Discover 5 ways to refinance auto loan, lowering interest rates, and monthly payments with auto loan refinancing options, bad credit refinance, and car loan refinancing strategies.

Refinancing an auto loan can be a smart move for many car owners, offering a range of benefits that can help alleviate financial stress and save money in the long run. Whether you're looking to lower your monthly payments, reduce your interest rate, or pay off your loan faster, refinancing can be a viable option. In this article, we'll explore the importance of refinancing an auto loan and why it's worth considering.

For many people, buying a car is a significant investment, and financing that purchase is often a necessity. However, circumstances can change over time, and the loan terms that seemed reasonable at the time of purchase may no longer be the best fit. Perhaps you've improved your credit score, or interest rates have dropped, making it possible to secure a better deal. Whatever the reason, refinancing your auto loan can be a great way to reassess your financial situation and make adjustments that work in your favor.

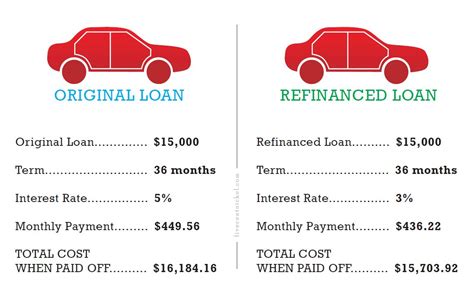

The process of refinancing an auto loan involves replacing your existing loan with a new one, typically with a different lender, to take advantage of more favorable terms. This can include lowering your interest rate, reducing your monthly payments, or shortening the length of your loan. By refinancing, you can potentially save hundreds or even thousands of dollars over the life of the loan, making it a worthwhile consideration for anyone looking to optimize their finances.

Understanding the Benefits of Refinancing an Auto Loan

Refinancing an auto loan can offer several benefits, including lower monthly payments, reduced interest rates, and the opportunity to pay off your loan faster. By exploring these benefits in more detail, you can gain a better understanding of how refinancing can help you achieve your financial goals.

Lower Monthly Payments

One of the primary advantages of refinancing an auto loan is the potential to lower your monthly payments. This can be achieved by extending the length of your loan, reducing your interest rate, or securing a more favorable loan term. By lowering your monthly payments, you can free up more money in your budget for other expenses, savings, or investments.Reduced Interest Rates

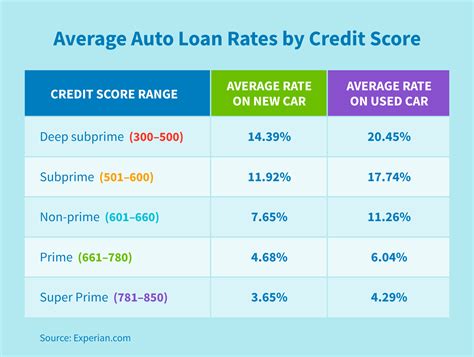

Another significant benefit of refinancing an auto loan is the opportunity to reduce your interest rate. If interest rates have dropped since you originally financed your vehicle, or if you've improved your credit score, you may be able to secure a lower interest rate through refinancing. This can result in significant savings over the life of the loan, as you'll pay less in interest charges.Paying Off Your Loan Faster

Refinancing an auto loan can also provide the opportunity to pay off your loan faster, which can be beneficial for several reasons. By shortening the length of your loan, you can pay less in interest charges over time and build equity in your vehicle more quickly. This can be especially advantageous if you're looking to sell or trade-in your vehicle in the near future.5 Ways to Refinance an Auto Loan

Now that we've explored the benefits of refinancing an auto loan, let's take a look at five ways to do so:

- Online Lenders: Online lenders offer a convenient and often streamlined process for refinancing an auto loan. These lenders typically provide competitive interest rates and flexible loan terms, making it easier to find a deal that suits your needs.

- Traditional Banks: Traditional banks are another option for refinancing an auto loan. While they may not always offer the most competitive interest rates, they can provide a sense of security and stability, especially for those who value a personal banking relationship.

- Credit Unions: Credit unions are member-owned cooperatives that often offer more favorable loan terms than traditional banks. They may provide lower interest rates, reduced fees, and more flexible repayment terms, making them a worthwhile consideration for refinancing an auto loan.

- Specialty Auto Lenders: Specialty auto lenders focus specifically on auto loans and may offer more competitive interest rates and flexible loan terms than traditional lenders. They often cater to borrowers with less-than-perfect credit, making them a viable option for those who may not qualify for loans through other channels.

- Dealership Financing: Dealership financing is another option for refinancing an auto loan, although it's often not the most recommended choice. Dealerships may offer convenient financing options, but they often come with higher interest rates and fees, which can increase the overall cost of the loan.

Steps to Refinance an Auto Loan

Refinancing an auto loan involves several steps, including:- Checking your credit score and history to determine your eligibility for refinancing

- Gathering necessary documents, such as your current loan information, income verification, and vehicle title

- Shopping around for lenders and comparing loan offers to find the best deal

- Applying for refinancing and awaiting approval

- Reviewing and signing the new loan agreement

Things to Consider When Refinancing an Auto Loan

While refinancing an auto loan can be a great way to save money and optimize your finances, there are several things to consider before making a decision. These include:

- Fees and Charges: Refinancing an auto loan may involve fees and charges, such as origination fees, title fees, and prepayment penalties. Be sure to factor these costs into your decision and consider whether they outweigh the potential benefits of refinancing.

- Interest Rates: Interest rates can fluctuate over time, and refinancing may not always result in a lower interest rate. Be sure to compare current interest rates with your existing loan terms to determine whether refinancing is a good option.

- Loan Terms: Refinancing an auto loan may involve extending the length of your loan, which can result in paying more in interest charges over time. Be sure to consider the potential long-term costs of refinancing and weigh them against the benefits.

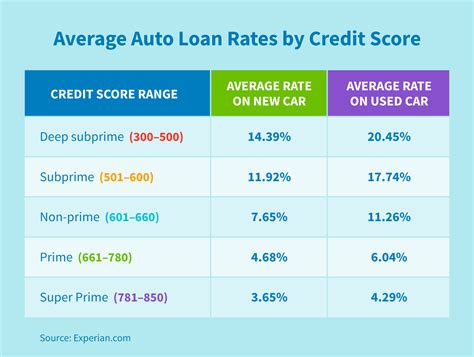

- Credit Score: Your credit score plays a significant role in determining your eligibility for refinancing and the interest rate you'll qualify for. Be sure to check your credit score and history before applying for refinancing and consider working to improve your credit if necessary.

Tips for Refinancing an Auto Loan

To get the most out of refinancing an auto loan, consider the following tips:- Shop around: Compare loan offers from multiple lenders to find the best deal.

- Check your credit score: A good credit score can help you qualify for better interest rates and loan terms.

- Consider a shorter loan term: While extending the length of your loan may lower your monthly payments, it can also result in paying more in interest charges over time.

- Read the fine print: Be sure to carefully review the terms and conditions of your new loan agreement before signing.

Common Mistakes to Avoid When Refinancing an Auto Loan

Refinancing an auto loan can be a complex process, and there are several common mistakes to avoid. These include:

- Not shopping around: Failing to compare loan offers from multiple lenders can result in missing out on the best deal.

- Not checking your credit score: A poor credit score can result in higher interest rates and less favorable loan terms.

- Not reading the fine print: Failing to carefully review the terms and conditions of your new loan agreement can result in unexpected fees and charges.

- Not considering the long-term costs: Refinancing an auto loan may involve extending the length of your loan, which can result in paying more in interest charges over time.

Refinancing an Auto Loan with Bad Credit

Refinancing an auto loan with bad credit can be more challenging, but it's not impossible. Consider the following options:- Subprime lenders: Subprime lenders specialize in providing loans to borrowers with less-than-perfect credit. While they may offer less favorable interest rates and loan terms, they can provide a viable option for refinancing an auto loan.

- Credit unions: Credit unions may offer more favorable loan terms and interest rates than traditional lenders, even for borrowers with bad credit.

- Co-signer: Having a co-signer with good credit can help you qualify for better interest rates and loan terms.

Auto Loan Refinancing Image Gallery

In conclusion, refinancing an auto loan can be a smart move for many car owners, offering a range of benefits that can help alleviate financial stress and save money in the long run. By understanding the benefits and process of refinancing, considering the things to keep in mind, and avoiding common mistakes, you can make an informed decision that works in your favor. Whether you're looking to lower your monthly payments, reduce your interest rate, or pay off your loan faster, refinancing can be a viable option. So why not explore your options today and see how refinancing an auto loan can help you achieve your financial goals? We invite you to share your thoughts and experiences with refinancing an auto loan in the comments below, and don't forget to share this article with anyone who may be considering refinancing their auto loan.