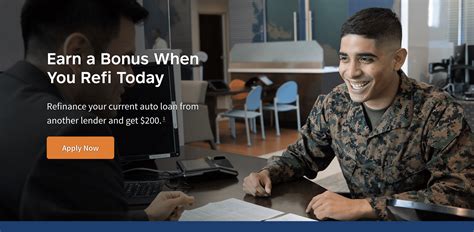

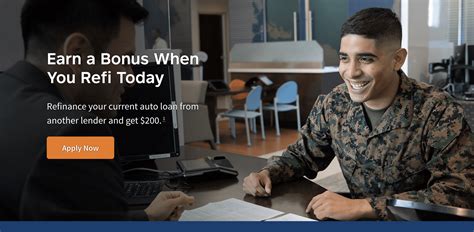

Discover 5 ways Navy Federal refinance car loans can help you save money, lower payments, and improve financing terms with auto refinance options, car loan refinancing, and debt consolidation.

Refinancing a car loan can be a smart financial move, especially if you're looking to lower your monthly payments or reduce the overall cost of your loan. Navy Federal, one of the largest credit unions in the United States, offers refinancing options for car loans. Here's an overview of the importance of refinancing and how Navy Federal can help.

Refinancing a car loan can be a great way to save money on interest, lower your monthly payments, or even remove a co-signer from the loan. With Navy Federal, you can refinance your car loan and take advantage of competitive interest rates and flexible repayment terms. Whether you're looking to refinance a car loan from another lender or consolidate multiple loans into one, Navy Federal has options to suit your needs.

In today's financial landscape, refinancing a car loan is more accessible than ever. With online applications and streamlined processes, you can refinance your car loan from the comfort of your own home. Navy Federal's refinancing options are designed to be user-friendly and hassle-free, allowing you to focus on what matters most - getting behind the wheel and enjoying your vehicle. With that said, let's dive into the details of Navy Federal's refinancing options and explore how you can benefit from them.

Understanding Navy Federal Refinance Car Loans

Navy Federal offers a range of refinancing options for car loans, including fixed-rate loans, variable-rate loans, and loans with flexible repayment terms. With competitive interest rates and low fees, Navy Federal's refinancing options can help you save money on your car loan. Whether you're looking to refinance a new or used vehicle, Navy Federal has options to suit your needs.

Benefits of Refinancing with Navy Federal

Refinancing your car loan with Navy Federal can offer several benefits, including:

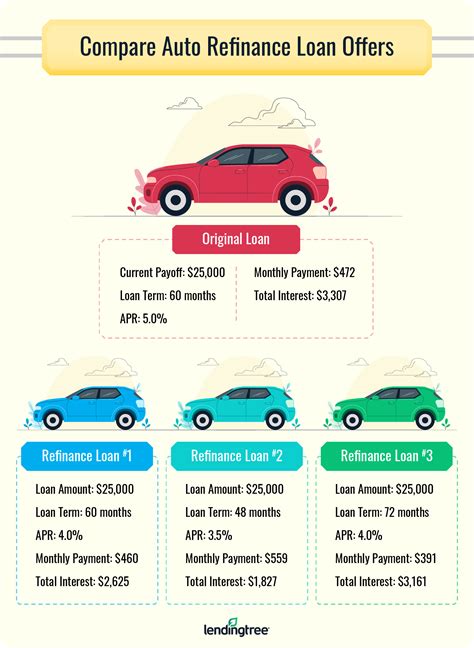

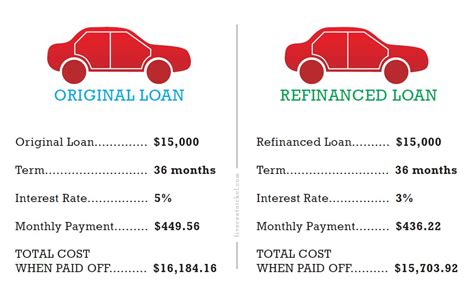

- Lower monthly payments: By refinancing your car loan, you may be able to lower your monthly payments and free up more money in your budget for other expenses.

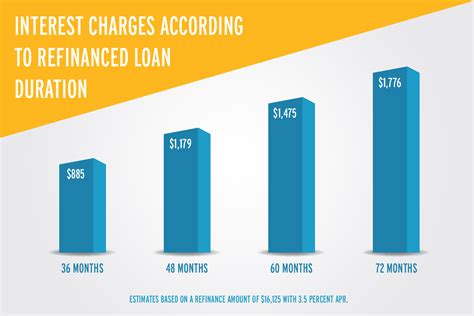

- Reduced interest rates: Navy Federal offers competitive interest rates on refinanced car loans, which can help you save money on interest over the life of the loan.

- Flexible repayment terms: Navy Federal offers flexible repayment terms, including the option to extend or shorten the length of your loan.

- No prepayment penalties: Navy Federal does not charge prepayment penalties, so you can pay off your loan early without incurring extra fees.

5 Ways to Refinance Your Car Loan with Navy Federal

Here are five ways to refinance your car loan with Navy Federal:

- Online Application: Navy Federal offers an online application process that allows you to refinance your car loan from the comfort of your own home. Simply visit the Navy Federal website, fill out the application, and upload any required documents.

- Phone Application: If you prefer to apply over the phone, Navy Federal's customer service representatives are available to assist you. Simply call the Navy Federal customer service number and let them guide you through the application process.

- In-Person Application: If you prefer to apply in person, you can visit a Navy Federal branch location. Navy Federal has branches located throughout the United States, so you're sure to find one near you.

- Mobile Application: Navy Federal also offers a mobile application that allows you to refinance your car loan on the go. Simply download the Navy Federal mobile app, fill out the application, and upload any required documents.

- Mail-In Application: If you prefer to apply by mail, Navy Federal offers a mail-in application process. Simply download the application from the Navy Federal website, fill it out, and mail it in with any required documents.

Requirements for Refinancing with Navy Federal

To refinance your car loan with Navy Federal, you'll need to meet certain requirements, including:

- You must be a member of Navy Federal Credit Union.

- You must have a valid government-issued ID.

- You must have a social security number or individual taxpayer identification number.

- You must have a verifiable income.

- You must have a good credit history.

How to Choose the Right Refinancing Option

Choosing the right refinancing option can be overwhelming, especially with so many options available. Here are some factors to consider when choosing a refinancing option:

- Interest Rate: Look for a refinancing option with a competitive interest rate. A lower interest rate can help you save money on interest over the life of the loan.

- Repayment Terms: Consider a refinancing option with flexible repayment terms. This can help you lower your monthly payments or pay off your loan early.

- Fees: Look for a refinancing option with low or no fees. This can help you save money on upfront costs.

- Credit Score: Consider a refinancing option that takes into account your credit score. A good credit score can help you qualify for a lower interest rate.

Tips for Refinancing Your Car Loan

Here are some tips to keep in mind when refinancing your car loan:

- Check your credit report: Before applying for a refinanced car loan, check your credit report to ensure it's accurate and up-to-date.

- Compare rates: Compare interest rates and terms from multiple lenders to find the best deal.

- Consider a co-signer: If you have a limited credit history or a low credit score, consider applying with a co-signer.

- Read the fine print: Carefully review the terms and conditions of your refinanced car loan to ensure you understand all the costs and fees involved.

Common Mistakes to Avoid When Refinancing

Here are some common mistakes to avoid when refinancing your car loan:

- Not checking your credit report: Failing to check your credit report can result in errors or inaccuracies that can affect your credit score.

- Not comparing rates: Failing to compare interest rates and terms from multiple lenders can result in missing out on a better deal.

- Not considering all costs: Failing to consider all the costs involved in refinancing, including fees and interest rates, can result in unexpected expenses.

- Not reading the fine print: Failing to carefully review the terms and conditions of your refinanced car loan can result in unexpected surprises.

Refinancing with Navy Federal: What to Expect

Refinancing your car loan with Navy Federal is a straightforward process. Here's what you can expect:

- Application process: The application process typically takes a few minutes to complete, and you can apply online, by phone, or in person.

- Approval process: Once you've applied, Navy Federal will review your application and verify your information. This typically takes a few days to a week.

- Funding process: Once you've been approved, Navy Federal will fund your refinanced car loan and pay off your existing loan.

Navy Federal Refinance Car Loan Image Gallery

In conclusion, refinancing your car loan with Navy Federal can be a smart financial move, especially if you're looking to lower your monthly payments or reduce the overall cost of your loan. By understanding the benefits and requirements of refinancing with Navy Federal, you can make an informed decision about whether refinancing is right for you. Remember to choose the right refinancing option, avoid common mistakes, and carefully review the terms and conditions of your refinanced car loan. With Navy Federal's competitive interest rates and flexible repayment terms, you can drive away in your vehicle with confidence. So why not take the first step today and explore your refinancing options with Navy Federal? We invite you to share your thoughts and experiences with refinancing your car loan in the comments below.