Discover 5 ways Navy Federal Las Vegas enhances banking with personalized services, online management, and member benefits, offering convenience, security, and financial growth solutions.

The city of Las Vegas is known for its vibrant entertainment scene, rich cultural heritage, and diverse financial institutions. Among these institutions, Navy Federal Credit Union stands out as a prominent player, offering a wide range of financial services to its members. For individuals and families living in Las Vegas, Navy Federal can be a valuable resource for managing finances, saving money, and achieving long-term financial goals. In this article, we will explore five ways Navy Federal Las Vegas can benefit its members, from convenient banking options to exclusive discounts and rewards.

The importance of having a reliable financial institution cannot be overstated, especially in a city like Las Vegas where the cost of living can be high. Navy Federal Credit Union has been serving its members for over 80 years, providing a safe and secure environment for individuals to manage their finances. With its strong reputation and commitment to excellence, Navy Federal has become a trusted name in the financial industry. Whether you're a native Las Vegan or a newcomer to the city, understanding the benefits of Navy Federal can help you make informed decisions about your financial future.

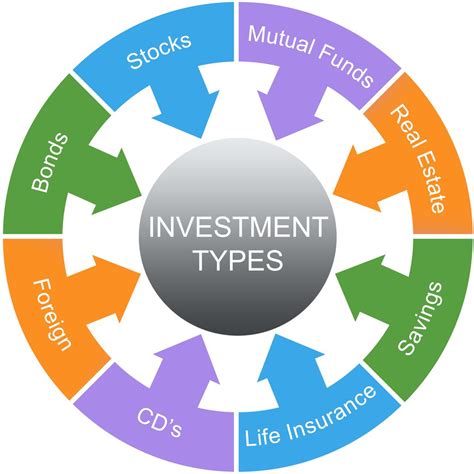

For many people, managing finances can be a daunting task, especially with the numerous options available in the market. Navy Federal Las Vegas simplifies this process by offering a range of services tailored to meet the unique needs of its members. From checking and savings accounts to loans and credit cards, Navy Federal provides a comprehensive suite of financial products designed to help individuals achieve their financial goals. Moreover, with its competitive interest rates and flexible repayment terms, Navy Federal makes it easier for members to borrow money when needed, whether it's for a new car, a home, or education expenses.

Convenient Banking Options

Exclusive Discounts and Rewards

Financial Education and Planning

Community Involvement

Member Benefits and Services

In terms of the benefits, here are some key points to consider:

- Convenient banking options, including online banking and mobile apps

- Exclusive discounts and rewards on financial products and services

- Financial education and planning resources to improve financial literacy

- Community involvement and support for local initiatives

- Member benefits and services, including investment products and insurance services

To take advantage of these benefits, individuals can follow these steps:

- Research Navy Federal Credit Union and its services

- Become a member by meeting the eligibility criteria

- Explore the range of financial products and services offered

- Utilize online banking and mobile apps for convenient account management

- Participate in financial education workshops and webinars to improve financial knowledge

Gallery of Navy Federal Las Vegas

Navy Federal Las Vegas Image Gallery

In conclusion, Navy Federal Las Vegas offers its members a unique combination of convenient banking options, exclusive discounts and rewards, financial education and planning resources, community involvement, and member benefits and services. By taking advantage of these benefits, individuals can improve their financial literacy, achieve their financial goals, and contribute to the local community. We invite you to share your experiences with Navy Federal Credit Union, ask questions, or provide feedback on how we can better serve our members. Your input is valuable to us, and we look forward to hearing from you.