Discover 5 ways Navy Federal Line of Credit benefits members, offering flexible financing, low rates, and convenient access to funds, with credit line management and loan options, providing financial freedom and security.

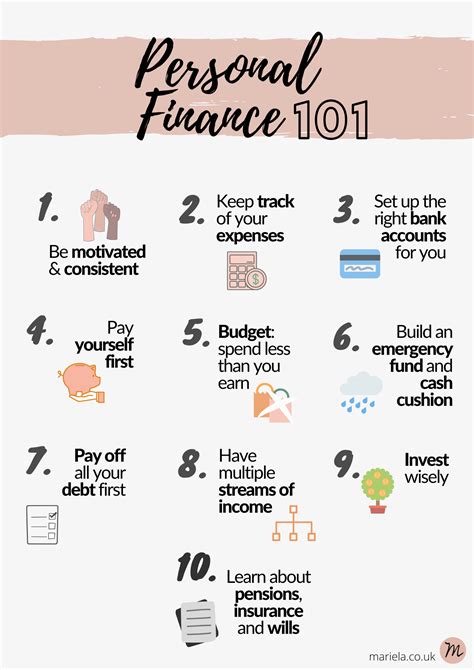

The importance of managing finances effectively cannot be overstated, especially for individuals with unique financial needs such as military personnel and their families. One institution that has been serving this community for decades is Navy Federal Credit Union, offering a range of financial products and services tailored to meet the distinct requirements of its members. Among its offerings, the Navy Federal line of credit stands out as a versatile tool that can help members achieve their financial goals, whether it's consolidating debt, financing large purchases, or covering unexpected expenses. Understanding the benefits and how to leverage a line of credit effectively is crucial for making the most out of this financial resource.

For those who are part of the Navy Federal community, having access to a line of credit can be a significant advantage. It provides a flexible way to borrow money as needed, with the option to repay and reuse the credit line. This feature is particularly beneficial for managing irregular income, covering emergency expenses, or taking advantage of investment opportunities. Moreover, the interest rates on lines of credit can be more favorable compared to other forms of credit, such as credit cards, making them an attractive option for long-term financial planning.

The flexibility and potential cost savings of a line of credit make it an appealing choice for various financial scenarios. However, it's essential to approach this form of credit with a clear understanding of its terms, including the interest rate, repayment terms, and any associated fees. By doing so, individuals can harness the full potential of a line of credit to improve their financial stability and achieve their goals. Whether it's for short-term needs or long-term strategies, a well-managed line of credit can be a valuable asset in one's financial toolkit.

Introduction to Navy Federal Line of Credit

Benefits of Using a Navy Federal Line of Credit

The benefits of using a Navy Federal line of credit are manifold. For starters, it offers a convenient source of emergency funding, helping members cover unexpected expenses without having to dip into their savings. Additionally, it can be used to consolidate higher-interest debt into a single, more manageable payment, potentially saving money on interest over time. The flexibility in repayment terms also allows members to adjust their payments according to their financial situation, providing a sense of security and control over their finances.How to Apply for a Navy Federal Line of Credit

Managing Your Navy Federal Line of Credit

Effective management of a Navy Federal line of credit involves understanding the terms of the agreement, including the interest rate, fees, and repayment schedule. It's also crucial to borrow only what is necessary and to make timely payments to avoid accumulating debt. Setting up automatic payments can help ensure that payments are never missed, and taking advantage of the flexible repayment terms can help adjust payments according to changing financial circumstances.Common Uses of a Navy Federal Line of Credit

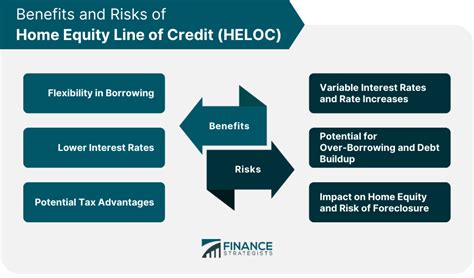

Advantages Over Other Financial Products

Compared to other financial products, such as personal loans or credit cards, a Navy Federal line of credit offers several advantages. The interest rates can be lower, and the repayment terms can be more flexible, allowing for better management of finances. Additionally, the revolving nature of the credit line means that members do not have to reapply for credit each time they need to borrow, making it a convenient option for ongoing financial needs.5 Ways to Maximize the Benefits of a Navy Federal Line of Credit

Conclusion and Next Steps

In conclusion, a Navy Federal line of credit is a powerful financial tool that, when used effectively, can help members achieve their financial objectives. By understanding its benefits, how to apply, and strategies for maximizing its use, individuals can make informed decisions about their financial futures. Whether for immediate needs or long-term plans, the flexibility and potential cost savings of a line of credit make it an attractive option for those looking to manage their finances wisely.Navy Federal Line of Credit Image Gallery

We invite you to share your thoughts and experiences with using a Navy Federal line of credit. How have you maximized its benefits to achieve your financial goals? Your insights can help others make informed decisions about their financial futures. Feel free to comment below, and don't forget to share this article with anyone who might find it useful. Together, we can work towards achieving financial stability and success.