Discover 5 ways Navy Federal Business Works enhances business banking with membership benefits, business loans, and credit card solutions, offering financial management and business growth opportunities.

The world of business banking can be complex and overwhelming, especially for small business owners or entrepreneurs who are just starting out. With so many options available, it can be difficult to know which bank to choose and how to navigate the various services and products that are offered. One option that is worth considering is Navy Federal Business, a division of Navy Federal Credit Union that provides business banking services to its members. In this article, we will explore five ways that Navy Federal Business works and how it can help businesses succeed.

Navy Federal Business is designed to provide businesses with the financial tools and resources they need to grow and thrive. From checking and savings accounts to loans and credit cards, Navy Federal Business offers a wide range of products and services that can help businesses manage their finances and achieve their goals. Whether you are just starting out or are an established business, Navy Federal Business has the expertise and resources to help you succeed.

One of the key benefits of Navy Federal Business is its commitment to providing personalized service to its members. Unlike larger banks, which can often seem impersonal and bureaucratic, Navy Federal Business takes a more personalized approach to banking. This means that business owners can work closely with a dedicated team of professionals who understand their unique needs and goals. By taking the time to get to know each business and its owners, Navy Federal Business can provide tailored solutions that meet their specific needs.

Business Checking and Savings Accounts

Some of the key features of Navy Federal Business checking and savings accounts include:

- No monthly maintenance fees

- No minimum balance requirements

- Unlimited transactions

- Free online banking and bill pay

- Free mobile banking By offering these features, Navy Federal Business provides businesses with the tools they need to manage their finances effectively and efficiently.

Business Loans and Credit Cards

Some of the key features of Navy Federal Business loans and credit cards include:

- Competitive interest rates

- Flexible repayment terms

- No prepayment penalties

- Access to a dedicated team of professionals

- Fast and easy application process By offering these features, Navy Federal Business provides businesses with the financing they need to succeed.

Online Banking and Mobile Banking

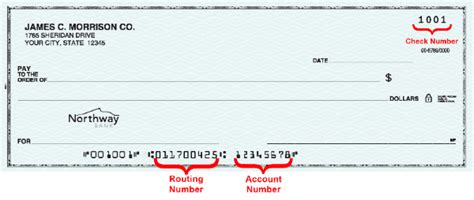

Some of the key features of Navy Federal Business online and mobile banking include:

- Secure and convenient access to accounts

- Ability to transfer funds and pay bills

- Access to account statements and transaction history

- Ability to deposit checks remotely

- Personalized alerts and notifications By offering these features, Navy Federal Business provides businesses with the tools they need to manage their finances effectively and efficiently.

Business Services and Support

Some of the key features of Navy Federal Business services and support include:

- Access to a dedicated team of professionals

- Guidance and advice on business topics

- Access to educational resources and workshops

- Opportunities to network with other businesses

- Access to exclusive discounts and promotions By offering these features, Navy Federal Business provides businesses with the support they need to succeed.

Membership and Eligibility

Some of the key benefits of membership include:

- Access to a wide range of financial products and services

- Competitive interest rates and terms

- Personalized service and support

- Access to educational resources and workshops

- Opportunities to network with other businesses By offering these benefits, Navy Federal Business provides businesses with the tools they need to succeed.

Business Banking Image Gallery

In conclusion, Navy Federal Business is a valuable resource for businesses of all sizes. By providing a wide range of financial products and services, including checking and savings accounts, loans and credit cards, online banking and mobile banking, business services and support, and membership and eligibility, Navy Federal Business helps businesses succeed and achieve their goals. Whether you are just starting out or are an established business, Navy Federal Business has the expertise and resources to help you grow and thrive. We invite you to share your thoughts and experiences with Navy Federal Business in the comments below, and to share this article with others who may be interested in learning more about business banking services.