Discover Navy Federal HELOC loan options, offering flexible home equity lines of credit with competitive rates, low fees, and borrowing limits, ideal for home improvements, debt consolidation, and major purchases.

The world of home financing can be complex and overwhelming, especially when it comes to navigating the various loan options available. For members of the Navy Federal Credit Union, one popular option is the Home Equity Line of Credit, or HELOC. In this article, we will delve into the details of Navy Federal HELOC loan options, exploring the benefits, working mechanisms, and steps involved in securing one of these loans.

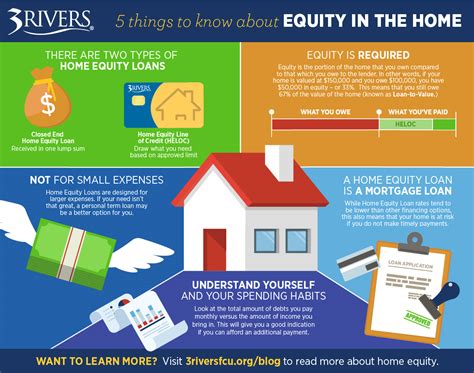

Home equity lines of credit have become increasingly popular in recent years, as homeowners seek to tap into the value of their properties to finance major expenses, such as home renovations, college tuition, or debt consolidation. With a HELOC, borrowers can access a line of credit that is secured by the equity in their home, allowing them to borrow and repay funds as needed. Navy Federal Credit Union, as one of the largest and most reputable credit unions in the country, offers a range of HELOC options tailored to meet the diverse needs of its members.

For those considering a Navy Federal HELOC, it is essential to understand the key features and benefits of these loans. One of the primary advantages of a HELOC is its flexibility, allowing borrowers to draw upon the line of credit as needed, rather than receiving a lump sum upfront. This can be particularly useful for homeowners who are embarking on a renovation project, as they can access funds as needed to pay for materials, labor, and other expenses. Additionally, HELOCs often offer competitive interest rates, which can be lower than those associated with other types of loans, such as personal loans or credit cards.

Navy Federal HELOC Loan Options

Navy Federal Credit Union offers a range of HELOC options, each with its own unique features and benefits. For example, the credit union's Home Equity Line of Credit allows borrowers to access up to 95% of their home's value, with loan amounts ranging from $10,000 to $500,000. This loan features a variable interest rate, which is tied to the prime rate, as well as a 10-year draw period, during which borrowers can access funds as needed.

Another option available to Navy Federal members is the Fixed-Rate Home Equity Loan, which offers a fixed interest rate and a loan term of up to 20 years. This loan is ideal for borrowers who prefer the predictability of a fixed monthly payment, as well as the security of a fixed interest rate. With this loan, borrowers can access up to 95% of their home's value, with loan amounts ranging from $10,000 to $500,000.

Benefits of Navy Federal HELOC Loan Options

The benefits of Navy Federal HELOC loan options are numerous, and include competitive interest rates, flexible repayment terms, and the ability to access funds as needed. Additionally, these loans often feature no closing costs or application fees, which can help to reduce the overall cost of borrowing. For Navy Federal members, the process of applying for a HELOC is also streamlined, with online applications and dedicated loan officers available to guide borrowers through the process.In terms of repayment, Navy Federal HELOC loan options offer a range of flexible terms, including interest-only payments during the draw period, as well as the option to make principal payments at any time. This can be particularly useful for borrowers who are looking to minimize their monthly payments, while also making progress on paying down the principal balance.

How to Apply for a Navy Federal HELOC Loan

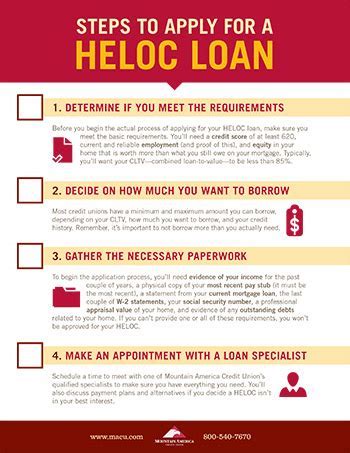

For Navy Federal members who are interested in applying for a HELOC loan, the process is relatively straightforward. The first step is to determine how much equity is available in the home, which can be done by subtracting the outstanding mortgage balance from the current market value of the property. Next, borrowers can apply online or by phone, providing basic financial information, such as income, credit score, and debt obligations.

Once the application is submitted, Navy Federal will review the borrower's creditworthiness, as well as the value of the property, to determine the loan amount and interest rate. This process typically takes several days to several weeks, depending on the complexity of the application. During this time, borrowers may be required to provide additional documentation, such as pay stubs, tax returns, or appraisal reports.

Steps to Securing a Navy Federal HELOC Loan

To secure a Navy Federal HELOC loan, borrowers should follow these steps: * Determine the available equity in the home * Apply online or by phone * Provide basic financial information * Wait for Navy Federal to review the application and determine the loan amount and interest rate * Review and sign the loan documents * Access the funds as needed during the draw periodIt is also essential to carefully review the loan terms and conditions, including the interest rate, fees, and repayment terms, to ensure that the loan is a good fit for the borrower's financial situation.

Navy Federal HELOC Loan Requirements

To qualify for a Navy Federal HELOC loan, borrowers must meet certain requirements, including:

- Being a member of Navy Federal Credit Union

- Having a minimum credit score of 620

- Having a minimum equity of 10% in the home

- Having a stable income and debt-to-income ratio

- Providing required documentation, such as pay stubs and tax returns

Additionally, borrowers must also meet the credit union's loan-to-value (LTV) ratio requirements, which vary depending on the loan amount and property type. For example, for loan amounts up to $250,000, the LTV ratio is 95%, while for loan amounts between $250,001 and $500,000, the LTV ratio is 90%.

Navy Federal HELOC Loan Fees and Charges

While Navy Federal HELOC loan options do not feature any application fees or closing costs, there are some fees and charges associated with these loans. For example, borrowers may be required to pay an annual fee, which ranges from $50 to $100, depending on the loan amount and terms. Additionally, there may be fees associated with late payments, as well as fees for accessing the line of credit.It is essential to carefully review the loan terms and conditions to understand the fees and charges associated with the loan, as well as the repayment terms and interest rate.

Navy Federal HELOC Loan Alternatives

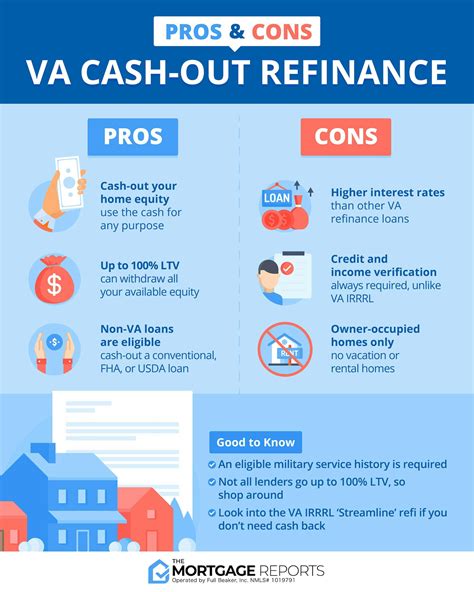

For Navy Federal members who are considering a HELOC loan, there are several alternatives to explore. One option is a home equity loan, which provides a lump sum upfront, rather than a line of credit. This loan features a fixed interest rate and a repayment term of up to 20 years.

Another alternative is a cash-out refinance, which involves refinancing the existing mortgage and taking out a new loan for a larger amount. This option can provide a lump sum upfront, as well as a lower interest rate and lower monthly payments.

Navy Federal HELOC Loan FAQs

Here are some frequently asked questions about Navy Federal HELOC loan options: * What is the interest rate for a Navy Federal HELOC loan? * How do I apply for a Navy Federal HELOC loan? * What are the repayment terms for a Navy Federal HELOC loan? * Can I use a Navy Federal HELOC loan for any purpose? * How long does it take to process a Navy Federal HELOC loan application?Navy Federal HELOC Loan Image Gallery

In conclusion, Navy Federal HELOC loan options offer a range of benefits and features that can help homeowners tap into the value of their properties. With competitive interest rates, flexible repayment terms, and the ability to access funds as needed, these loans can be an attractive option for those looking to finance major expenses or consolidate debt. By understanding the key features and benefits of Navy Federal HELOC loan options, as well as the requirements and fees associated with these loans, borrowers can make informed decisions about their financial situation. We invite you to share your thoughts and experiences with Navy Federal HELOC loan options in the comments below, and to explore the various loan options available to you.