Boost financial stability with 5 Navy Federal tips, including credit score management, loan options, and investment strategies, to enhance banking experience and secure economic growth.

As a member of the military community, managing finances can be a daunting task, especially with the unique challenges that come with serving in the armed forces. Navy Federal Credit Union has been a trusted financial institution for military members and their families for over 80 years, offering a wide range of financial products and services designed to meet their specific needs. In this article, we will explore five valuable tips from Navy Federal that can help you navigate the world of personal finance and achieve your financial goals.

The importance of financial literacy cannot be overstated, particularly for military members who may face frequent deployments, relocations, and other financial stressors. By understanding how to manage their finances effectively, military families can reduce their stress levels, achieve financial stability, and build a secure future. Navy Federal's commitment to providing personalized financial guidance and support has made it an invaluable resource for the military community.

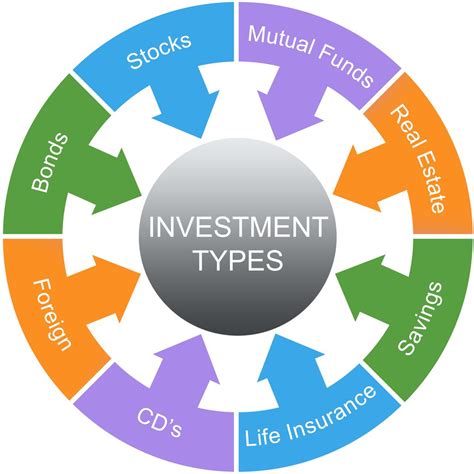

Navy Federal's expertise in military finance has enabled it to develop a range of innovative products and services tailored to the unique needs of military members and their families. From competitive savings rates to flexible loan options, Navy Federal's financial solutions are designed to help military families achieve their financial goals, whether that means buying a home, funding their children's education, or planning for retirement. By following these five tips from Navy Federal, you can take control of your finances, make informed decisions, and build a brighter financial future.

Understanding Your Financial Goals

Assessing Your Financial Situation

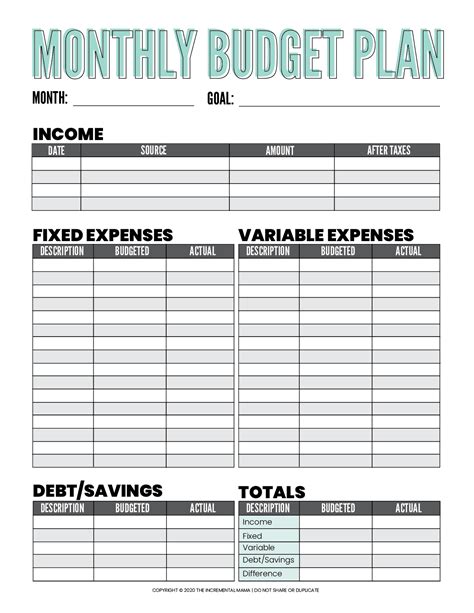

To create an effective financial plan, you need to have a thorough understanding of your current financial situation. This includes tracking your income and expenses, monitoring your credit report, and assessing your debt obligations. Navy Federal offers a range of financial tools and resources to help you get started, including budgeting worksheets, credit score tracking, and debt consolidation options. By taking a close look at your financial situation, you can identify areas for improvement and develop strategies to overcome any financial challenges you may be facing.Building an Emergency Fund

Managing Debt Effectively

For many military families, debt can be a significant financial burden. Whether it's credit card debt, student loans, or a mortgage, managing debt effectively is crucial for achieving financial stability. Navy Federal offers a range of debt management tools and resources, including debt consolidation loans, credit counseling, and financial education workshops. By understanding the different types of debt, creating a debt repayment plan, and avoiding new debt, you can take control of your finances and build a stronger financial future.Investing in Your Future

Protecting Your Finances

Finally, protecting your finances is essential for achieving financial stability. This includes protecting your identity, monitoring your credit report, and avoiding financial scams. Navy Federal offers a range of financial protection tools and resources, including identity theft protection, credit monitoring, and financial education workshops. By being proactive and taking steps to protect your finances, you can avoid financial pitfalls and build a stronger financial future.Additional Tips for Military Families

Conclusion and Next Steps

In conclusion, achieving financial stability requires a comprehensive approach that includes understanding your financial goals, building an emergency fund, managing debt effectively, investing in your future, and protecting your finances. By following these five tips from Navy Federal and taking advantage of the resources and guidance available, you can take control of your finances and build a brighter financial future. Whether you're just starting out or nearing retirement, Navy Federal's commitment to providing personalized financial guidance and support can help you achieve your financial goals and live a more secure, stable life.Navy Federal Image Gallery

We hope this article has provided you with valuable insights and tips for managing your finances effectively. By following these five tips from Navy Federal and taking advantage of the resources and guidance available, you can achieve financial stability and build a brighter financial future. If you have any questions or comments, please don't hesitate to share them below. We would love to hear from you and help you on your journey to financial success.