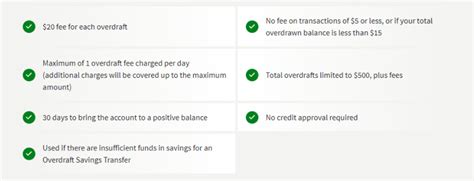

Navy Federal's overdraft fees are currently set at $29 per transaction, with a maximum of four overdraft fees per day. This means that if a member exceeds their available balance, they may be charged up to $116 in overdraft fees in a single day. While this may seem like a significant amount, it is worth noting that Navy Federal's overdraft fees are generally lower than those charged by many banks.

How Navy Federal Overdraft Fees Work

Navy Federal's overdraft fees are triggered when a member's account balance falls below zero. This can happen when a member writes a check, uses their debit card, or makes an online payment that exceeds their available balance. When this happens, Navy Federal will charge an overdraft fee, which will be deducted from the member's account.CFPB Regulations

The CFPB has implemented several regulations aimed at protecting consumers from unfair overdraft practices. These regulations include requirements for clear and transparent disclosure of overdraft fees, as well as guidelines for financial institutions to follow when processing overdraft transactions. Navy Federal, like other financial institutions, must comply with these regulations and ensure that its overdraft practices are fair and consumer-friendly.

Key CFPB Regulations

Some key CFPB regulations related to overdraft fees include: * Requirements for clear and transparent disclosure of overdraft fees * Guidelines for financial institutions to follow when processing overdraft transactions * Prohibitions on unfair and abusive overdraft practices * Requirements for financial institutions to provide consumers with options for managing their accounts and avoiding overdraftsManaging Overdraft Fees

While overdraft fees can be a significant burden for consumers, there are steps that can be taken to manage and avoid them. Some strategies for managing overdraft fees include:

- Keeping a close eye on account balances

- Setting up low-balance alerts

- Transferring funds from a savings or money market account to a checking account

- Using a budgeting app to track expenses and stay on top of finances

- Avoiding overdrafts by keeping a cushion of funds in a checking account

Benefits of Managing Overdraft Fees

Managing overdraft fees can have several benefits, including: * Avoiding costly overdraft fees * Reducing stress and anxiety related to financial management * Improving overall financial health and stability * Building a stronger relationship with a financial institutionNavy Federal Overdraft Fee Policies

Navy Federal's overdraft fee policies are designed to be fair and consumer-friendly. The credit union offers several options for managing overdrafts, including overdraft protection and overdraft lines of credit. Navy Federal also provides members with tools and resources to help them manage their accounts and avoid overdrafts.

Navy Federal Overdraft Protection

Navy Federal's overdraft protection program allows members to link their checking account to a savings or money market account. If a member's checking account balance falls below zero, funds will be transferred from the linked account to cover the overdraft. This can help members avoid costly overdraft fees and reduce the risk of overdrafts.CFPB Guidance on Overdraft Practices

The CFPB has issued guidance on overdraft practices, emphasizing the importance of clear and transparent disclosure of overdraft fees. The guidance also emphasizes the need for financial institutions to provide consumers with options for managing their accounts and avoiding overdrafts.

Key CFPB Guidance

Some key CFPB guidance on overdraft practices includes: * Requirements for clear and transparent disclosure of overdraft fees * Guidelines for financial institutions to follow when processing overdraft transactions * Prohibitions on unfair and abusive overdraft practices * Requirements for financial institutions to provide consumers with options for managing their accounts and avoiding overdraftsConsumer Protection

The CFPB's guidance on overdraft practices is designed to protect consumers from unfair and abusive practices. By requiring clear and transparent disclosure of overdraft fees, the CFPB aims to empower consumers to make informed decisions about their financial management.

Benefits of Consumer Protection

The CFPB's guidance on overdraft practices has several benefits, including: * Protecting consumers from unfair and abusive practices * Empowering consumers to make informed decisions about their financial management * Promoting transparency and accountability in the financial industry * Reducing the risk of overdrafts and costly overdraft feesOverdraft Fees Image Gallery

In conclusion, understanding overdraft fees and the regulations surrounding them is crucial for consumers who want to manage their finances effectively. Navy Federal's overdraft fees and policies are designed to be fair and consumer-friendly, and the credit union offers several options for managing overdrafts. The CFPB's guidance on overdraft practices emphasizes the importance of clear and transparent disclosure of overdraft fees and provides consumers with options for managing their accounts and avoiding overdrafts. By being informed and taking steps to manage overdraft fees, consumers can avoid costly overdraft fees and improve their overall financial health. We invite you to share your thoughts and experiences with overdraft fees in the comments below, and to explore our other resources on personal finance and consumer protection.