Boost financial stability with 5 Navy Federal tips, including credit score management, loan options, and investment strategies, to enhance banking experience and secure economic growth.

As a member of the Navy Federal Credit Union, you're part of a community that prioritizes your financial well-being. With a wide range of services and benefits, Navy Federal is dedicated to helping you achieve your financial goals. Whether you're looking to save money, invest in your future, or simply manage your daily expenses, Navy Federal has the tools and expertise to support you. In this article, we'll explore five valuable tips to help you make the most of your Navy Federal membership.

Being part of a credit union like Navy Federal comes with numerous advantages, including lower fees, higher savings rates, and more personalized service. By taking advantage of these benefits, you can improve your financial stability and security. From budgeting and saving to investing and borrowing, Navy Federal offers a comprehensive range of services designed to meet your unique needs. By understanding how to utilize these services effectively, you can unlock the full potential of your membership and achieve greater financial success.

Navy Federal's commitment to its members is built on a foundation of trust, integrity, and exceptional service. With a long history of serving the military community, Navy Federal has developed a deep understanding of the unique challenges and opportunities faced by its members. By leveraging this expertise, you can gain valuable insights and guidance to help you navigate the complexities of personal finance. Whether you're a seasoned financial expert or just starting out, Navy Federal's resources and support can help you make informed decisions and achieve your long-term goals.

Understanding Navy Federal Services

Benefits of Navy Federal Membership

Some of the key benefits of Navy Federal membership include: * Lower fees and interest rates on loans and credit cards * Higher savings rates and more competitive investment options * Personalized service and expert financial guidance * Access to a wide range of financial tools and resources * Opportunities to participate in exclusive member events and promotionsManaging Your Finances with Navy Federal

Key Financial Management Strategies

Some key strategies for managing your finances with Navy Federal include: * Creating a budget and tracking your expenses * Building an emergency savings fund and investing for the future * Using Navy Federal's financial tools and resources to monitor your accounts and stay on top of your finances * Taking advantage of Navy Federal's expert financial guidance and advice * Staying informed about changes in the financial market and adjusting your strategy accordinglyInvesting with Navy Federal

Key Investment Strategies

Some key strategies for investing with Navy Federal include: * Diversifying your portfolio to minimize risk and maximize returns * Taking a long-term approach to investing and avoiding get-rich-quick schemes * Using Navy Federal's expert financial guidance and advice to inform your investment decisions * Staying informed about changes in the financial market and adjusting your strategy accordingly * Using tax-advantaged accounts such as 401(k)s and IRAs to optimize your investment returnsBorrowing with Navy Federal

Key Borrowing Strategies

Some key strategies for borrowing with Navy Federal include: * Understanding the terms and conditions of your loan or credit card agreement * Borrowing only what you need and avoiding unnecessary debt * Using Navy Federal's expert financial guidance and advice to inform your borrowing decisions * Staying informed about changes in the financial market and adjusting your strategy accordingly * Using Navy Federal's financial tools and resources to monitor your accounts and stay on top of your debtProtecting Your Finances with Navy Federal

Key Financial Protection Strategies

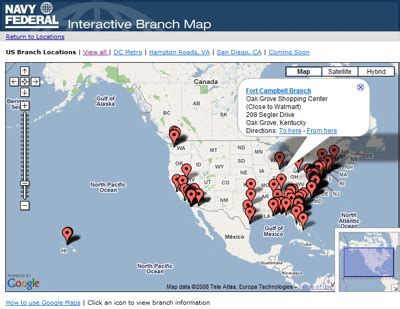

Some key strategies for protecting your finances with Navy Federal include: * Monitoring your accounts regularly and reporting any suspicious activity * Using strong passwords and keeping your personal information secure * Taking advantage of Navy Federal's identity theft protection services * Using Navy Federal's insurance services to protect your assets and income * Staying informed about changes in the financial market and adjusting your strategy accordinglyNavy Federal Image Gallery

By following these five Navy Federal tips and taking advantage of the credit union's wide range of services and benefits, you can achieve greater financial stability and success. Whether you're looking to save money, invest in your future, or simply manage your daily expenses, Navy Federal has the tools and expertise to support you. So why not start today and discover the benefits of Navy Federal membership for yourself? Share your thoughts and experiences with Navy Federal in the comments below, and don't forget to share this article with your friends and family who may benefit from these valuable tips.