Resolve Navy Federal Credit Union access restricted issues with expert guidance on login, account access, and security measures, including troubleshooting tips and online banking solutions.

The importance of online security and access control cannot be overstated, especially when it comes to financial institutions. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, takes the security of its members' accounts very seriously. However, sometimes members may encounter issues with accessing their accounts, which can be frustrating and worrisome. In this article, we will delve into the topic of Navy Federal Credit Union access restricted issues, exploring the possible causes, solutions, and best practices for maintaining secure and uninterrupted access to your account.

Access to financial accounts is crucial in today's digital age, where most transactions, payments, and account management tasks are performed online. Any restriction or limitation in accessing these accounts can disrupt financial planning, cause inconvenience, and even lead to financial losses. Understanding the reasons behind access restrictions and knowing how to resolve them is essential for all users of online banking services, including those of Navy Federal Credit Union.

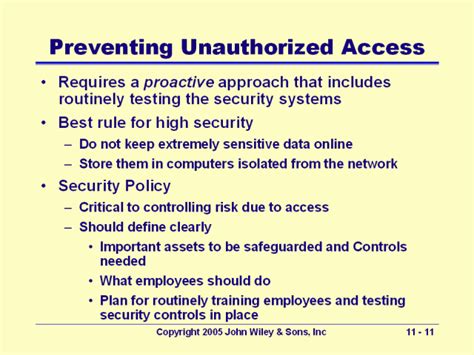

The security measures implemented by financial institutions like Navy Federal Credit Union are designed to protect members' accounts from unauthorized access and potential cyber threats. These measures can sometimes flag legitimate access attempts as suspicious, leading to temporary or permanent restrictions on account access. Common reasons for access restrictions include multiple failed login attempts, login from an unrecognized device or location, and suspicion of fraudulent activity. In such cases, members may see a message indicating that their access is restricted, and they may be required to verify their identity or take other steps to regain access to their accounts.

Navy Federal Credit Union Security Measures

Types of Access Restrictions

Access restrictions can vary in nature and severity, depending on the reason for the restriction and the security policies of the institution. Temporary restrictions might require members to wait for a certain period before attempting to log in again, while more severe restrictions might necessitate direct contact with the credit union's customer service to verify identity and reactivate the account. Understanding the different types of restrictions and how to address them can help members navigate these situations more effectively.Causes of Access Restrictions

Resolving Access Restrictions

Resolving access restrictions often involves verifying the member's identity and ensuring that the access attempt is legitimate. This can be done through various means, including: - Contacting Navy Federal Credit Union's customer service directly - Using the credit union's online platform to request access restoration - Visiting a local branch in person - Responding to security questions or prompts sent by the credit union The specific steps required may vary depending on the nature of the restriction and the credit union's policies.Preventing Access Restrictions

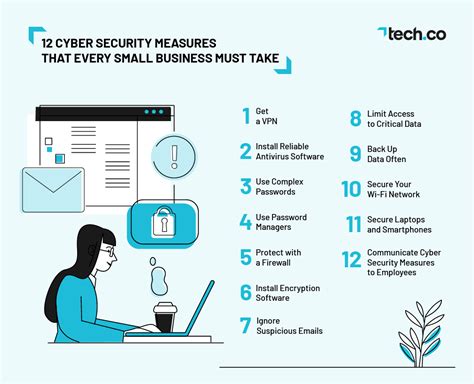

Best Practices for Online Banking

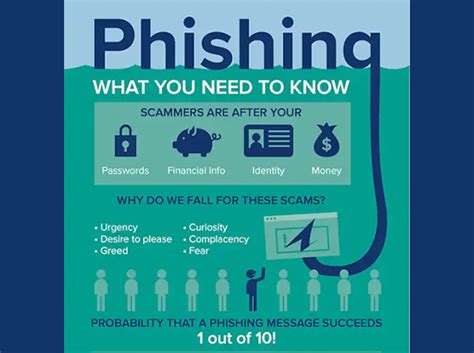

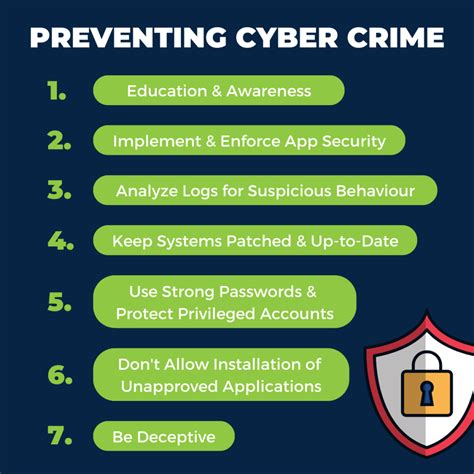

Best practices for online banking are essential for maintaining the security and integrity of financial accounts. These practices include monitoring account activity regularly, using secure networks for online banking, and avoiding the use of public computers or public Wi-Fi for sensitive financial transactions. Additionally, members should be aware of phishing scams and other types of cyber threats, knowing how to identify and report them.FAQs About Access Restrictions

Gallery of Access Restriction Solutions

Access Restriction Solutions Image Gallery

In conclusion, access restrictions on Navy Federal Credit Union accounts are a critical aspect of maintaining the security and integrity of members' financial information. By understanding the causes of these restrictions, knowing how to resolve them, and adopting best practices for online banking, members can ensure secure and uninterrupted access to their accounts. If you have experienced access restrictions or have questions about online banking security, we invite you to share your thoughts and concerns in the comments below. Your feedback and insights are invaluable in helping us create a more secure and user-friendly online banking environment for everyone.