Find Navy Federal Credit Unions near you with convenient locations, offering banking services, loans, and financial solutions for military members and families, including online banking and mobile access.

Finding a nearby Navy Federal Credit Union can be a convenient way to manage your finances, especially if you're a member of the military or a Department of Defense employee. With numerous locations across the United States and abroad, Navy Federal Credit Union offers a wide range of financial services, including banking, loans, and investments. In this article, we'll explore the importance of having a nearby Navy Federal Credit Union, how to find one, and the benefits of being a member.

Having a credit union near you can be beneficial in many ways. For one, it provides easy access to your accounts, allowing you to deposit, withdraw, and manage your funds with ease. Additionally, Navy Federal Credit Union offers a variety of services, including financial counseling, investment advice, and loan options, all of which can be accessed at a nearby branch. Whether you're looking to purchase a home, finance a car, or simply manage your everyday expenses, having a nearby credit union can be a valuable resource.

For members of the military and their families, having a nearby Navy Federal Credit Union can be especially important. Military life often involves frequent moves, deployments, and other challenges that can make managing finances difficult. A nearby credit union can provide a sense of stability and security, allowing you to focus on your duties and responsibilities without worrying about your financial well-being. Moreover, Navy Federal Credit Union offers specialized services and benefits for military members, including low-interest loans, credit cards, and other financial products tailored to their unique needs.

Navy Federal Credit Union Locations

Navy Federal Credit Union has over 350 branches worldwide, making it one of the largest credit unions in the United States. With locations in nearly every state, as well as in several countries overseas, it's likely that there's a Navy Federal Credit Union near you. To find a nearby branch, you can use the credit union's online locator tool, which allows you to search by zip code, city, or state. You can also use your smartphone's GPS to find the nearest location.

Benefits of Navy Federal Credit Union Membership

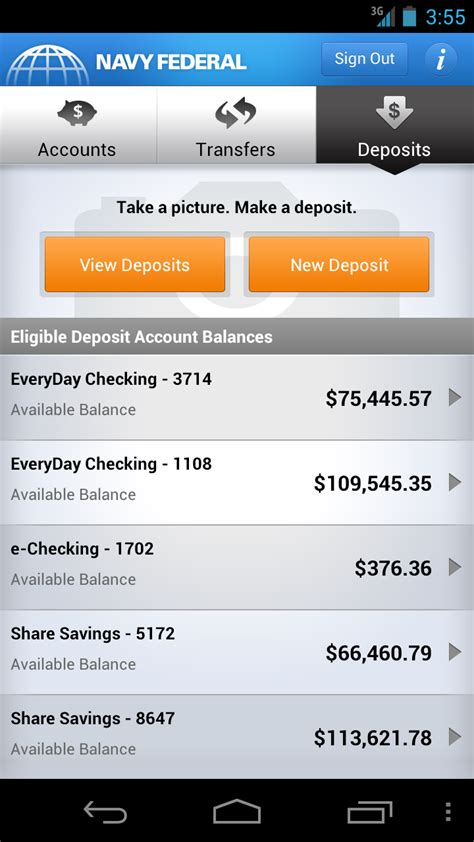

Being a member of Navy Federal Credit Union comes with numerous benefits, including competitive interest rates, low fees, and personalized service. Members can take advantage of a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investments. Additionally, Navy Federal Credit Union offers online banking and mobile banking apps, making it easy to manage your accounts and conduct transactions from anywhere.

Some of the key benefits of Navy Federal Credit Union membership include:

- Competitive interest rates on loans and credit cards

- Low fees on accounts and transactions

- Personalized service from experienced financial professionals

- Access to online banking and mobile banking apps

- A wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investments

- Specialized services and benefits for military members, including low-interest loans and credit cards

How to Join Navy Federal Credit Union

Joining Navy Federal Credit Union is a straightforward process that can be completed online or in person at a nearby branch. To be eligible for membership, you must meet one of the following criteria:

- Be a member of the military, including active duty, retired, or reserve

- Be a Department of Defense employee or contractor

- Be a family member of a military member or Department of Defense employee

- Be a veteran or retiree of the military

To join, you'll need to provide some basic information, including your name, address, and Social Security number. You'll also need to fund your account with a minimum deposit, which is typically $5. Once you've completed the application process, you'll be able to access all of the benefits and services that Navy Federal Credit Union has to offer.

Navy Federal Credit Union Services

Navy Federal Credit Union offers a wide range of services to its members, including:

- Checking and savings accounts

- Credit cards

- Loans, including mortgages, auto loans, and personal loans

- Investments, including stocks, bonds, and mutual funds

- Insurance, including life insurance, disability insurance, and long-term care insurance

- Financial counseling and planning

- Online banking and mobile banking apps

In addition to these services, Navy Federal Credit Union also offers specialized services and benefits for military members, including:

- Low-interest loans and credit cards

- Specialized mortgage products, including VA loans and FHA loans

- Financial counseling and planning tailored to the unique needs of military members

Navy Federal Credit Union Reviews

Navy Federal Credit Union has received numerous positive reviews from its members, who praise the credit union's competitive interest rates, low fees, and personalized service. Many members have reported being satisfied with the credit union's online banking and mobile banking apps, as well as its wide range of financial products and services.

Some common themes in Navy Federal Credit Union reviews include:

- Competitive interest rates and low fees

- Personalized service from experienced financial professionals

- Wide range of financial products and services

- Easy-to-use online banking and mobile banking apps

- Specialized services and benefits for military members

Navy Federal Credit Union Fees

Navy Federal Credit Union is known for having low fees compared to other financial institutions. Some common fees associated with Navy Federal Credit Union accounts and services include:

- Monthly maintenance fees on checking and savings accounts

- Overdraft fees

- ATM fees

- Loan origination fees

- Credit card fees, including annual fees and late payment fees

However, it's worth noting that many of these fees can be avoided by maintaining a minimum balance, using a debit card instead of an ATM card, and making timely payments on loans and credit cards.

Navy Federal Credit Union Routing Number

The Navy Federal Credit Union routing number is 256074974. This number is used to facilitate transactions, including direct deposits, wire transfers, and automatic payments. It's typically found at the bottom of a check or deposit slip, and can also be found on the credit union's website or by contacting customer service.

Gallery of Navy Federal Credit Union Images

Navy Federal Credit Union Image Gallery

In conclusion, Navy Federal Credit Union is a valuable resource for members of the military, Department of Defense employees, and their families. With numerous locations across the United States and abroad, competitive interest rates, and low fees, it's an excellent choice for anyone looking to manage their finances effectively. Whether you're looking to purchase a home, finance a car, or simply manage your everyday expenses, Navy Federal Credit Union has the services and expertise to help. We invite you to share your experiences with Navy Federal Credit Union, ask questions, or provide feedback in the comments section below. Additionally, if you found this article helpful, please consider sharing it with others who may benefit from the information.