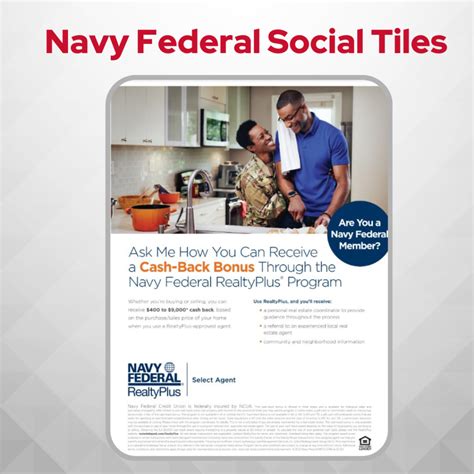

Discover 5 exclusive Navy Federal perks, including rewards, low rates, and flexible terms, offering members financial freedom and security through credit union benefits and services.

As a member of the military community, it's essential to have access to financial services that cater to your unique needs. Navy Federal Credit Union has been serving the military community for over 80 years, providing a wide range of financial products and services that are designed to help you achieve your financial goals. With over 10 million members, Navy Federal is one of the largest credit unions in the world, and for good reason. In this article, we'll explore five Navy Federal perks that make it an excellent choice for military personnel, veterans, and their families.

Navy Federal offers a range of benefits that set it apart from other financial institutions. From competitive interest rates to exclusive discounts, Navy Federal is committed to helping its members save money, manage their finances, and achieve their long-term goals. Whether you're looking to buy a home, finance a car, or simply manage your everyday expenses, Navy Federal has a range of products and services that can help. With its strong reputation for customer service and commitment to the military community, it's no wonder that Navy Federal is the go-to financial institution for so many military families.

One of the key advantages of Navy Federal is its ability to understand the unique needs of the military community. From deployments to PCS moves, military life can be unpredictable and challenging. Navy Federal gets it, and has designed its products and services to help members navigate these challenges with ease. With a range of online and mobile banking tools, Navy Federal makes it easy to manage your finances from anywhere in the world. Plus, with its extensive network of branches and ATMs, you can access your money whenever you need it. Whether you're stationed in the US or overseas, Navy Federal is always available to help.

Competitive Interest Rates

How Competitive Interest Rates Work

Competitive interest rates work by offering higher interest rates on deposits and lower interest rates on loans. This means that you can earn more money on your savings and pay less interest on your loans. For example, if you have a savings account with a 2.0% APY, you'll earn $20 in interest per year on a $1,000 deposit. On the other hand, if you have a loan with a 6.0% APR, you'll pay $60 in interest per year on a $1,000 loan. By offering competitive interest rates, Navy Federal helps its members save money and achieve their financial goals.Exclusive Discounts

Types of Exclusive Discounts

Navy Federal offers a range of exclusive discounts, including: * Insurance discounts: Save up to 20% on car insurance premiums, and up to 10% on home insurance premiums. * Investment discounts: Save up to 10% on investment fees, including mutual funds and ETFs. * Loan discounts: Save up to 1.0% on loan interest rates, including personal loans and mortgages. * Other discounts: Save up to 10% on other products and services, including credit cards and checking accounts.Financial Education Resources

Types of Financial Education Resources

Navy Federal offers a range of financial education resources, including: * Online courses: Cover topics such as budgeting, saving, and investing. * Webinars: Provide more in-depth training on topics such as retirement planning and estate planning. * Workshops: Offer hands-on training on topics such as credit management and debt reduction. * One-on-one coaching: Provide personalized financial coaching and planning.Convenient Online and Mobile Banking

Features of Convenient Online and Mobile Banking

Navy Federal's online and mobile banking tools offer a range of features, including: * Account management: View your account balances, transfer funds, and pay bills. * Mobile deposit: Deposit checks using your mobile device. * Bill pay: Pay bills online or through the mobile app. * Transfer funds: Transfer funds between accounts or to other banks. * Account alerts: Receive alerts when transactions are made or when accounts are low.Extensive Network of Branches and ATMs

Features of Extensive Network of Branches and ATMs

Navy Federal's network of branches and ATMs offers a range of features, including: * Surcharge-free ATMs: Access your cash without paying a surcharge. * Branch locations: Find a Navy Federal branch near you. * ATM locations: Find a Navy Federal ATM near you. * Extended hours: Many branches offer extended hours, including evenings and weekends.Navy Federal Perks Image Gallery

In conclusion, Navy Federal offers a range of perks that make it an excellent choice for military personnel, veterans, and their families. From competitive interest rates to exclusive discounts, financial education resources, convenient online and mobile banking, and an extensive network of branches and ATMs, Navy Federal is committed to helping its members achieve their financial goals. Whether you're looking to buy a home, finance a car, or simply manage your everyday expenses, Navy Federal has a range of products and services that can help. We invite you to share your thoughts on Navy Federal's perks and how they have helped you achieve your financial goals. Please comment below and share this article with your friends and family who may benefit from Navy Federal's services.