Navy Federal Overdraft Fee Lawsuit: Learn about overdraft protection, excessive fees, and class action lawsuits against Navy Federal Credit Union, and understand your rights regarding unfair banking practices and debit card transactions.

The issue of overdraft fees has been a contentious one in the banking industry for many years. Consumers have long complained about the exorbitant fees charged by banks when their accounts are overdrawn, even if the overdraft is minor or accidental. One of the largest credit unions in the United States, Navy Federal Credit Union, has recently been embroiled in a lawsuit related to its overdraft fee practices. The lawsuit alleges that Navy Federal has been charging its members excessive and unfair overdraft fees, in violation of federal and state laws.

The lawsuit, which was filed in 2020, claims that Navy Federal has been engaging in a practice known as "reordering transactions" to maximize the number of overdraft fees it can charge its members. This practice involves processing transactions in a way that causes the account to be overdrawn, even if the member had sufficient funds to cover the transactions when they were made. For example, if a member has $100 in their account and makes two transactions, one for $50 and one for $75, Navy Federal might process the $75 transaction first, causing the account to be overdrawn, and then charge the member an overdraft fee. The lawsuit alleges that this practice is unfair and deceptive, and that Navy Federal has been using it to generate millions of dollars in revenue from overdraft fees.

The issue of overdraft fees is an important one, not just for Navy Federal members but for consumers in general. Overdraft fees can be a significant burden on consumers, particularly those who are living paycheck to paycheck or who have limited financial resources. According to a report by the Consumer Financial Protection Bureau (CFPB), overdraft fees can range from $25 to $35 per transaction, and can add up quickly if a consumer has multiple overdrafts in a short period of time. The CFPB has also found that overdraft fees disproportionately affect low-income and minority consumers, who are more likely to have limited financial resources and to be charged overdraft fees.

Navy Federal Overdraft Fee Lawsuit Background

Key Allegations in the Lawsuit

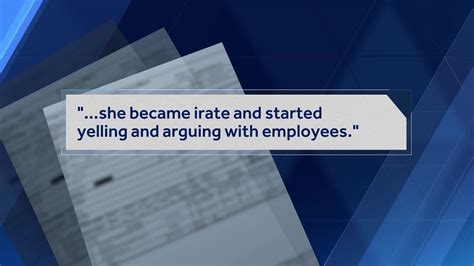

The lawsuit against Navy Federal makes several key allegations about the credit union's overdraft fee practices. These allegations include: * That Navy Federal has been reordering transactions to maximize the number of overdraft fees it can charge its members * That Navy Federal has been charging overdraft fees on transactions that were authorized by the member, but that were not actually overdrafts * That Navy Federal has been failing to provide adequate notice to its members about overdraft fees and how to avoid them * That Navy Federal has been engaging in unfair and deceptive practices in its marketing and sale of overdraft protection servicesNavy Federal Overdraft Fee Lawsuit Implications

Regulatory Environment

The regulatory environment for overdraft fees is complex and evolving. The CFPB has been actively involved in regulating overdraft fees, and has issued several reports and guidelines on the topic. The CFPB has also taken enforcement action against several banks and credit unions for unfair or deceptive overdraft fee practices. In addition to the CFPB, other regulatory agencies such as the Federal Reserve and the Office of the Comptroller of the Currency (OCC) also have a role in regulating overdraft fees.Navy Federal Overdraft Fee Lawsuit Settlement

Consumer Protection

The Navy Federal overdraft fee lawsuit highlights the importance of consumer protection in the banking industry. Consumers need to be aware of their rights and responsibilities when it comes to overdraft fees, and need to take steps to protect themselves from unfair or deceptive practices. This can include carefully reviewing account agreements and fee schedules, monitoring account activity regularly, and contacting the bank or credit union if there are any issues or concerns.Navy Federal Overdraft Fee Lawsuit FAQs

Gallery of Overdraft Fee Lawsuits

Overdraft Fee Lawsuit Image Gallery

Navy Federal Overdraft Fee Lawsuit Final Thoughts