Discover 5 Navy HELOC rates, offering competitive home equity line of credit options with flexible repayment terms, low interest rates, and borrowing limits, ideal for naval personnel and veterans seeking financial assistance and mortgage solutions.

The world of home equity lines of credit (HELOCs) can be complex, especially when it comes to navigating the various rates and terms offered by different lenders. For those associated with the Navy, whether as active personnel, veterans, or family members, finding the right HELOC with favorable rates is crucial for leveraging the equity in their homes. In this article, we will delve into the specifics of Navy HELOC rates, exploring the benefits, how they work, and what to consider when applying for one.

Understanding the importance of HELOCs for Navy personnel and their families is key. These financial tools can provide access to funds for a variety of needs, from home improvements and debt consolidation to covering unexpected expenses. Given the unique challenges and opportunities that come with a career in the Navy, having a financial product tailored to their situation can be incredibly valuable. The Navy Federal Credit Union, for example, offers a range of financial services, including HELOCs, designed specifically with the needs of military personnel and their families in mind.

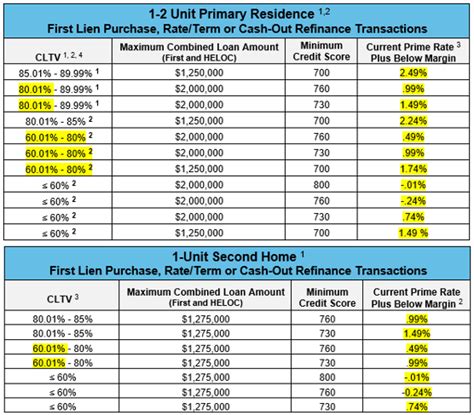

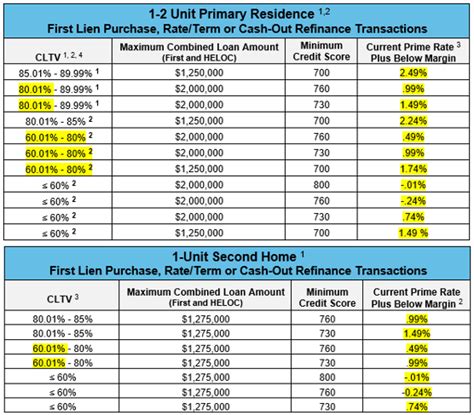

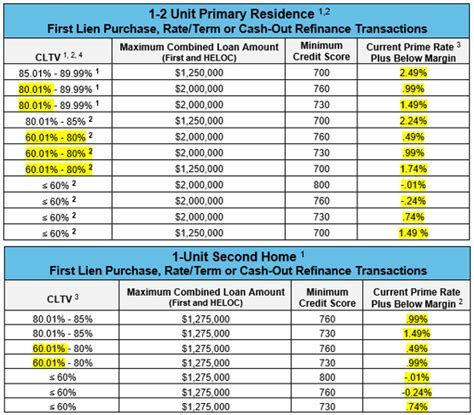

The process of obtaining a HELOC involves several steps, including applying for the line of credit, undergoing a home appraisal if necessary, and then receiving access to the funds. The rates offered on these lines of credit can vary significantly depending on the lender, the applicant's credit score, and the loan-to-value ratio of the property. For Navy personnel, being aware of these factors and how they impact the HELOC rate is essential for making informed financial decisions.

Introduction to Navy HELOC Rates

Navy HELOC rates are competitive and designed to meet the unique financial needs of military families. These rates can fluctuate based on market conditions and the borrower's financial situation. It's crucial to understand that a HELOC is a type of revolving credit, similar to a credit card, where the borrower can draw funds as needed, up to the maximum credit limit. This flexibility makes HELOCs a popular choice for covering various expenses, but it also means that the interest rate can impact the total cost of borrowing significantly.

Benefits of Navy HELOCs

The benefits of Navy HELOCs include competitive interest rates, flexible repayment terms, and the potential to tap into the equity built up in a home. For military families, these benefits can be particularly appealing, given the potential for frequent moves and the need for financial flexibility. Moreover, some lenders offer special discounts or benefits for military personnel, such as lower interest rates or reduced fees, which can further enhance the appeal of a Navy HELOC.

How Navy HELOC Rates Work

Understanding how Navy HELOC rates work is essential for anyone considering this financial product. The rate is typically variable, meaning it can change over time based on market conditions. This variability can affect the monthly payments, making it important for borrowers to understand the terms of their HELOC and how changes in the interest rate might impact their financial situation. Additionally, the introductory rates offered by some lenders can be significantly lower than the standard rate, providing an incentive for borrowers to apply. However, it's crucial to review the terms and conditions carefully, as these introductory rates usually expire after a certain period.

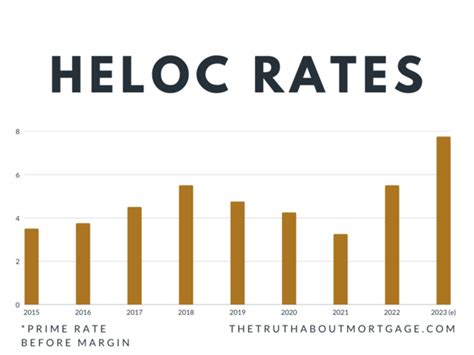

Factors Affecting Navy HELOC Rates

Several factors can affect the rates offered on Navy HELOCs, including the borrower's credit score, the loan-to-value ratio of the property, and the current market conditions. A good credit score can significantly lower the interest rate, making the HELOC more affordable. Similarly, a lower loan-to-value ratio can also lead to better terms, as it represents a lower risk for the lender. Market conditions, such as the federal funds rate set by the Federal Reserve, can also influence the rates offered on HELOCs, as these rates are often tied to prime rates or other benchmarks.

Applying for a Navy HELOC

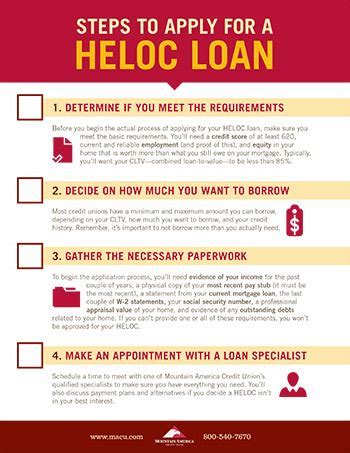

Applying for a Navy HELOC involves several steps, starting with checking eligibility and understanding the requirements. Potential borrowers should review their credit reports, ensure their credit score is in good standing, and gather necessary documents, such as proof of income and identity. The application process typically involves submitting an application, possibly undergoing a home appraisal, and then waiting for approval. Once approved, the borrower can access the line of credit, drawing funds as needed and making payments based on the terms agreed upon.

Tips for Getting the Best Navy HELOC Rate

To get the best Navy HELOC rate, borrowers should shop around, comparing rates and terms from different lenders. Improving credit scores, reducing debt, and considering a shorter repayment term can also lead to more favorable rates. Additionally, looking for lenders that offer discounts for military personnel or other incentives can further reduce the cost of the HELOC. It's also advisable to carefully review the fine print, understanding all the fees associated with the HELOC, including origination fees, annual fees, and any potential penalties for early payoff or late payments.

Navy HELOC FAQs

For those considering a Navy HELOC, having answers to frequently asked questions can provide clarity and help in making a decision. Questions about eligibility, application processes, and the use of funds are common. Understanding how the HELOC works, including how interest is calculated and how payments are structured, is also essential. Moreover, knowing the differences between a HELOC and a home equity loan, as well as the potential risks and benefits of each, can help borrowers choose the financial product that best meets their needs.

Gallery of Navy HELOC Images

Navy HELOC Image Gallery

In conclusion, navigating the world of Navy HELOC rates requires a thorough understanding of how these financial products work, their benefits, and the factors that affect their rates. By doing their research, comparing rates, and carefully reviewing the terms and conditions, military families can make informed decisions about whether a Navy HELOC is right for them. Whether for home improvements, debt consolidation, or covering unexpected expenses, a Navy HELOC can provide the financial flexibility that military families often need. We invite you to share your thoughts and experiences with Navy HELOCs in the comments below, and to consider sharing this article with others who may benefit from this information.