Boost financial stability with 5 Navy Federal Loan Tips, covering loan options, interest rates, and repayment terms, to help you make informed decisions on personal loans, credit scores, and debt management.

Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its loan program, which provides members with access to competitive interest rates, flexible repayment terms, and personalized service. Whether you're looking to purchase a new car, consolidate debt, or finance a major expense, Navy Federal loans can be a great option. In this article, we'll explore five Navy Federal loan tips to help you make the most of your borrowing experience.

When it comes to borrowing money, it's essential to do your research and understand the terms and conditions of your loan. Navy Federal offers a variety of loan products, each with its own set of benefits and drawbacks. By taking the time to review your options and choose the loan that best fits your needs, you can save money, reduce stress, and achieve your financial goals. From personal loans and credit cards to mortgages and home equity loans, Navy Federal has a loan product that can help you achieve your financial objectives.

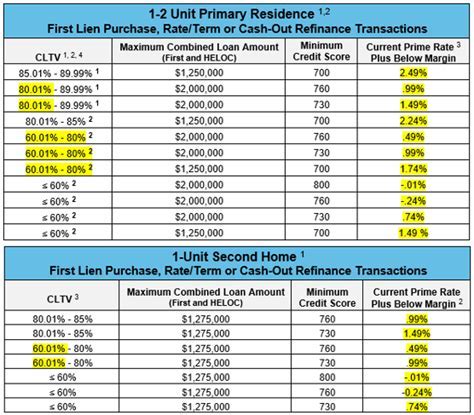

Navy Federal loans are known for their competitive interest rates, which can help you save money on your monthly payments. However, interest rates are just one factor to consider when choosing a loan. You should also think about the repayment term, fees, and other costs associated with your loan. By carefully reviewing the terms and conditions of your loan, you can avoid surprises and make informed decisions about your borrowing. Whether you're a seasoned borrower or just starting out, Navy Federal loans can provide you with the financial flexibility and support you need to achieve your goals.

Understanding Navy Federal Loan Options

Some of the most popular Navy Federal loan products include:

- Personal loans: These loans offer fixed interest rates, flexible repayment terms, and loan amounts up to $50,000.

- Credit cards: Navy Federal credit cards offer competitive interest rates, rewards programs, and no annual fees.

- Mortgages: Navy Federal mortgages offer competitive interest rates, flexible repayment terms, and loan amounts up to $1 million.

- Home equity loans: These loans allow you to borrow against the equity in your home, with loan amounts up to $500,000.

Navy Federal Loan Benefits

How to Apply for a Navy Federal Loan

Applying for a Navy Federal loan is a straightforward process that can be completed online, by phone, or in person. To apply, you'll need to provide some basic information, such as your name, address, and social security number. You'll also need to provide financial information, such as your income, expenses, and credit history. By applying for a Navy Federal loan, you can gain access to competitive interest rates, flexible repayment terms, and personalized service.Some of the steps involved in applying for a Navy Federal loan include:

- Checking your eligibility: Before applying, you'll need to check your eligibility for a Navy Federal loan. This can be done online or by contacting a Navy Federal representative.

- Gathering required documents: You'll need to gather some basic documents, such as your ID, social security number, and financial information.

- Submitting your application: Once you've gathered the required documents, you can submit your application online, by phone, or in person.

- Reviewing and signing your loan agreement: If your application is approved, you'll need to review and sign your loan agreement, which outlines the terms and conditions of your loan.

Navy Federal Loan Repayment Options

Navy Federal Loan Forgiveness Options

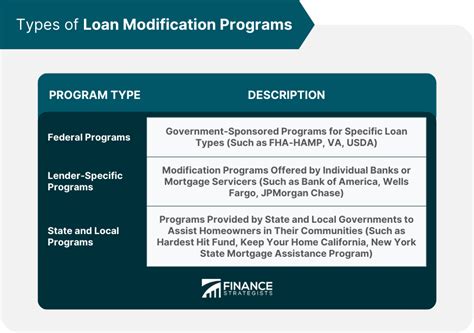

Navy Federal loans offer a number of forgiveness options that can help you manage your debt and achieve your financial goals. Some of the most popular forgiveness options include: * Debt consolidation: Debt consolidation can help you combine multiple debts into a single loan with a lower interest rate and a single monthly payment. * Loan modification: Loan modification can help you modify the terms of your loan, such as the interest rate or repayment term, to make your payments more affordable. * Debt management plans: Debt management plans can help you create a budget and repayment plan that can help you manage your debt and achieve your financial objectives.Navy Federal Loan Customer Service

Navy Federal Loan FAQs

Navy Federal loans have a number of frequently asked questions that can help you understand the borrowing process and achieve your financial objectives. Some of the most common FAQs include: * What are the interest rates for Navy Federal loans? * How do I apply for a Navy Federal loan? * What are the repayment terms for Navy Federal loans? * Can I consolidate my debt with a Navy Federal loan? * How do I contact Navy Federal customer service?Navy Federal Loan Image Gallery

By following these five Navy Federal loan tips, you can make the most of your borrowing experience and achieve your financial goals. Whether you're looking to purchase a new car, consolidate debt, or finance a major expense, Navy Federal loans can provide you with the financial flexibility and support you need. So why wait? Apply for a Navy Federal loan today and start achieving your financial objectives. We invite you to share your thoughts and experiences with Navy Federal loans in the comments below. Have you applied for a Navy Federal loan? What was your experience like? Do you have any tips or advice for others who are considering applying for a Navy Federal loan? Share your story and help others make informed decisions about their borrowing.