Unlock affordable Navy mortgage options with 5 expert tips, including VA loan benefits, credit score optimization, and naval base location considerations.

As a member of the Navy, managing your finances effectively is crucial to ensure a stable and secure future for yourself and your family. One of the most significant financial decisions you'll make is purchasing a home, and navigating the mortgage process can be overwhelming. However, with the right guidance, you can make informed decisions and achieve your dream of homeownership. In this article, we'll delve into the world of Navy mortgages, exploring the benefits, challenges, and providing you with five valuable tips to help you navigate the process.

The Navy mortgage process is designed to provide service members with access to affordable and stable housing options. With the Veterans Affairs (VA) loan guarantee program, Navy personnel can enjoy favorable loan terms, including lower interest rates, lower or no down payment requirements, and reduced closing costs. However, the mortgage process can be complex, and it's essential to understand the intricacies of the system to make the most of the benefits available to you.

Understanding the Navy mortgage process is critical to making informed decisions about your financial future. The VA loan guarantee program is a valuable benefit that can help you achieve homeownership, but it's essential to be aware of the eligibility requirements, loan limits, and the documentation needed to secure a mortgage. By taking the time to educate yourself on the process, you can avoid common pitfalls and ensure a smooth transition into homeownership.

Understanding Navy Mortgage Benefits

Key Benefits of Navy Mortgages

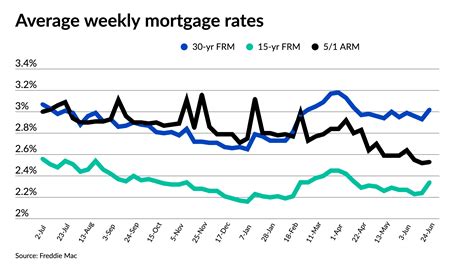

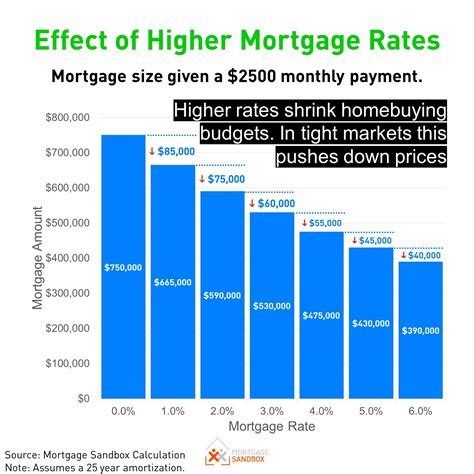

Some of the key benefits of Navy mortgages include: * Lower interest rates: VA loans often offer lower interest rates compared to conventional loans, resulting in lower monthly mortgage payments. * Lower or no down payment requirements: With the VA loan guarantee program, you may not need to make a down payment, or you may be able to make a lower down payment. * Reduced closing costs: The VA loan program can help reduce closing costs, making it easier to purchase a home. * More lenient credit score requirements: The VA loan program has more lenient credit score requirements, making it easier to qualify for a mortgage.Navigating the Navy Mortgage Process

Steps to Navigate the Navy Mortgage Process

Some of the steps to navigate the Navy mortgage process include: 1. Pre-approval: Get pre-approved for a mortgage to determine how much you can borrow and what your monthly payments will be. 2. Pre-qualification: Get pre-qualified for a mortgage to determine your eligibility for a VA loan. 3. Loan application: Submit your loan application and provide the required documentation to secure a mortgage.5 Tips for Navy Mortgages

Common Mistakes to Avoid

Conclusion and Next Steps

Final Thoughts

As you navigate the Navy mortgage process, keep in mind that it's essential to stay informed and adapt to changing circumstances. The VA loan guarantee program is a valuable benefit that can help you achieve homeownership, but it's crucial to understand the program's requirements, benefits, and limitations. By taking the time to educate yourself on the process and following the tips outlined in this article, you can make informed decisions and achieve your dream of homeownership.Navy Mortgage Image Gallery

We hope this article has provided you with valuable insights and tips to help you navigate the Navy mortgage process. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family who may be interested in learning more about Navy mortgages. Take the first step towards achieving your dream of homeownership today!