Discover 5 ways Navy Federal Pledge Loan benefits members, offering low-interest rates, flexible terms, and secured borrowing options with savings pledges, certificates, and investment accounts.

Navy Federal Credit Union is a well-established financial institution that offers a wide range of loan products to its members, including the Navy Federal Pledge Loan. This loan option allows borrowers to use a certificate of deposit (CD) or savings account as collateral to secure a lower interest rate. In this article, we will explore the benefits and features of the Navy Federal Pledge Loan and provide guidance on how to make the most of this financial product.

The Navy Federal Pledge Loan is an attractive option for individuals who want to borrow money at a lower interest rate while still earning interest on their savings. By using a CD or savings account as collateral, borrowers can reduce their loan's interest rate, making it easier to manage their debt. Additionally, the Navy Federal Pledge Loan offers flexible repayment terms, allowing borrowers to choose a repayment schedule that suits their financial situation.

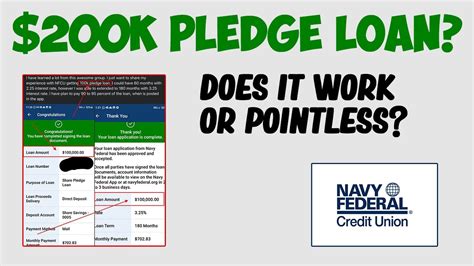

One of the key advantages of the Navy Federal Pledge Loan is its competitive interest rates. By using a CD or savings account as collateral, borrowers can qualify for lower interest rates, which can result in significant savings over the life of the loan. Furthermore, the Navy Federal Pledge Loan offers a range of loan amounts, from $1,000 to $100,000, making it an ideal option for individuals with different financial needs.

Benefits of Navy Federal Pledge Loan

Some of the key benefits of the Navy Federal Pledge Loan include:

- Lower interest rates: By using a CD or savings account as collateral, borrowers can qualify for lower interest rates, which can result in significant savings over the life of the loan.

- Flexible repayment terms: The Navy Federal Pledge Loan offers flexible repayment terms, allowing borrowers to choose a repayment schedule that suits their financial situation.

- Earn interest on savings: By using a CD or savings account as collateral, borrowers can continue to earn interest on their savings, which can help offset the cost of the loan.

- Range of loan amounts: The Navy Federal Pledge Loan offers a range of loan amounts, from $1,000 to $100,000, making it an ideal option for individuals with different financial needs.

How to Apply for Navy Federal Pledge Loan

The application process for the Navy Federal Pledge Loan is straightforward and requires minimal documentation. Borrowers will need to provide identification, income verification, and information about their CD or savings account. Once the application is submitted, Navy Federal will review the borrower's creditworthiness and collateral to determine the loan amount and interest rate.

Some of the key steps to apply for the Navy Federal Pledge Loan include:

- Establish membership with Navy Federal Credit Union.

- Gather required documentation, including identification, income verification, and information about the CD or savings account.

- Apply for the Navy Federal Pledge Loan online, by phone, or in person at a Navy Federal branch.

- Wait for Navy Federal to review the application and determine the loan amount and interest rate.

Types of Collateral for Navy Federal Pledge Loan

It's essential to note that the collateral used for the Navy Federal Pledge Loan must be in the borrower's name, and the account must be in good standing. Additionally, the collateral will be held by Navy Federal until the loan is repaid in full.

Repayment Terms for Navy Federal Pledge Loan

Some of the key repayment terms for the Navy Federal Pledge Loan include:

- Monthly payments: Borrowers can choose to make monthly payments, which will be automatically deducted from their checking account.

- Bi-weekly payments: Borrowers can also choose to make bi-weekly payments, which can help reduce the loan balance faster.

- Lump sum payments: Borrowers can make lump sum payments at any time, which can help reduce the loan balance and interest paid over the life of the loan.

Advantages of Using Navy Federal Pledge Loan

Some of the key advantages of using the Navy Federal Pledge Loan include:

- Lower interest rates: By using a CD or savings account as collateral, borrowers can qualify for lower interest rates, which can result in significant savings over the life of the loan.

- Flexible repayment terms: The Navy Federal Pledge Loan offers flexible repayment terms, allowing borrowers to choose a repayment schedule that suits their financial situation.

- Earn interest on savings: By using a CD or savings account as collateral, borrowers can continue to earn interest on their savings, which can help offset the cost of the loan.

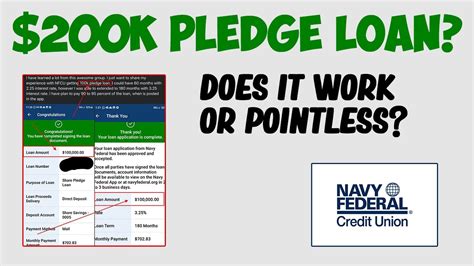

Gallery of Navy Federal Pledge Loan

Navy Federal Pledge Loan Image Gallery

In conclusion, the Navy Federal Pledge Loan is a valuable financial product that offers several benefits to borrowers, including lower interest rates, flexible repayment terms, and the ability to earn interest on their savings. By using a CD or savings account as collateral, borrowers can reduce their loan's interest rate, making it easier to manage their debt. We encourage readers to share their experiences with the Navy Federal Pledge Loan and provide feedback on how this financial product has helped them achieve their financial goals. Additionally, we invite readers to ask questions and seek guidance on how to make the most of the Navy Federal Pledge Loan. By working together, we can help individuals make informed financial decisions and achieve financial stability.