Consolidate debt with Navy Federal loans, offering low rates and flexible terms, helping members manage credit card debt, personal loans, and bills, with benefits like simplified payments and reduced interest rates.

Debt consolidation can be a viable option for individuals struggling with multiple debts, such as credit cards, personal loans, and other financial obligations. It involves combining these debts into a single loan with a lower interest rate and a longer repayment period, making it easier to manage and pay off. One of the popular options for debt consolidation is the Navy Federal Debt Consolidation Loan, offered by Navy Federal Credit Union. This loan is designed to help members consolidate their debts and improve their financial situation.

The importance of debt consolidation cannot be overstated. Managing multiple debts can be overwhelming, and it's easy to fall behind on payments. This can lead to late fees, penalty interest rates, and damage to credit scores. By consolidating debts, individuals can simplify their finances, reduce their monthly payments, and save money on interest. Moreover, debt consolidation can provide a sense of relief and reduce stress, allowing individuals to focus on other aspects of their lives.

Debt consolidation is not a new concept, and it has been around for decades. However, with the rise of online lending and credit unions, it has become more accessible and convenient. Navy Federal Credit Union, in particular, has been a popular choice for debt consolidation due to its competitive interest rates, flexible terms, and member-friendly approach. As one of the largest credit unions in the United States, Navy Federal has a long history of serving its members and providing them with financial solutions tailored to their needs.

Navy Federal Debt Consolidation Loan Overview

The Navy Federal Debt Consolidation Loan is a personal loan designed to help members consolidate their debts and improve their financial situation. This loan offers a range of benefits, including competitive interest rates, flexible repayment terms, and no origination fees. Members can borrow up to $50,000, depending on their creditworthiness and income, and choose from a variety of repayment terms, including 60, 72, and 84 months.

One of the key advantages of the Navy Federal Debt Consolidation Loan is its competitive interest rate. Compared to other lenders, Navy Federal offers some of the lowest interest rates on the market, making it an attractive option for individuals looking to consolidate their debts. Additionally, the loan has no origination fees, which means that members don't have to pay any upfront costs to apply for the loan.

Benefits of Navy Federal Debt Consolidation Loan

The Navy Federal Debt Consolidation Loan offers several benefits, including: * Competitive interest rates * Flexible repayment terms * No origination fees * Simplified finances * Reduced monthly payments * Improved credit scoreThese benefits make the Navy Federal Debt Consolidation Loan an attractive option for individuals looking to consolidate their debts and improve their financial situation. By combining multiple debts into a single loan, members can simplify their finances, reduce their monthly payments, and save money on interest.

How to Apply for Navy Federal Debt Consolidation Loan

Applying for the Navy Federal Debt Consolidation Loan is a straightforward process. Members can apply online, by phone, or in person at a Navy Federal branch. To apply, members will need to provide some basic information, including their income, employment history, and credit score. They will also need to provide information about the debts they want to consolidate, including the outstanding balance and interest rate.

Once the application is submitted, Navy Federal will review it and provide a decision within a few business days. If approved, the loan will be disbursed, and members can use the funds to pay off their debts. The repayment period will begin immediately, and members can choose from a variety of repayment options, including automatic payments and online payments.

Eligibility Requirements

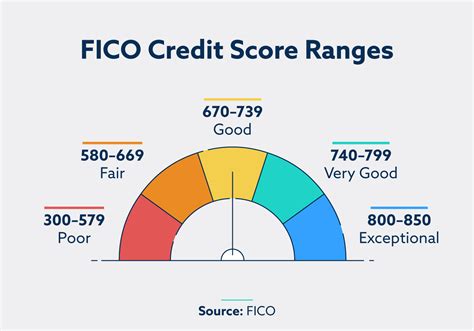

To be eligible for the Navy Federal Debt Consolidation Loan, members must meet certain requirements, including: * Being a member of Navy Federal Credit Union * Having a minimum credit score of 600 * Having a stable income and employment history * Having a debt-to-income ratio of less than 40%These requirements are in place to ensure that members are able to repay the loan and that the loan is a good fit for their financial situation. By meeting these requirements, members can increase their chances of being approved for the loan and getting the financial help they need.

Navy Federal Debt Consolidation Loan Rates and Terms

The Navy Federal Debt Consolidation Loan offers competitive interest rates and flexible repayment terms. The interest rate will depend on the member's credit score and income, as well as the loan amount and repayment term. Generally, the interest rate will range from 6.99% to 18.00% APR, depending on the loan terms.

The repayment terms will also vary, depending on the loan amount and interest rate. Members can choose from a variety of repayment terms, including 60, 72, and 84 months. The monthly payment will be calculated based on the loan amount, interest rate, and repayment term, and will be due on the same day each month.

Repayment Options

Navy Federal offers a range of repayment options, including: * Automatic payments * Online payments * Phone payments * Mail paymentsThese repayment options make it easy for members to make their monthly payments and stay on track with their loan. By choosing the right repayment option, members can ensure that they never miss a payment and that their loan is paid off on time.

Navy Federal Debt Consolidation Loan Reviews

The Navy Federal Debt Consolidation Loan has received positive reviews from members who have used the loan to consolidate their debts. Many members have reported that the loan has helped them simplify their finances, reduce their monthly payments, and improve their credit score.

One member reported that the loan had saved them over $500 per month in interest payments, and that they were able to pay off their debts in just a few years. Another member reported that the loan had helped them consolidate their credit card debt and improve their credit score, allowing them to qualify for a lower interest rate on their mortgage.

Common Complaints

While the Navy Federal Debt Consolidation Loan has received positive reviews, there are some common complaints from members. Some members have reported that the application process can be lengthy and that the interest rates are not always competitive. Others have reported that the loan terms are not flexible enough, and that the repayment period is too long.However, these complaints are not unique to Navy Federal, and are common among many lenders. By doing their research and comparing rates and terms, members can find the best loan for their needs and avoid common pitfalls.

Navy Federal Debt Consolidation Loan Image Gallery

In conclusion, the Navy Federal Debt Consolidation Loan is a viable option for individuals looking to consolidate their debts and improve their financial situation. With its competitive interest rates, flexible repayment terms, and no origination fees, this loan can help members simplify their finances, reduce their monthly payments, and save money on interest. By doing their research and comparing rates and terms, members can find the best loan for their needs and achieve financial freedom. We invite you to share your thoughts and experiences with debt consolidation loans in the comments section below, and to share this article with anyone who may be struggling with debt.