Discover Navy Federal personal loans options, including unsecured loans, debt consolidation, and home improvement loans with competitive rates and flexible terms.

The world of personal loans can be overwhelming, with numerous options available to consumers. However, for those who are part of the Navy Federal Credit Union, there is a range of personalized loan options tailored to meet their specific needs. As a credit union, Navy Federal offers its members a unique set of benefits, including competitive interest rates, flexible repayment terms, and personalized service. In this article, we will delve into the world of Navy Federal personal loans, exploring the various options available, their benefits, and what sets them apart from other lenders.

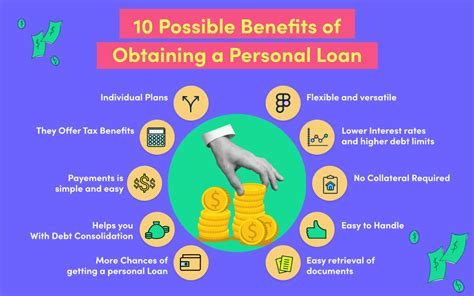

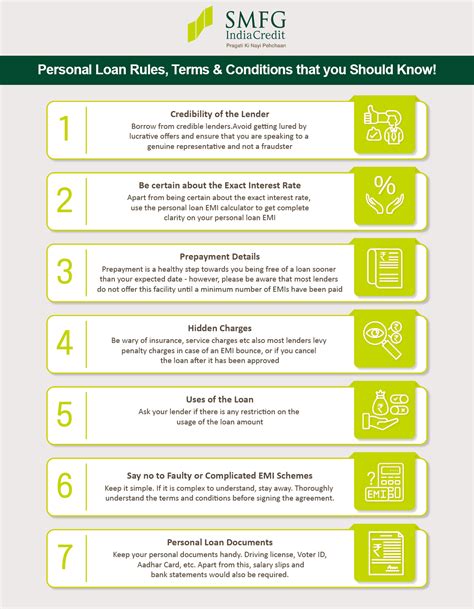

For individuals looking to consolidate debt, finance a large purchase, or cover unexpected expenses, a personal loan can be a viable solution. Navy Federal personal loans offer a range of benefits, including fixed interest rates, flexible repayment terms, and no prepayment penalties. This means that borrowers can budget their payments with confidence, knowing exactly how much they will owe each month. Additionally, with no prepayment penalties, borrowers can pay off their loan early without incurring additional fees.

Navy Federal Personal Loan Options

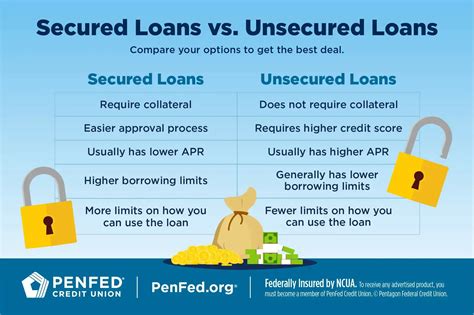

Navy Federal offers a range of personal loan options, each designed to meet the unique needs of its members. These options include unsecured personal loans, secured personal loans, and home equity loans. Unsecured personal loans are ideal for those who need quick access to cash without putting up collateral. Secured personal loans, on the other hand, require collateral, such as a vehicle or savings account, and often offer more favorable interest rates. Home equity loans allow homeowners to tap into the equity in their home, providing a low-cost way to finance large expenses.

Unsecured Personal Loans

Unsecured personal loans are a popular option for Navy Federal members, offering a range of benefits, including quick approval, flexible repayment terms, and no collateral requirements. These loans are ideal for those who need to consolidate debt, finance a large purchase, or cover unexpected expenses. With unsecured personal loans, borrowers can borrow up to $50,000, with repayment terms ranging from 12 to 60 months.Secured Personal Loans

Secured personal loans offer a range of benefits, including lower interest rates, larger loan amounts, and longer repayment terms. These loans require collateral, such as a vehicle or savings account, which can be seized by the lender if the borrower defaults on the loan. Secured personal loans are ideal for those who need to finance a large expense, such as a wedding or home improvement project. With secured personal loans, borrowers can borrow up to $100,000, with repayment terms ranging from 12 to 180 months.

Home Equity Loans

Home equity loans allow homeowners to tap into the equity in their home, providing a low-cost way to finance large expenses. These loans offer a range of benefits, including low interest rates, tax-deductible interest, and flexible repayment terms. Home equity loans are ideal for those who need to finance a large expense, such as a home improvement project or college tuition. With home equity loans, borrowers can borrow up to $500,000, with repayment terms ranging from 5 to 20 years.Benefits of Navy Federal Personal Loans

Navy Federal personal loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and personalized service. These benefits make Navy Federal personal loans an attractive option for those who need to finance a large expense or consolidate debt. Additionally, Navy Federal offers a range of tools and resources to help borrowers manage their debt, including online budgeting tools and financial counseling.

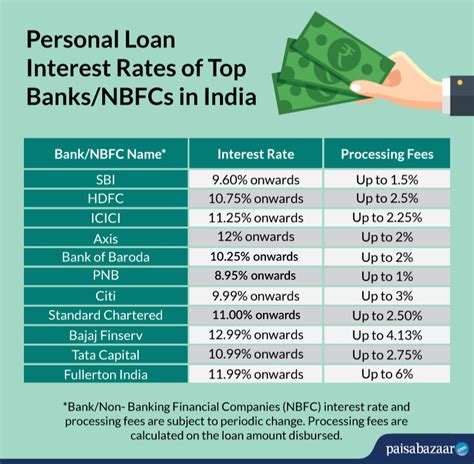

Competitive Interest Rates

Navy Federal personal loans offer competitive interest rates, which can help borrowers save money on interest payments. These rates are often lower than those offered by other lenders, making Navy Federal personal loans a cost-effective option for those who need to finance a large expense. Additionally, Navy Federal offers a range of interest rate discounts, including a 0.25% discount for automatic payments and a 0.50% discount for military personnel.How to Apply for a Navy Federal Personal Loan

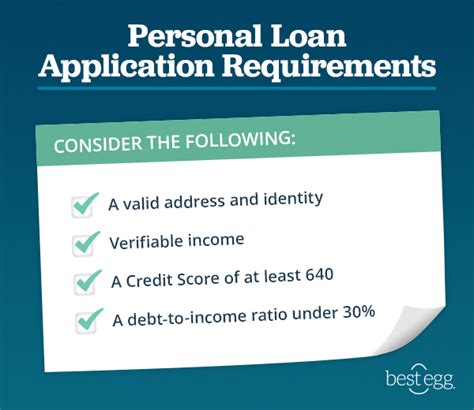

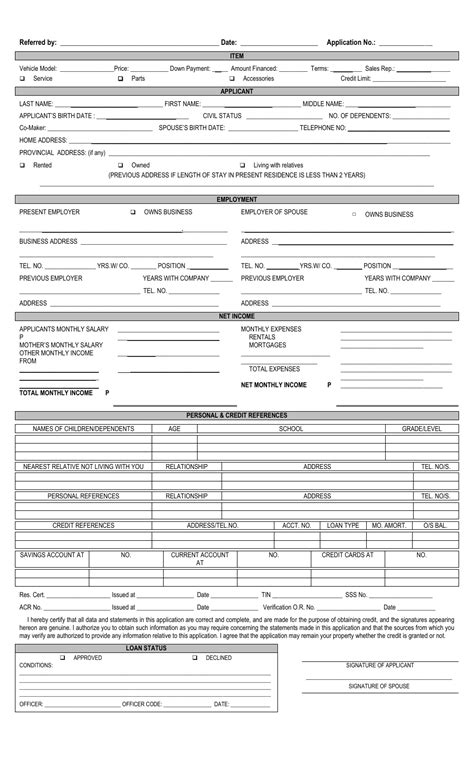

Applying for a Navy Federal personal loan is a straightforward process, which can be completed online, by phone, or in person. To apply, borrowers will need to provide personal and financial information, including their income, credit score, and employment history. Additionally, borrowers will need to provide documentation, such as pay stubs and identification, to verify their information.

Online Application

The online application process is quick and easy, taking only a few minutes to complete. Borrowers can apply online by visiting the Navy Federal website and clicking on the "Apply for a Loan" button. From there, borrowers will be prompted to provide personal and financial information, which will be used to determine their eligibility for a loan.Navy Federal Personal Loan Requirements

To be eligible for a Navy Federal personal loan, borrowers must meet certain requirements, including membership in the Navy Federal Credit Union, a minimum credit score, and a stable income. Additionally, borrowers must provide documentation, such as pay stubs and identification, to verify their information.

Membership Requirements

To be eligible for a Navy Federal personal loan, borrowers must be members of the Navy Federal Credit Union. Membership is open to active and retired members of the military, as well as their families and household members. To join, individuals can visit the Navy Federal website and click on the "Join Now" button.Conclusion and Next Steps

In conclusion, Navy Federal personal loans offer a range of benefits, including competitive interest rates, flexible repayment terms, and personalized service. These loans are ideal for those who need to finance a large expense or consolidate debt. To apply, borrowers can visit the Navy Federal website, call the credit union, or visit a branch in person. By providing personal and financial information, borrowers can determine their eligibility for a loan and begin the application process.

Final Thoughts

Navy Federal personal loans are a great option for those who need to finance a large expense or consolidate debt. With competitive interest rates, flexible repayment terms, and personalized service, these loans offer a range of benefits that can help borrowers achieve their financial goals. By understanding the different types of personal loans available, the benefits of each, and the application process, borrowers can make informed decisions about their financial future.Navy Federal Personal Loan Image Gallery

We encourage you to share your thoughts and experiences with Navy Federal personal loans in the comments below. If you have any questions or need further guidance, please don't hesitate to ask. Additionally, if you found this article informative and helpful, please share it with others who may be considering a personal loan. By working together, we can help each other achieve our financial goals and make informed decisions about our financial future.