Discover Navy Federal home equity loan options, including HELOCs and fixed-rate loans, with competitive rates and flexible terms, ideal for home improvement, debt consolidation, and refinancing, offering borrowing solutions for members with existing mortgages.

As a homeowner, you've worked hard to build equity in your property, and now you're looking to tap into that value to achieve your financial goals. Whether you're seeking to consolidate debt, fund a home renovation, or cover unexpected expenses, a home equity loan can be a viable solution. Navy Federal Credit Union, one of the largest and most reputable credit unions in the United States, offers a range of home equity loan options to its members. In this article, we'll delve into the details of Navy Federal's home equity loan products, exploring their benefits, features, and requirements.

Home equity loans can be a powerful tool for homeowners, providing access to a significant amount of funds at competitive interest rates. With a home equity loan, you can borrow against the equity in your home, using the funds to address a variety of financial needs. From paying off high-interest debt to financing a major home improvement project, the possibilities are endless. Navy Federal's home equity loan options are designed to meet the diverse needs of its members, offering flexible terms, competitive rates, and personalized service.

Navy Federal's home equity loan products are built on a foundation of trust, transparency, and member-centricity. As a not-for-profit credit union, Navy Federal is committed to serving the best interests of its members, rather than maximizing profits. This approach is reflected in the credit union's home equity loan options, which are designed to provide members with affordable, flexible, and sustainable financing solutions. Whether you're a seasoned homeowner or a first-time borrower, Navy Federal's home equity loan experts are available to guide you through the process, helping you navigate the complexities of borrowing against your home's equity.

Types of Home Equity Loans Offered by Navy Federal

Navy Federal offers a range of home equity loan products, each with its unique features, benefits, and requirements. The credit union's home equity loan options include:

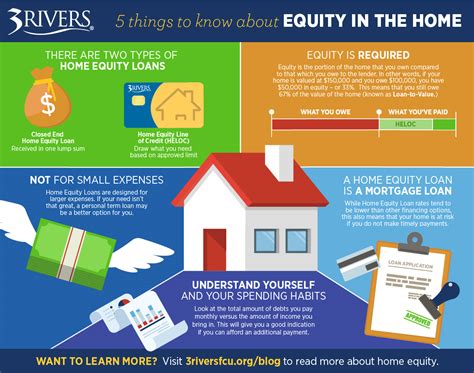

- Home Equity Loan: A traditional home equity loan, which provides a lump sum of funds at a fixed interest rate, with repayment terms ranging from 5 to 20 years.

- Home Equity Line of Credit (HELOC): A revolving line of credit, which allows you to borrow and repay funds as needed, with a variable interest rate and a repayment term of up to 20 years.

- Home Equity Loan with Interest-Only Payments: A home equity loan with an interest-only payment option, which enables you to make lower monthly payments during the initial years of the loan.

Benefits of Navy Federal Home Equity Loans

Navy Federal's home equity loan options offer a range of benefits, including:

- Competitive interest rates: Navy Federal's home equity loan rates are among the most competitive in the market, helping you save money on interest payments.

- Flexible repayment terms: The credit union's home equity loan products offer flexible repayment terms, allowing you to choose a loan term that aligns with your financial goals and budget.

- Low or no fees: Navy Federal's home equity loans often come with low or no fees, reducing the overall cost of borrowing.

- Personalized service: Navy Federal's home equity loan experts are available to provide personalized guidance and support throughout the loan process.

How to Apply for a Navy Federal Home Equity Loan

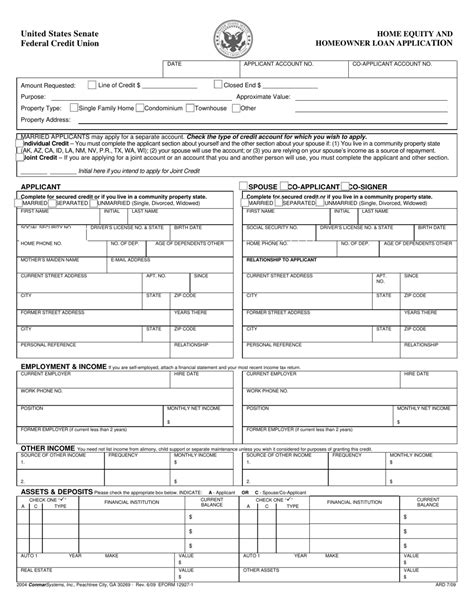

Applying for a Navy Federal home equity loan is a straightforward process, which can be completed online, by phone, or in-person at a Navy Federal branch. To apply, you'll need to:

- Check your eligibility: Ensure you meet Navy Federal's membership requirements and have a sufficient amount of equity in your home.

- Gather required documents: Collect financial documents, such as pay stubs, bank statements, and tax returns, to support your loan application.

- Submit your application: Complete the online application, or contact a Navy Federal representative to guide you through the process.

- Review and sign loan documents: Once your application is approved, review and sign the loan documents, which will outline the terms and conditions of your home equity loan.

Home Equity Loan Requirements and Eligibility

To be eligible for a Navy Federal home equity loan, you'll need to meet the credit union's membership requirements and have a sufficient amount of equity in your home. The specific requirements include:

- Membership: You must be a member of Navy Federal Credit Union to apply for a home equity loan.

- Equity: You'll need to have a minimum amount of equity in your home, typically 15% to 20% of the property's value.

- Credit score: A good credit score can help you qualify for a home equity loan with a competitive interest rate.

- Income: You'll need to demonstrate a stable income and a reasonable debt-to-income ratio.

Home Equity Loan Rates and Terms

Navy Federal's home equity loan rates and terms are designed to be competitive and flexible, allowing you to choose a loan that aligns with your financial goals and budget. The credit union's home equity loan rates are influenced by a range of factors, including:

- Loan amount: The amount you borrow can impact the interest rate you're offered.

- Loan term: The length of the loan can affect the interest rate and monthly payments.

- Credit score: A good credit score can help you qualify for a more competitive interest rate.

- Market conditions: Interest rates can fluctuate in response to changes in market conditions.

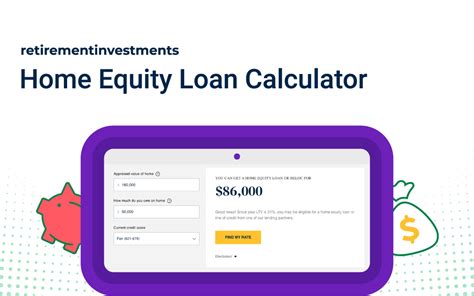

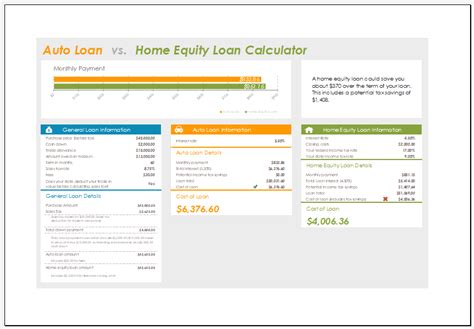

Home Equity Loan Calculator and Tools

Navy Federal offers a range of tools and resources to help you navigate the home equity loan process, including:

- Home equity loan calculator: A online tool that enables you to estimate your monthly payments and explore different loan scenarios.

- Loan comparison tool: A resource that allows you to compare different home equity loan products and rates.

- Financial guides and tutorials: Educational resources that provide insights and guidance on managing your finances and making informed borrowing decisions.

Home Equity Loan FAQs

Here are some frequently asked questions about Navy Federal's home equity loan products:

- What is the minimum loan amount for a Navy Federal home equity loan?

- How long does it take to process a home equity loan application?

- Can I use a home equity loan to consolidate debt?

- Are there any fees associated with a Navy Federal home equity loan?

Home Equity Loan Image Gallery

In conclusion, Navy Federal's home equity loan options offer a range of benefits and features that can help you achieve your financial goals. With competitive interest rates, flexible repayment terms, and personalized service, Navy Federal's home equity loans are an attractive solution for homeowners seeking to tap into their property's equity. Whether you're looking to consolidate debt, fund a home renovation, or cover unexpected expenses, a Navy Federal home equity loan can provide the funds you need to move forward. We invite you to share your thoughts and experiences with home equity loans in the comments below, and to explore the resources and tools available on our website to learn more about this valuable financial product.