Resolve Navy Federal errors with 5 expert Oops fixes, addressing common issues, login problems, and account glitches, to ensure seamless banking experiences and online security.

The importance of maintaining a good financial standing cannot be overstated, especially when it comes to managing credit and loans. For members of the Navy Federal Credit Union, understanding how to navigate potential issues with their accounts is crucial. Navy Federal, being one of the largest and most reputable credit unions in the world, offers a wide range of financial services to its members, including credit cards, personal loans, mortgages, and more. However, like any financial institution, issues can arise, and it's essential for members to know how to address them promptly.

Navigating financial challenges can be daunting, but being informed about common issues and their solutions can significantly reduce stress and financial hardship. Whether it's dealing with overdrafts, credit card disputes, or loan application issues, having the right strategies and knowledge can make all the difference. This article aims to guide Navy Federal members through some common "oops" moments they might encounter and provide practical fixes to get their financial health back on track.

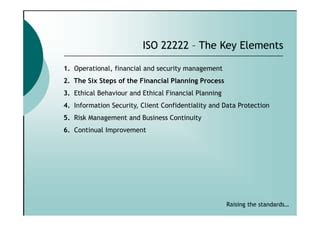

Financial literacy is key to avoiding and resolving financial mishaps. By understanding the terms and conditions of their accounts, loans, and credit cards, Navy Federal members can better manage their finances and make informed decisions. Moreover, being proactive and reaching out to Navy Federal's customer service can often resolve issues quickly and efficiently. In the following sections, we will delve into specific scenarios and provide step-by-step guides on how to address them, ensuring that readers are well-equipped to handle any financial "oops" that come their way.

Understanding Navy Federal's Services

Benefits of Membership

Membership with Navy Federal comes with numerous benefits, including competitive interest rates on loans and credit cards, low fees, and exceptional customer service. Members also have access to financial counseling and education resources, which can be invaluable in navigating complex financial decisions. Furthermore, the credit union's mobile banking app allows for easy account management, enabling members to monitor their accounts, transfer funds, and pay bills on the go. This level of convenience and support can significantly reduce the likelihood of financial mistakes and make resolving issues much simpler.Fixing Overdraft Issues

Preventive Measures

Preventing overdrafts from occurring in the first place is the best strategy. Navy Federal members can set up account alerts to notify them when their balance falls below a certain threshold, giving them time to add funds before any transactions cause an overdraft. Regularly monitoring account activity and keeping track of upcoming payments can also help avoid overdrafts. For members who frequently find themselves at risk of overdraft, reviewing their budget and adjusting their spending habits may be necessary to ensure they have sufficient funds in their account at all times.Resolving Credit Card Disputes

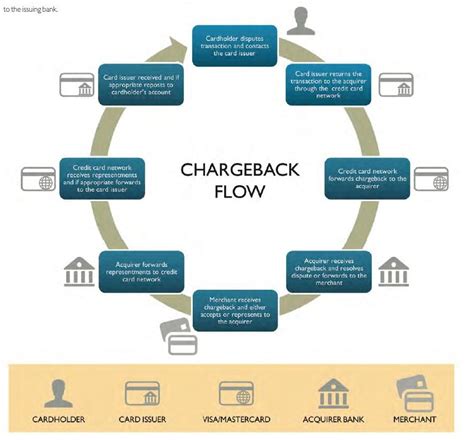

Steps to Dispute a Charge

The process of disputing a credit card charge involves several steps: - Identify the disputed charge on the statement and gather relevant information, such as the date of the transaction, the amount, and the merchant's name. - Attempt to resolve the issue with the merchant directly. - If unresolved, contact Navy Federal's customer service department to file a formal dispute. - Provide all requested documentation and information to support the dispute. - Wait for the investigation to be completed and the issue to be resolved, which may involve a temporary credit to the account pending the outcome.Addressing Loan Application Issues

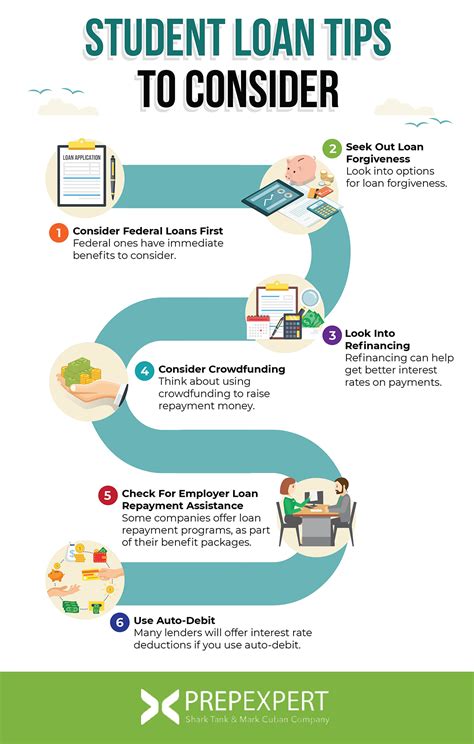

Improving Credit Score

Improving one's credit score can significantly enhance the chances of loan approval. This can be achieved by: - Paying bills on time to demonstrate a history of reliable payments. - Reducing debt to lower the debt-to-income ratio. - Avoiding applying for multiple lines of credit in a short period. - Monitoring credit reports for errors and disputing any inaccuracies found.Managing Account Security

Best Practices for Online Security

Best practices for maintaining online security include: - Using antivirus software and keeping it up to date. - Avoiding public computers or public Wi-Fi for banking activities. - Logging out of online banking sessions when finished. - Being cautious of phishing scams and never providing personal or financial information in response to unsolicited emails or calls.Conclusion and Next Steps

Final Thoughts

The key to successfully managing finances and resolving issues when they arise is a combination of financial literacy, proactive account management, and leveraging the support services offered by Navy Federal. By following the guidelines and tips outlined in this article, members can better equip themselves to handle any financial situation that comes their way, ensuring a stable and secure financial future.Navy Federal Oops Fixes Image Gallery

We invite our readers to share their experiences and tips on managing financial "oops" moments in the comments below. Your insights could help others navigate similar challenges. Additionally, if you found this article informative and helpful, please consider sharing it with friends and family who might benefit from the information. By working together and supporting one another, we can all achieve greater financial stability and success.