Discover how Navy Federal home loans work with flexible mortgage options, competitive rates, and exclusive benefits for military members, veterans, and their families, offering affordable financing solutions and personalized service.

Navy Federal home loans have been a popular choice for many individuals and families looking to purchase or refinance a home. As one of the largest credit unions in the world, Navy Federal offers a wide range of mortgage products and services that cater to the unique needs of its members. In this article, we will delve into the world of Navy Federal home loans and explore the various ways they work.

For those who are new to the concept of Navy Federal home loans, it's essential to understand the basics. Navy Federal Credit Union is a not-for-profit, member-owned financial cooperative that serves members of the military, veterans, and their families. The credit union offers a variety of financial products and services, including home loans, which are designed to help members achieve their dream of homeownership. With competitive interest rates, flexible repayment terms, and personalized service, Navy Federal home loans have become a go-to option for many homebuyers.

One of the key benefits of Navy Federal home loans is their flexibility. The credit union offers a range of mortgage products, including fixed-rate and adjustable-rate loans, as well as government-backed loans such as VA and FHA loans. This means that members can choose the loan that best fits their needs and financial situation. Additionally, Navy Federal home loans often come with competitive interest rates and low fees, which can help members save money over the life of the loan. Whether you're a first-time homebuyer or a seasoned homeowner, Navy Federal has a home loan product that can help you achieve your goals.

Understanding Navy Federal Home Loans

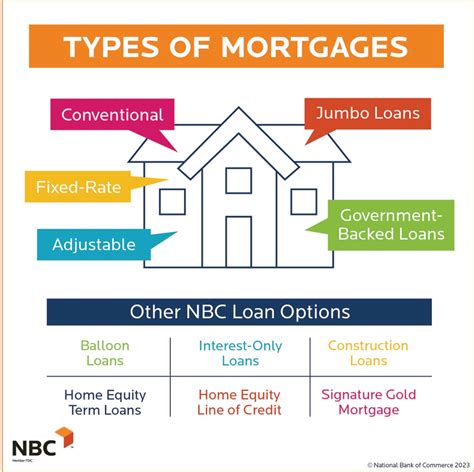

To understand how Navy Federal home loans work, it's essential to explore the different types of loans available. The credit union offers a range of mortgage products, including conventional loans, government-backed loans, and jumbo loans. Conventional loans are the most common type of mortgage and are not insured by the government. Government-backed loans, on the other hand, are insured by the government and offer more lenient credit score requirements and lower down payment options. Jumbo loans are designed for borrowers who need to finance a more expensive home and offer loan amounts that exceed the conventional loan limits.

Types of Navy Federal Home Loans

Navy Federal offers several types of home loans, including: * Conventional loans: These loans are not insured by the government and offer competitive interest rates and flexible repayment terms. * Government-backed loans: These loans are insured by the government and offer more lenient credit score requirements and lower down payment options. * Jumbo loans: These loans are designed for borrowers who need to finance a more expensive home and offer loan amounts that exceed the conventional loan limits. * VA loans: These loans are designed for veterans and active-duty military personnel and offer competitive interest rates and low fees. * FHA loans: These loans are designed for first-time homebuyers and offer lenient credit score requirements and low down payment options.Benefits of Navy Federal Home Loans

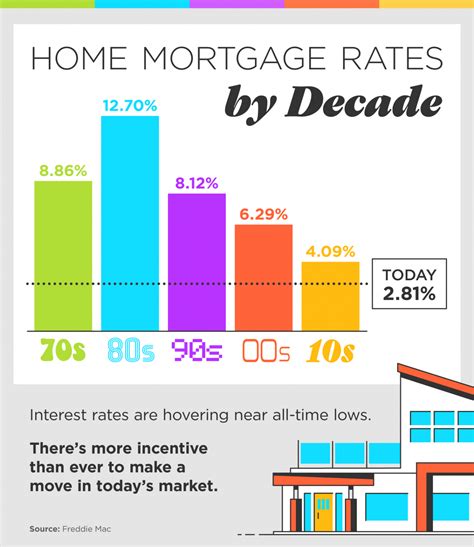

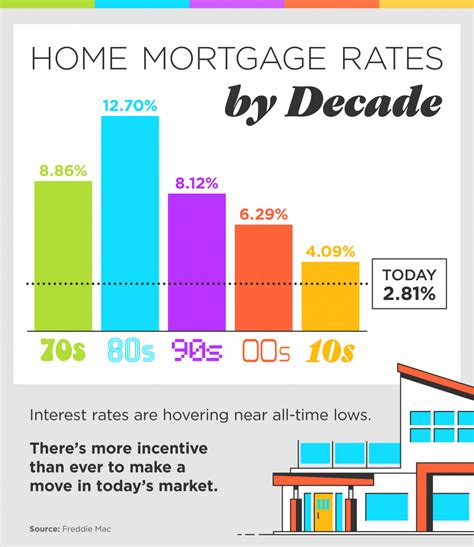

So, what are the benefits of Navy Federal home loans? One of the key advantages is the competitive interest rates. Navy Federal offers some of the lowest interest rates in the industry, which can help members save money over the life of the loan. Additionally, the credit union offers flexible repayment terms, which can help members choose a loan that fits their budget and financial situation. Other benefits of Navy Federal home loans include low fees, personalized service, and a wide range of mortgage products to choose from.

Advantages of Navy Federal Home Loans

Some of the advantages of Navy Federal home loans include: * Competitive interest rates: Navy Federal offers some of the lowest interest rates in the industry, which can help members save money over the life of the loan. * Flexible repayment terms: The credit union offers flexible repayment terms, which can help members choose a loan that fits their budget and financial situation. * Low fees: Navy Federal home loans often come with low fees, which can help members save money over the life of the loan. * Personalized service: The credit union offers personalized service, which can help members get the help they need to navigate the homebuying process. * Wide range of mortgage products: Navy Federal offers a wide range of mortgage products, which can help members choose the loan that best fits their needs and financial situation.How to Apply for a Navy Federal Home Loan

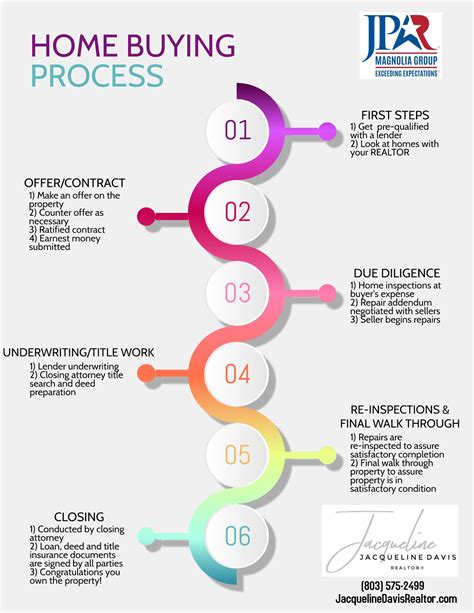

So, how do you apply for a Navy Federal home loan? The process is relatively straightforward. First, you'll need to become a member of the credit union, which requires meeting certain eligibility requirements. Once you're a member, you can apply for a home loan online, by phone, or in person at a Navy Federal branch. You'll need to provide some basic information, such as your income, credit score, and employment history, as well as some documentation, such as pay stubs and bank statements.

Steps to Apply for a Navy Federal Home Loan

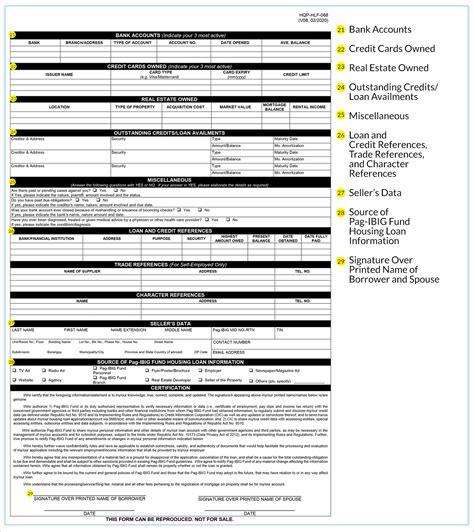

Here are the steps to apply for a Navy Federal home loan: * Become a member of the credit union: You'll need to meet certain eligibility requirements to become a member of Navy Federal. * Gather required documents: You'll need to provide some basic information, such as your income, credit score, and employment history, as well as some documentation, such as pay stubs and bank statements. * Apply for a home loan: You can apply for a home loan online, by phone, or in person at a Navy Federal branch. * Get pre-approved: Once you've applied for a home loan, you'll need to get pre-approved, which will give you an idea of how much you can borrow. * Find a home: Once you're pre-approved, you can start looking for a home that fits your budget and needs.Common Mistakes to Avoid When Applying for a Navy Federal Home Loan

When applying for a Navy Federal home loan, there are several common mistakes to avoid. One of the biggest mistakes is not checking your credit score before applying. Your credit score plays a big role in determining the interest rate you'll qualify for, so it's essential to check your score and work on improving it if necessary. Another mistake is not getting pre-approved before starting your home search. Getting pre-approved will give you an idea of how much you can borrow and will also give you an advantage when making an offer on a home.

Mistakes to Avoid When Applying for a Navy Federal Home Loan

Here are some common mistakes to avoid when applying for a Navy Federal home loan: * Not checking your credit score: Your credit score plays a big role in determining the interest rate you'll qualify for, so it's essential to check your score and work on improving it if necessary. * Not getting pre-approved: Getting pre-approved will give you an idea of how much you can borrow and will also give you an advantage when making an offer on a home. * Not providing required documentation: You'll need to provide some basic information, such as your income, credit score, and employment history, as well as some documentation, such as pay stubs and bank statements. * Not shopping around: It's essential to shop around and compare rates and terms from different lenders to find the best deal.Navy Federal Home Loan FAQs

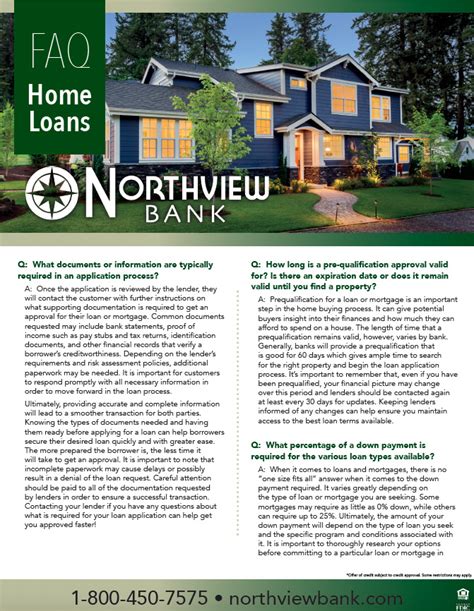

Here are some frequently asked questions about Navy Federal home loans:

- What are the eligibility requirements for a Navy Federal home loan?

- How do I apply for a Navy Federal home loan?

- What are the interest rates for Navy Federal home loans?

- Can I get pre-approved for a Navy Federal home loan?

- How long does it take to close on a Navy Federal home loan?

Navy Federal Home Loan FAQ Answers

Here are the answers to some frequently asked questions about Navy Federal home loans: * To be eligible for a Navy Federal home loan, you must be a member of the credit union and meet certain credit score and income requirements. * You can apply for a Navy Federal home loan online, by phone, or in person at a Navy Federal branch. * The interest rates for Navy Federal home loans vary depending on the type of loan and your credit score. * Yes, you can get pre-approved for a Navy Federal home loan, which will give you an idea of how much you can borrow. * The time it takes to close on a Navy Federal home loan varies, but it typically takes around 30-60 days.Navy Federal Home Loan Image Gallery

In conclusion, Navy Federal home loans offer a range of benefits and options for members looking to purchase or refinance a home. With competitive interest rates, flexible repayment terms, and personalized service, Navy Federal home loans are an excellent choice for those who are eligible. By understanding the different types of loans available, the application process, and the common mistakes to avoid, members can make informed decisions and find the right loan for their needs. We invite you to share your thoughts and experiences with Navy Federal home loans in the comments below. If you found this article helpful, please share it with others who may be considering a Navy Federal home loan.