Boost financial stability with 5 Navy Federal tips, including credit score management, loan options, and investment strategies, to enhance banking experience and secure economic growth.

The world of personal finance can be overwhelming, especially for those who are just starting to build their financial foundation. With so many options and institutions to choose from, it's essential to find a financial partner that understands your unique needs and goals. For many, Navy Federal Credit Union has been a trusted ally in navigating the complexities of personal finance. As one of the largest and most reputable credit unions in the world, Navy Federal offers a wide range of financial products and services designed to help its members achieve financial stability and success. In this article, we'll explore five Navy Federal tips that can help you make the most of your membership and take control of your financial future.

Building a strong financial foundation requires a combination of knowledge, discipline, and the right tools. Navy Federal has been serving its members for over 80 years, providing them with the resources and expertise they need to achieve their financial goals. From saving and investing to borrowing and protecting, Navy Federal offers a comprehensive suite of financial products and services that can help you every step of the way. Whether you're a seasoned financial expert or just starting to build your financial knowledge, Navy Federal has the tips and resources you need to succeed.

As a member of Navy Federal, you have access to a wide range of financial products and services, including checking and savings accounts, credit cards, loans, and investment products. But with so many options to choose from, it can be difficult to know where to start. That's why we've put together five Navy Federal tips to help you make the most of your membership and achieve your financial goals. From maximizing your savings to minimizing your debt, these tips will provide you with the knowledge and expertise you need to take control of your financial future.

Understanding Navy Federal Membership

Benefits of Navy Federal Membership

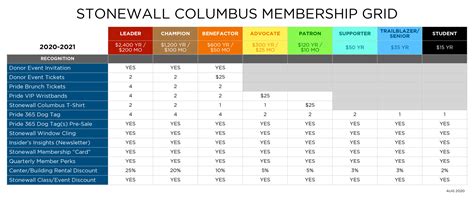

Some of the benefits of Navy Federal membership include: * Competitive rates on loans and credit cards * High-yield savings accounts and certificates * Low fees and flexible terms * Access to a network of branches and ATMs * Online and mobile banking tools * Personalized service and support By understanding the benefits and perks of Navy Federal membership, you can make informed decisions about your finances and get the most out of your membership.Maximizing Your Savings

Strategies for Saving

Some strategies for saving include: * Setting aside a fixed amount each month * Taking advantage of high-yield savings accounts and certificates * Using tax-advantaged retirement accounts * Avoiding unnecessary expenses and fees * Using budgeting and savings tools to track your progress By maximizing your savings, you can achieve financial stability and security, and make progress towards your long-term goals.Minimizing Your Debt

Strategies for Managing Debt

Some strategies for managing debt include: * Creating a budget and tracking your expenses * Prioritizing high-interest debt and paying it off first * Using balance transfer credit cards or debt consolidation loans * Avoiding unnecessary expenses and fees * Using credit counseling and financial planning tools to get back on track By minimizing your debt, you can free up more money in your budget, reduce your financial stress, and achieve financial stability and security.Investing in Your Future

Investment Options

Some investment options include: * Stocks and bonds * Mutual funds and ETFs * Index funds and other low-cost investments * Retirement accounts, such as IRAs and 401(k)s * Real estate and other alternative investments By investing in your future, you can achieve financial stability and security, and make progress towards your long-term goals.Protecting Your Finances

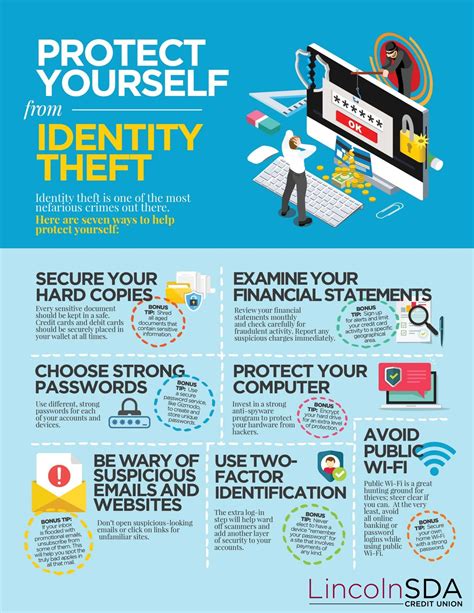

Strategies for Protecting Your Finances

Some strategies for protecting your finances include: * Monitoring your credit report and score * Using identity theft protection and credit monitoring tools * Insuring your assets and income * Avoiding unnecessary risks and expenses * Using financial planning and budgeting tools to stay on track By protecting your finances, you can achieve financial stability and security, and make progress towards your long-term goals.Navy Federal Image Gallery

By following these five Navy Federal tips, you can take control of your finances and achieve financial stability and success. Whether you're looking to maximize your savings, minimize your debt, invest in your future, or protect your finances, Navy Federal has the resources and expertise you need to succeed. So why not get started today? Take the first step towards achieving your financial goals and start building the financial future you deserve. We invite you to share your thoughts and experiences with Navy Federal in the comments below, and to share this article with anyone who may benefit from these valuable tips.