Navy Federal pre-approval is a crucial step in the home buying process, especially for those who are eager to secure their dream home. With the competitive real estate market, having a pre-approval letter from a reputable lender like Navy Federal can give buyers an edge over others. In this article, we will delve into the world of Navy Federal pre-approval, exploring its benefits, working mechanisms, and steps to obtain one.

The importance of Navy Federal pre-approval cannot be overstated. It not only provides buyers with a clear understanding of their budget but also demonstrates their seriousness to sellers. In a market where multiple offers are common, a pre-approval letter can be the deciding factor. Moreover, Navy Federal pre-approval can help buyers navigate the complex and often overwhelming process of securing a mortgage. By understanding how Navy Federal pre-approval works, buyers can make informed decisions and avoid potential pitfalls.

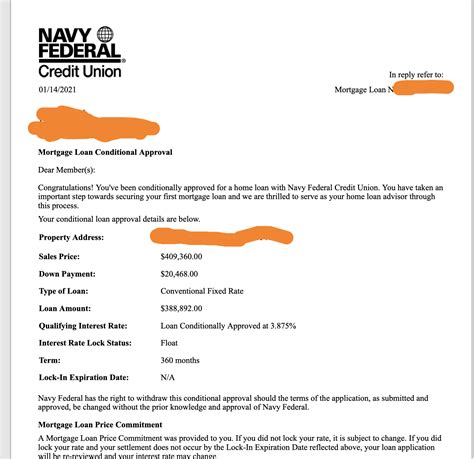

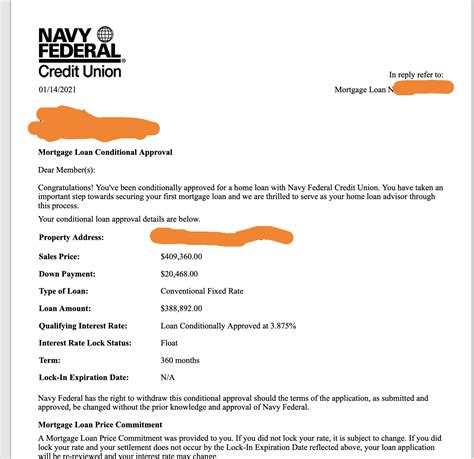

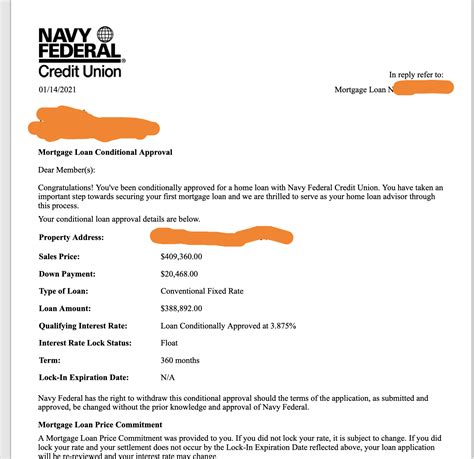

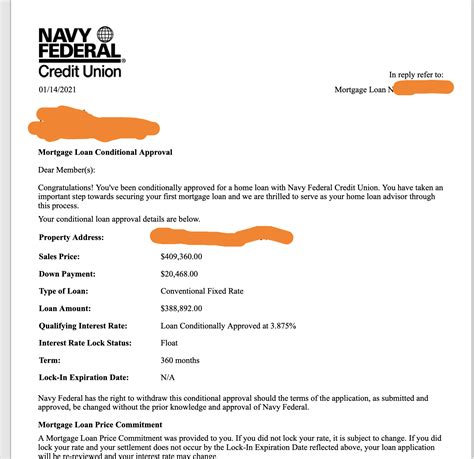

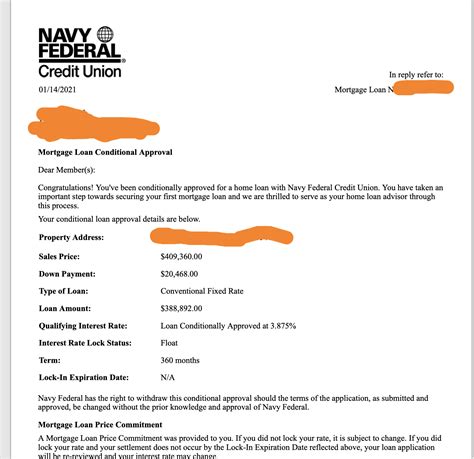

For those who are new to the concept of pre-approval, it's essential to understand that it's not a guarantee of a loan. Rather, it's a conditional approval based on the buyer's creditworthiness and financial situation. Navy Federal pre-approval typically involves a review of the buyer's credit report, income, and assets. This information is used to determine the maximum loan amount and interest rate the buyer qualifies for. With this knowledge, buyers can begin their home search with confidence, knowing exactly how much they can afford.

Benefits of Navy Federal Pre Approval

The benefits of Navy Federal pre-approval are numerous. Some of the most significant advantages include:

* Increased negotiating power: With a pre-approval letter, buyers can demonstrate their seriousness to sellers, giving them an edge over other offers.

* Clear budget understanding: Navy Federal pre-approval provides buyers with a clear understanding of their budget, helping them avoid overspending.

* Streamlined process: Pre-approval can expedite the mortgage application process, reducing the time it takes to close on a home.

* Competitive interest rates: Navy Federal offers competitive interest rates, which can help buyers save thousands of dollars over the life of the loan.

* Personalized service: As a member-owned lender, Navy Federal provides personalized service, guiding buyers through the entire process.

How to Get Navy Federal Pre Approval

Obtaining Navy Federal pre-approval is a relatively straightforward process. Here are the steps to follow:

1. Check eligibility: Buyers must be members of Navy Federal to apply for pre-approval. Membership is open to active-duty and retired military personnel, as well as their families.

2. Gather documentation: Buyers will need to provide financial documentation, including pay stubs, bank statements, and tax returns.

3. Apply online or in-person: Buyers can apply for pre-approval online or in-person at a Navy Federal branch.

4. Review credit report: Navy Federal will review the buyer's credit report to determine their creditworthiness.

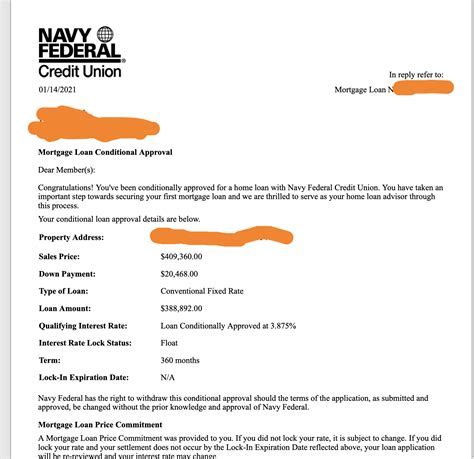

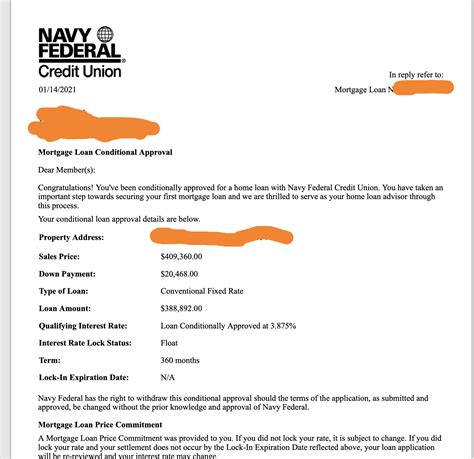

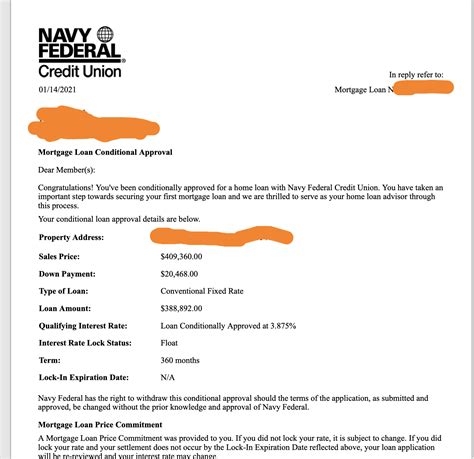

5. Receive pre-approval letter: Once approved, buyers will receive a pre-approval letter outlining the maximum loan amount and interest rate.

Navy Federal Pre Approval Requirements

To qualify for Navy Federal pre-approval, buyers must meet certain requirements. These include:

* Credit score: A minimum credit score of 620 is required for most loan programs.

* Income: Buyers must have a stable income and a debt-to-income ratio of 43% or less.

* Assets: Buyers must have sufficient assets to cover down payment and closing costs.

* Membership: Buyers must be members of Navy Federal to apply for pre-approval.

Navy Federal Pre Approval Process

The Navy Federal pre-approval process typically involves the following steps:

1. Application: Buyers submit an application for pre-approval, either online or in-person.

2. Credit review: Navy Federal reviews the buyer's credit report to determine their creditworthiness.

3. Income verification: Navy Federal verifies the buyer's income and employment status.

4. Asset verification: Navy Federal verifies the buyer's assets, including bank statements and investment accounts.

5. Pre-approval letter: Once approved, buyers receive a pre-approval letter outlining the maximum loan amount and interest rate.

Navy Federal Pre Approval FAQs

Here are some frequently asked questions about Navy Federal pre-approval:

* What is the minimum credit score required for pre-approval?

* How long does the pre-approval process take?

* Can I apply for pre-approval online or in-person?

* What documentation do I need to provide for pre-approval?

* How long is the pre-approval letter valid?

Gallery of Navy Federal Pre Approval Images

Navy Federal Pre Approval Image Gallery

In conclusion, Navy Federal pre-approval is a vital step in the home buying process. By understanding the benefits, requirements, and process of pre-approval, buyers can navigate the complex world of mortgages with confidence. Whether you're a first-time buyer or an experienced homeowner, Navy Federal pre-approval can help you achieve your dreams of homeownership. We invite you to share your experiences with Navy Federal pre-approval in the comments below. Have you recently obtained pre-approval from Navy Federal? What was your experience like? Share your story and help others make informed decisions about their mortgage options.