Discover 5 Navy Federal Loan Requirements, including credit score, income, and membership needs, to navigate Navy Federal Credit Unions lending process with ease, using debt-to-income ratio and loan options like personal loans and mortgages.

The importance of understanding loan requirements cannot be overstated, especially when it comes to reputable financial institutions like Navy Federal Credit Union. For individuals seeking to secure a loan, whether for personal, educational, or mortgage purposes, navigating the eligibility criteria and application process is crucial. Navy Federal, known for its member-centric approach and competitive rates, offers a range of loan products tailored to meet diverse financial needs. However, to take advantage of these offerings, potential borrowers must first grasp the fundamental requirements and considerations involved.

Understanding the specific requirements for Navy Federal loans is not just about meeting the eligibility criteria; it's also about making informed financial decisions. Each type of loan, from personal loans to mortgages, comes with its own set of conditions that borrowers must fulfill. By delving into these requirements, individuals can better position themselves for loan approval and set the stage for a successful financial partnership with Navy Federal. Moreover, being aware of the loan requirements helps in planning and preparing the necessary documents and financial standing, thereby streamlining the application process.

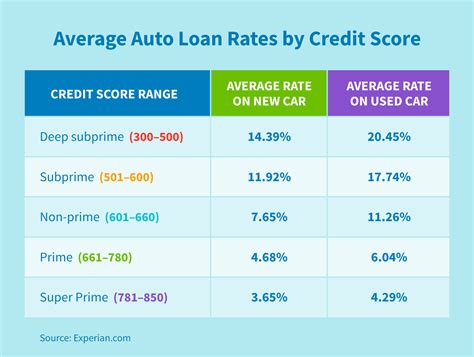

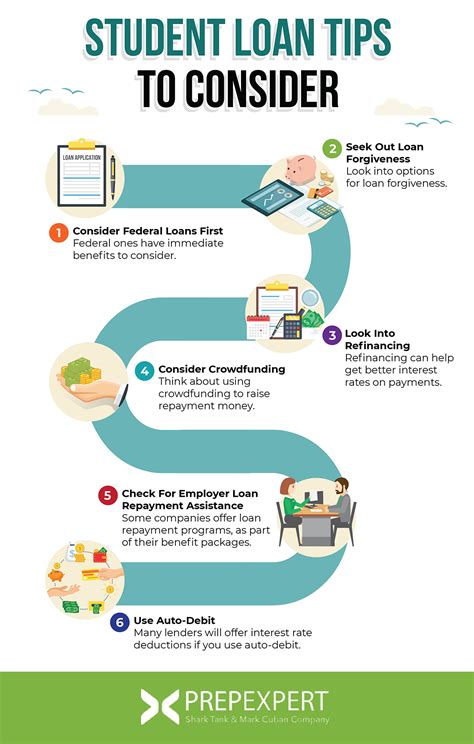

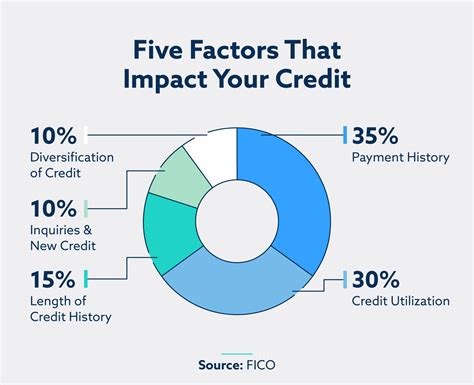

The process of applying for a loan with Navy Federal involves several key steps, including checking eligibility, choosing the right loan product, gathering required documents, and submitting the application. Throughout this process, understanding the specific requirements for the desired loan type is essential. For instance, credit score, income stability, and debt-to-income ratio play significant roles in determining loan eligibility and terms. By focusing on these aspects, borrowers can not only increase their chances of approval but also work towards securing more favorable loan terms.

Overview of Navy Federal Loan Requirements

Navy Federal Credit Union offers a variety of loans designed to cater to the diverse needs of its members. From personal loans and credit cards to home loans and student loans, each product has its unique set of requirements and benefits. To qualify for a Navy Federal loan, members typically need to meet certain eligibility criteria, which may include membership requirements, creditworthiness, income verification, and other financial assessments. Understanding these requirements is the first step towards a successful loan application.

Membership Eligibility

To apply for any Navy Federal loan, the primary requirement is to be a member of the credit union. Membership is open to all Department of Defense and Coast Guard Active Duty, civilian, and contractor personnel, as well as their families. This includes veterans, retirees, and annuitants. Individuals related to current members or those who have worked with organizations affiliated with Navy Federal may also be eligible. The membership process typically involves joining online or in-person and opening a savings account with a minimum deposit.Types of Loans Offered by Navy Federal

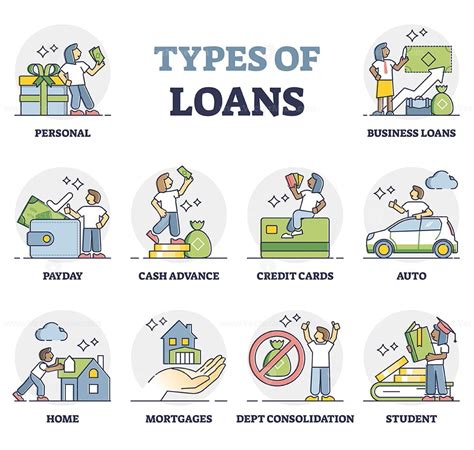

Navy Federal provides a broad spectrum of loan products to meet the varied financial needs of its members. These include:

- Personal Loans: Designed for general purposes, such as consolidating debt, covering unexpected expenses, or financing large purchases.

- Auto Loans: For buying new or used vehicles, with competitive rates and flexible terms.

- Home Loans: Including mortgages for purchasing homes, refinancing existing mortgages, and home equity loans or lines of credit.

- Student Loans: To help finance education expenses, with options for undergraduate and graduate studies.

- Credit Cards: Offering a range of credit card products with rewards, low APRs, and no annual fees.

Loan Application Process

The loan application process at Navy Federal is designed to be straightforward and efficient. Members can apply online, by phone, or in-person at a branch. The process generally involves: 1. **Checking Eligibility**: Ensuring you meet the basic membership and loan-specific requirements. 2. **Choosing Your Loan**: Selecting the loan product that best fits your financial needs. 3. **Gathering Documents**: Typically includes identification, proof of income, and other financial documents. 4. **Applying**: Submitting your application, which may involve a credit check. 5. **Review and Approval**: Navy Federal reviews your application and makes a decision.Benefits of Choosing Navy Federal for Your Loan

Choosing Navy Federal for your loan needs can offer several benefits, including:

- Competitive Rates: Navy Federal often provides more favorable interest rates compared to traditional banks.

- Flexible Terms: Loans can be tailored to fit your financial situation, with options for longer or shorter repayment periods.

- Low or No Fees: Many Navy Federal loans come with minimal or no fees, saving you money over the life of the loan.

- Member Service: As a member-centric organization, Navy Federal is known for its high level of customer service and support.

- Financial Education: Members have access to resources and tools to help manage their finances and make informed decisions.

Managing Your Loan

After securing a loan, managing your debt effectively is crucial. This involves making timely payments, monitoring your credit score, and considering options for loan consolidation or refinancing if needed. Navy Federal offers various tools and services to help members manage their loans, including online banking, mobile apps, and financial counseling.Conclusion and Next Steps

In conclusion, understanding the requirements and benefits of Navy Federal loans is essential for making informed financial decisions. By grasping the eligibility criteria, loan options, and application process, individuals can navigate the path to securing a loan that meets their needs. Whether you're looking to consolidate debt, finance a large purchase, or achieve your long-term financial goals, Navy Federal's loan products and member-centric approach make it a valuable consideration.

Final Considerations

Before applying for a loan, it's essential to review your financial situation, understand the terms and conditions of the loan, and consider how the loan will impact your credit score and overall financial health. Navy Federal's commitment to its members, combined with its comprehensive range of loan products, positions it as a leading choice for those seeking financial assistance.Navy Federal Loan Gallery

We invite you to share your thoughts and experiences with Navy Federal loans in the comments below. If you found this article informative and helpful, please consider sharing it with others who may be exploring their loan options. For those ready to take the next step, we encourage you to visit the Navy Federal website or contact their customer service to learn more about how their loan products can support your financial goals.