Find Navy Federal Credit Union Miami location, hours, and services. Get directions to NFCU Miami branches, ATMs, and contact info for banking, loans, and credit cards.

The Navy Federal Credit Union is a well-established financial institution that serves the military community, including active duty personnel, veterans, and their families. With numerous locations across the United States, Navy Federal Credit Union has become a trusted name in the financial sector. For individuals living in or around Miami, Florida, having access to a local branch can be incredibly convenient. In this article, we will delve into the details of the Navy Federal Credit Union Miami location, exploring its services, benefits, and what sets it apart from other financial institutions.

The Miami location of Navy Federal Credit Union is designed to provide members with a wide range of financial services and products tailored to their unique needs. From everyday banking solutions like checking and savings accounts, to more complex financial planning tools such as investments and insurance, the credit union aims to be a one-stop shop for all financial requirements. Moreover, the branch is staffed by knowledgeable and friendly professionals who understand the specific challenges and opportunities faced by military families, ensuring that members receive personalized advice and support.

For those considering joining Navy Federal Credit Union or looking to switch from another financial institution, understanding the benefits of membership is crucial. One of the most significant advantages is the competitive rates offered on loans and credit cards, which can help members save money and achieve their financial goals more efficiently. Additionally, the credit union's commitment to community involvement and financial education sets it apart, providing resources and workshops that empower members to make informed financial decisions.

Services Offered by Navy Federal Credit Union Miami

The Navy Federal Credit Union Miami location offers a comprehensive suite of services designed to cater to the diverse financial needs of its members. These services include:

- Checking and savings accounts with competitive interest rates and minimal fees

- Loans for various purposes, such as auto purchases, home mortgages, and personal expenses, often with more favorable terms than those found at traditional banks

- Credit cards with rewards programs and low APRs

- Investment and retirement planning tools

- Insurance products for auto, home, and life

- Financial counseling and education resources

Benefits of Membership

Membership with Navy Federal Credit Union comes with numerous benefits that can enhance one's financial well-being and provide peace of mind. Some of the key advantages include:

- Competitive rates on deposits and loans

- Lower fees compared to traditional banks

- Access to a network of ATMs without surcharge fees

- Personalized service from representatives who understand the military community

- Opportunities for financial education and planning

How to Become a Member

Becoming a member of Navy Federal Credit Union is a straightforward process that can be completed online or in-person at a local branch. Eligibility for membership is extended to:

- Active duty personnel of the Army, Marine Corps, Navy, Air Force, and Coast Guard

- Veterans and retirees of the military

- Family members of current or veteran military personnel, including spouses, children, and household members

- Employees of the Department of Defense and certain government agencies

To join, prospective members will need to provide identification and proof of eligibility, along with an initial deposit into a savings account.

Financial Education and Community Involvement

Navy Federal Credit Union is committed to empowering its members through financial education and community involvement. The credit union offers various resources and programs aimed at promoting financial literacy and stability, including workshops, webinars, and online tools. Additionally, Navy Federal Credit Union actively participates in community events and supports initiatives that benefit military families and veterans, reinforcing its dedication to serving those who serve.

Locations and Hours of Operation

For members in the Miami area, finding a convenient location is easy. Navy Federal Credit Union operates multiple branches in and around Miami, each with its own hours of operation. Members can visit the credit union's website or contact the member service center to find the nearest location and its hours. Additionally, many services are available online or through the mobile app, allowing members to manage their finances from anywhere at any time.

Security and Technology

In today's digital age, the security of financial information is of paramount importance. Navy Federal Credit Union prioritizes the protection of its members' data, employing advanced security measures and technologies to safeguard accounts and transactions. The credit union's online banking and mobile app are designed with security in mind, offering features such as two-factor authentication, encryption, and real-time alerts for suspicious activity.

Customer Service and Support

Navy Federal Credit Union is renowned for its exceptional customer service, with a dedicated team available to assist members with their financial needs. Whether through phone, email, or in-person at a branch, members can expect personalized support and guidance. The credit union also offers a 24/7 contact center for immediate assistance with urgent matters.

Community Outreach and Involvement

The credit union's commitment to community outreach and involvement is a testament to its mission of serving the military community. Through various initiatives and partnerships, Navy Federal Credit Union supports programs that benefit military families, veterans, and the communities in which they live. This includes sponsorship of events, donations to charitable organizations, and volunteer efforts by credit union employees.

Financial Planning and Advice

For members seeking to improve their financial situation or achieve long-term goals, Navy Federal Credit Union offers comprehensive financial planning and advice. This includes access to certified financial advisors who can provide guidance on investments, retirement planning, and other complex financial matters. Additionally, the credit union's website and mobile app feature a range of financial tools and resources, including budgeting worksheets, savings calculators, and educational articles.

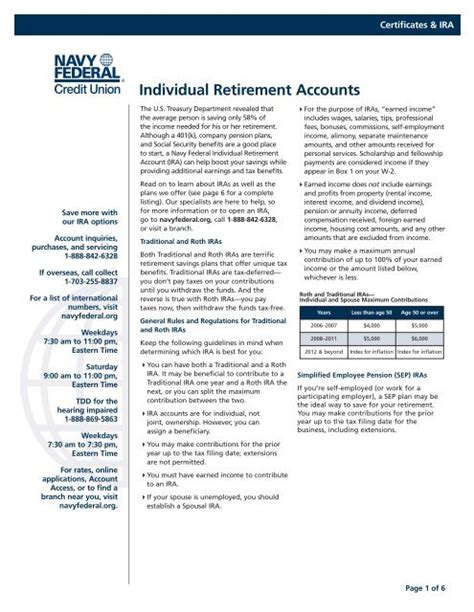

Investment and Retirement Services

Navy Federal Credit Union recognizes the importance of planning for the future, offering a variety of investment and retirement services designed to help members secure their financial futures. From individual retirement accounts (IRAs) to brokerage services and investment advice, the credit union provides the tools and expertise needed to make informed investment decisions.

Insurance Products

The credit union offers a range of insurance products to protect members and their families from unforeseen events. This includes auto insurance, home insurance, life insurance, and other types of coverage. By offering competitive rates and personalized service, Navy Federal Credit Union helps members find the insurance solutions that best fit their needs and budgets.

Loans and Credit Cards

For members in need of financing for a vehicle, home, or other significant purchases, Navy Federal Credit Union provides loans with competitive interest rates and flexible terms. The credit union also offers a variety of credit cards, each with its own set of benefits, such as rewards programs, low APRs, and no annual fees. Whether for everyday expenses or long-term financing, Navy Federal Credit Union's loan and credit card options are designed to meet the diverse financial needs of its members.

Online Banking and Mobile App

In today's fast-paced world, having access to financial services anytime, anywhere is crucial. Navy Federal Credit Union's online banking and mobile app provide members with a convenient and secure way to manage their accounts, pay bills, transfer funds, and access financial tools and resources. With features such as mobile deposit, account alerts, and budgeting tools, members can stay on top of their finances with ease.

Security Measures

The security of members' financial information is a top priority for Navy Federal Credit Union. To protect against fraud and identity theft, the credit union employs robust security measures, including encryption, firewalls, and multi-factor authentication. Members are also encouraged to take steps to secure their accounts, such as using strong passwords, monitoring account activity regularly, and reporting any suspicious transactions promptly.

Navy Federal Credit Union Image Gallery

In conclusion, the Navy Federal Credit Union Miami location is a valuable resource for members of the military community living in or around Miami. With its comprehensive range of financial services, commitment to financial education, and dedication to community involvement, the credit union stands out as a leader in the financial sector. Whether you're looking for everyday banking solutions, long-term financial planning, or simply a financial institution that understands the unique challenges and opportunities of military life, Navy Federal Credit Union is an excellent choice. We invite you to explore the benefits of membership, visit a local branch, or contact the credit union directly to learn more about how Navy Federal Credit Union can serve your financial needs. Share your experiences with Navy Federal Credit Union or ask questions in the comments below, and consider sharing this article with others who may benefit from the credit union's services.