Maximize your naval salary with 5 Navy Payday Tips, including budgeting, saving, and investing strategies for financial stability and security, tailored to military personnel and veterans.

Being part of the Navy comes with its own set of financial challenges and opportunities. Managing your finances effectively is crucial, not just for your personal well-being but also for your career advancement. Here are some insights into why financial literacy is important for Navy personnel and how it can impact your life and career.

Financial management for Navy personnel involves understanding the unique aspects of military pay, benefits, and the challenges that come with frequent deployments and relocations. It requires a deep understanding of how Navy pay works, including basic pay, allowances, and special pays. Moreover, it involves making smart decisions about saving, investing, and managing debt, all while navigating the uncertainties of military life.

The importance of financial literacy cannot be overstated. It is the foundation upon which you build your financial stability and security. By understanding how to manage your finances effectively, you can avoid debt, build wealth, and ensure that you and your family are protected against financial shocks. Whether you're just starting your Navy career or are nearing retirement, having a solid grasp of financial management principles is essential for achieving your long-term goals.

Navy Pay Structure

Basic Pay

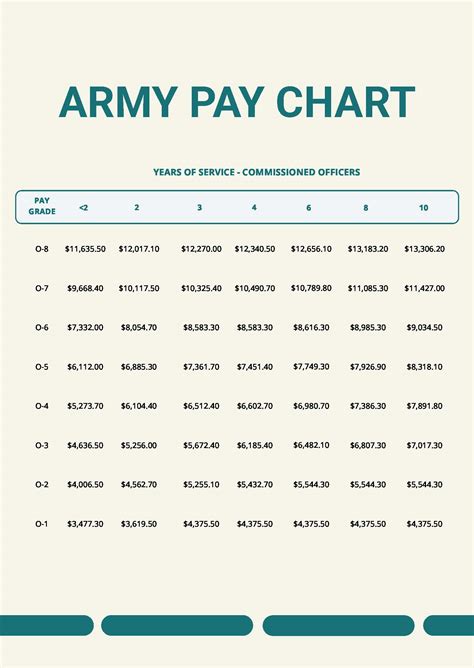

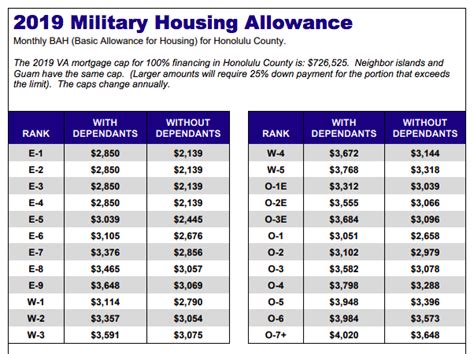

Basic pay is the primary source of income for Navy personnel. It is paid twice a month and is based on the pay grade and time in service. The pay grades are divided into three categories: enlisted (E-1 to E-9), warrant officer (W-1 to W-5), and officer (O-1 to O-10). Each pay grade has a corresponding pay scale, with increases in pay as you advance in rank or accumulate more years of service.Allowances and Special Pays

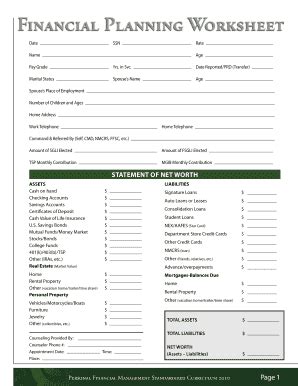

Managing Your Finances

Effective financial management is key to making the most of your Navy pay. It involves creating a budget, saving for the future, managing debt, and making smart investment decisions. Given the unpredictability of military life, having an emergency fund in place is crucial. This fund should cover at least three to six months of living expenses and can provide a financial cushion in case of unexpected expenses or deployments.5 Navy Payday Tips

-

Save and Invest: Saving is crucial, but investing can help your money grow over time. Consider contributing to the Thrift Savings Plan (TSP), which is a retirement savings plan for military personnel and federal employees.

-

Manage Debt: High-interest debt can quickly derail your financial plans. Focus on paying off high-interest loans and credit cards as soon as possible. Consider consolidating debt into lower-interest loans or balance transfer credit cards.

-

Take Advantage of Benefits: The Navy offers a range of benefits that can help reduce your expenses. From on-base shopping facilities to military discounts on travel and entertainment, taking advantage of these benefits can help stretch your dollar further.

-

Educate Yourself: Financial literacy is key to making smart financial decisions. Take advantage of financial counseling services offered by the Navy and educate yourself on personal finance, investing, and money management.

Financial Planning for the Future

Retirement Planning

Retirement planning is an essential part of long-term financial planning. The military offers a pension system for those who serve 20 years or more, but it's also important to supplement this with personal savings and investments. The TSP is a powerful tool for building retirement savings, and contributing to it consistently can make a significant difference in your retirement fund over time.Navigating Financial Challenges

Seeking Financial Assistance

The Navy offers various forms of financial assistance, from counseling services to emergency loans. Don't hesitate to seek help if you're facing financial difficulties. Financial counselors can provide personalized advice and help you develop a plan to get back on track.Navy Financial Management Image Gallery

In conclusion, managing your finances as a Navy personnel requires a deep understanding of the Navy pay structure, allowances, and special pays, as well as the discipline to save, invest, and manage debt effectively. By following the 5 Navy payday tips outlined above and taking advantage of the financial resources and benefits available to you, you can achieve financial stability and security, both during and after your military service. Remember, financial literacy is a journey, and there's always more to learn. Stay informed, stay disciplined, and you'll be on your way to a brighter financial future. We encourage you to share your thoughts and experiences on financial management in the comments below and to consider sharing this article with others who may benefit from these insights.