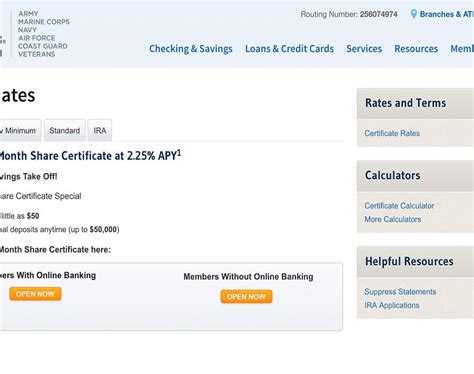

Calculate loan payments with Navy Federals loan calculator tool, exploring mortgage, auto, and personal loan options, and discover flexible repayment terms and interest rates.

The world of personal finance can be overwhelming, especially when it comes to managing debt and making informed decisions about borrowing money. One of the most critical tools in navigating this complex landscape is a loan calculator. For members of the Navy Federal Credit Union, the Navy Federal Loan Calculator Tool is an invaluable resource. This tool provides individuals with a clear and concise way to understand the terms of their loan, including the total cost, monthly payments, and payoff period. In this article, we will delve into the importance of using a loan calculator, the benefits of the Navy Federal Loan Calculator Tool, and how it can help individuals make smart financial decisions.

The importance of loan calculators cannot be overstated. These tools allow individuals to input various parameters, such as the loan amount, interest rate, and repayment term, to get a detailed breakdown of their loan. This information is crucial in determining whether a loan is affordable and aligns with one's financial goals. Without a loan calculator, individuals may find themselves struggling to make payments or facing unexpected costs. The Navy Federal Loan Calculator Tool is designed to provide members with a comprehensive understanding of their loan, empowering them to make informed decisions about their financial future.

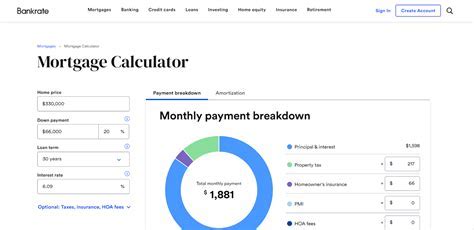

The Navy Federal Loan Calculator Tool is a user-friendly and intuitive platform that allows members to calculate their loan payments, payoff period, and total cost. The tool is accessible online, making it convenient for members to use from the comfort of their own homes. By inputting a few simple parameters, such as the loan amount, interest rate, and repayment term, members can instantly see the results. This tool is not only useful for those considering a new loan but also for individuals looking to refinance an existing loan or consolidate debt. The Navy Federal Loan Calculator Tool provides members with the information they need to make smart financial decisions and achieve their goals.

Navy Federal Loan Calculator Tool Benefits

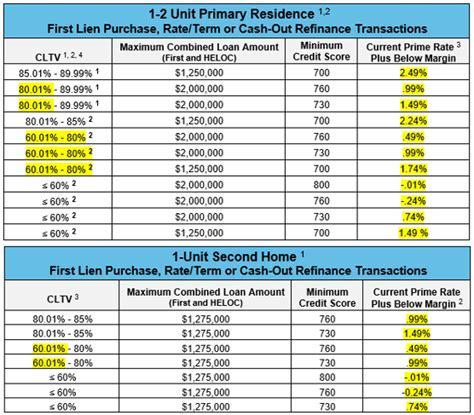

The Navy Federal Loan Calculator Tool offers numerous benefits to its members. One of the most significant advantages is the ability to compare different loan scenarios. By adjusting the input parameters, members can see how different interest rates, repayment terms, and loan amounts affect their monthly payments and total cost. This allows individuals to make informed decisions about which loan option is best for their financial situation. Additionally, the tool provides members with a detailed breakdown of their loan, including the total interest paid over the life of the loan. This information is essential in understanding the true cost of borrowing and making smart financial decisions.

Another significant benefit of the Navy Federal Loan Calculator Tool is its ability to help members save money. By inputting different loan scenarios, individuals can identify opportunities to reduce their monthly payments or payoff period. For example, members may find that by increasing their monthly payment, they can pay off their loan faster and save thousands of dollars in interest. The tool also allows members to explore different repayment strategies, such as making bi-weekly payments or applying extra funds to the principal balance. By using the Navy Federal Loan Calculator Tool, members can take control of their finances and make informed decisions about their loan.

How to Use the Navy Federal Loan Calculator Tool

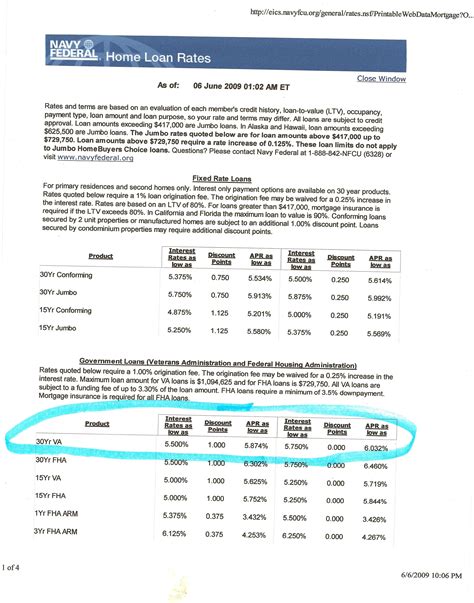

Using the Navy Federal Loan Calculator Tool is a straightforward process. To get started, members simply need to visit the Navy Federal Credit Union website and navigate to the loan calculator page. From there, they can input the necessary parameters, such as the loan amount, interest rate, and repayment term. The tool will instantly provide a detailed breakdown of the loan, including the monthly payment, payoff period, and total cost. Members can adjust the input parameters to explore different loan scenarios and compare the results.

One of the key features of the Navy Federal Loan Calculator Tool is its ability to provide members with a comprehensive breakdown of their loan. The tool includes a variety of calculators, such as a loan payment calculator, payoff calculator, and refinance calculator. Each of these calculators is designed to provide members with specific information about their loan, such as the monthly payment, payoff period, and total interest paid. By using these calculators, members can gain a deeper understanding of their loan and make informed decisions about their financial future.

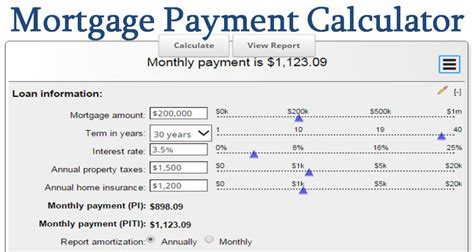

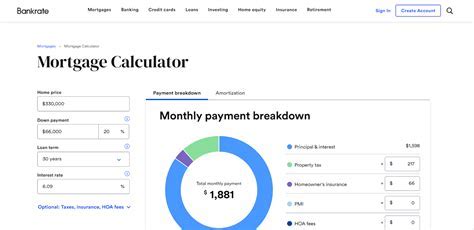

Loan Payment Calculator

The loan payment calculator is one of the most useful features of the Navy Federal Loan Calculator Tool. This calculator allows members to input the loan amount, interest rate, and repayment term to get a detailed breakdown of their monthly payment. The calculator also provides members with information about the total interest paid over the life of the loan, as well as the payoff period. By using the loan payment calculator, members can determine whether a loan is affordable and aligns with their financial goals.Payoff Calculator

The payoff calculator is another valuable feature of the Navy Federal Loan Calculator Tool. This calculator allows members to input the current loan balance, interest rate, and desired payoff period to get a detailed breakdown of their monthly payment. The calculator also provides members with information about the total interest paid over the life of the loan, as well as the total amount paid. By using the payoff calculator, members can determine the best strategy for paying off their loan and saving money on interest.Navy Federal Loan Calculator Tool Features

The Navy Federal Loan Calculator Tool includes a variety of features designed to provide members with a comprehensive understanding of their loan. One of the most significant features is the ability to compare different loan scenarios. By adjusting the input parameters, members can see how different interest rates, repayment terms, and loan amounts affect their monthly payments and total cost. This allows individuals to make informed decisions about which loan option is best for their financial situation.

Another key feature of the Navy Federal Loan Calculator Tool is its ability to provide members with a detailed breakdown of their loan. The tool includes a variety of calculators, such as a loan payment calculator, payoff calculator, and refinance calculator. Each of these calculators is designed to provide members with specific information about their loan, such as the monthly payment, payoff period, and total interest paid. By using these calculators, members can gain a deeper understanding of their loan and make informed decisions about their financial future.

Refinance Calculator

The refinance calculator is a valuable feature of the Navy Federal Loan Calculator Tool. This calculator allows members to input the current loan balance, interest rate, and desired repayment term to get a detailed breakdown of their monthly payment. The calculator also provides members with information about the total interest paid over the life of the loan, as well as the total amount paid. By using the refinance calculator, members can determine whether refinancing their loan is a good option and how it can help them save money on interest.Navy Federal Loan Calculator Tool Advantages

The Navy Federal Loan Calculator Tool offers numerous advantages to its members. One of the most significant advantages is the ability to make informed decisions about their loan. By using the tool, members can gain a comprehensive understanding of their loan, including the monthly payment, payoff period, and total cost. This information is essential in determining whether a loan is affordable and aligns with one's financial goals.

Another significant advantage of the Navy Federal Loan Calculator Tool is its ability to help members save money. By inputting different loan scenarios, individuals can identify opportunities to reduce their monthly payments or payoff period. For example, members may find that by increasing their monthly payment, they can pay off their loan faster and save thousands of dollars in interest. The tool also allows members to explore different repayment strategies, such as making bi-weekly payments or applying extra funds to the principal balance. By using the Navy Federal Loan Calculator Tool, members can take control of their finances and make informed decisions about their loan.

Financial Planning

The Navy Federal Loan Calculator Tool is also a valuable resource for financial planning. By using the tool, members can gain a comprehensive understanding of their loan and how it fits into their overall financial picture. The tool can help members identify areas where they can improve their financial situation, such as reducing debt or increasing their income. By using the Navy Federal Loan Calculator Tool, members can create a personalized financial plan that aligns with their goals and helps them achieve financial stability.Navy Federal Loan Calculator Tool Image Gallery

In conclusion, the Navy Federal Loan Calculator Tool is a valuable resource for members of the Navy Federal Credit Union. This tool provides individuals with a comprehensive understanding of their loan, including the monthly payment, payoff period, and total cost. By using the Navy Federal Loan Calculator Tool, members can make informed decisions about their loan, identify opportunities to save money, and create a personalized financial plan that aligns with their goals. Whether you're considering a new loan, looking to refinance an existing loan, or simply want to understand your current loan, the Navy Federal Loan Calculator Tool is an essential resource. We invite you to share your thoughts on the Navy Federal Loan Calculator Tool and how it has helped you make informed decisions about your loan. Please comment below and let us know how you've used the tool to achieve your financial goals.