Unlock smart borrowing with 5 HELOC tips, including home equity management, loan options, and credit score optimization for wise financial decisions.

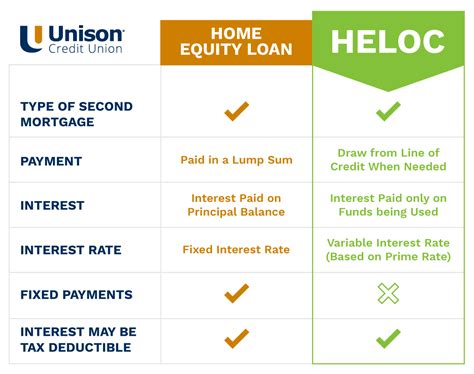

Home equity lines of credit, commonly referred to as HELOCs, have become a popular financial tool for homeowners looking to tap into the value of their property. With a HELOC, individuals can borrow money using the equity in their home as collateral, often at a lower interest rate than other types of loans. However, navigating the world of HELOCs can be complex, and it's essential to understand the ins and outs before making a decision. In this article, we'll delve into the world of HELOCs, exploring their benefits, drawbacks, and providing valuable tips for those considering this financial option.

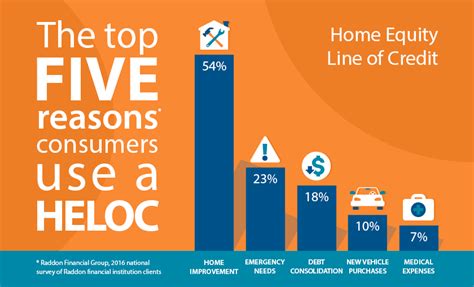

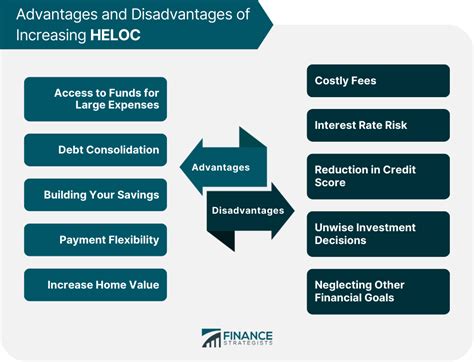

For many homeowners, a HELOC can be a lifeline, providing access to much-needed funds for home renovations, debt consolidation, or other significant expenses. However, it's crucial to approach HELOCs with caution, as they can also lead to financial difficulties if not managed properly. With the right knowledge and strategy, a HELOC can be a powerful tool for achieving financial goals. In the following sections, we'll discuss the key aspects of HELOCs, including their advantages, disadvantages, and essential tips for making the most of this financial product.

A HELOC can be a valuable resource for homeowners, offering a flexible and often cost-effective way to borrow money. By understanding how HELOCs work and being aware of the potential pitfalls, individuals can make informed decisions about whether this financial tool is right for them. With the ability to borrow and repay funds as needed, a HELOC can provide a sense of security and financial freedom. However, it's essential to carefully consider the terms and conditions of a HELOC before signing on the dotted line. In the next section, we'll explore the benefits and drawbacks of HELOCs in more detail, providing a comprehensive overview of this financial product.

Understanding Heloc Benefits

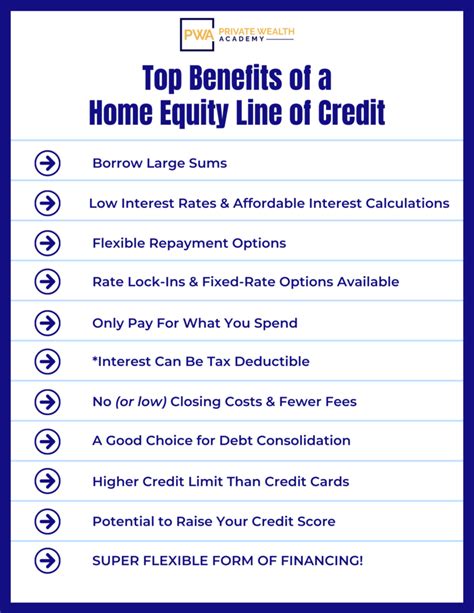

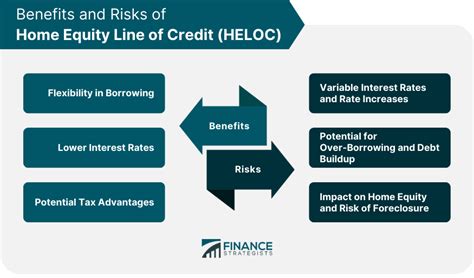

Some of the key benefits of HELOCs include:

- Flexibility: Borrowers can access funds as needed, making it an ideal option for ongoing expenses or projects.

- Lower interest rates: HELOCs often come with lower interest rates than other types of loans, making them a more affordable option for borrowing money.

- Tax benefits: The interest paid on a HELOC may be tax-deductible, providing additional savings for borrowers.

- Large borrowing limits: HELOCs often have large borrowing limits, making them a good option for significant expenses or projects.

Heloc Drawbacks And Risks

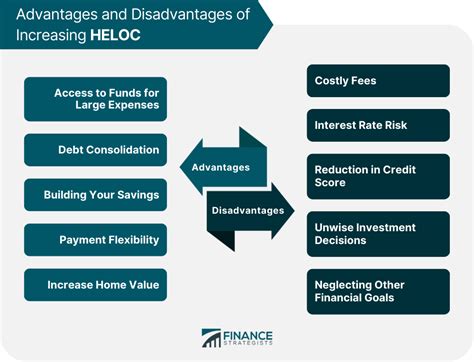

Some of the key drawbacks and risks of HELOCs include:

- Risk of foreclosure: Since a HELOC is a secured loan, the borrower's home is used as collateral, putting it at risk if the borrower is unable to repay the loan.

- Variable interest rates: HELOCs often come with variable interest rates, which can increase over time, making it more challenging for borrowers to repay the loan.

- Fees and charges: HELOCs often come with fees and charges, such as origination fees, annual fees, and closing costs.

- Debt accumulation: HELOCs can lead to debt accumulation if borrowers are not careful, as they may be tempted to borrow more than they can afford to repay.

5 Essential Heloc Tips

Heloc And Credit Score

A borrower's credit score plays a significant role in determining their eligibility for a HELOC and the interest rate they'll qualify for. Generally, borrowers with good credit scores (above 700) will qualify for better interest rates and terms. However, those with poor credit scores (below 600) may face higher interest rates, fees, and stricter repayment terms. It's essential to monitor your credit score and work on improving it before applying for a HELOC.Heloc Alternatives

Heloc FAQs

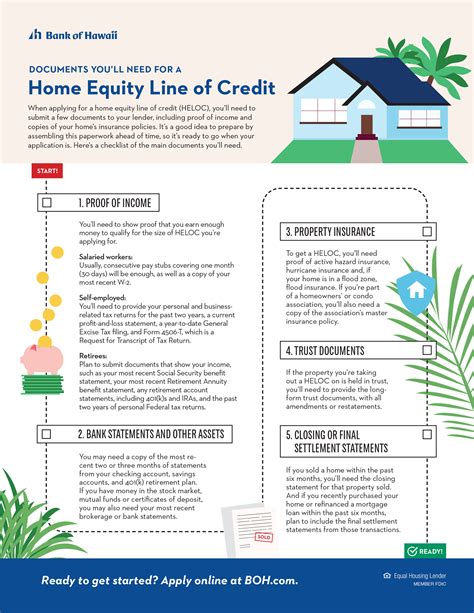

Heloc Image Gallery

In conclusion, a HELOC can be a powerful financial tool for homeowners, offering flexibility, lower interest rates, and tax benefits. However, it's essential to approach HELOCs with caution, carefully considering the terms and conditions, risks, and alternatives. By understanding the benefits and drawbacks of HELOCs and following the essential tips outlined in this article, borrowers can make informed decisions about whether this financial product is right for them. We invite you to share your thoughts and experiences with HELOCs in the comments below, and don't forget to share this article with others who may be considering this financial option.