Maximize your Navy Federal Roth IRA with expert tips, optimizing retirement savings, investment strategies, and tax benefits, while avoiding common mistakes and fees.

Saving for retirement is a crucial aspect of financial planning, and one popular option for doing so is through a Roth Individual Retirement Account (Roth IRA). Navy Federal, a well-established credit union, offers its members the opportunity to open a Roth IRA, providing a flexible and potentially tax-efficient way to build wealth over time. Understanding the nuances of a Navy Federal Roth IRA can help you make the most of your retirement savings.

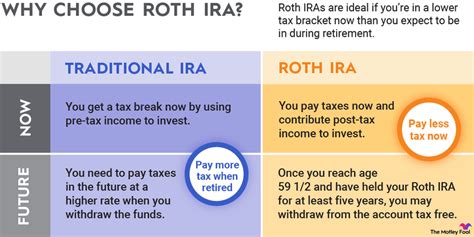

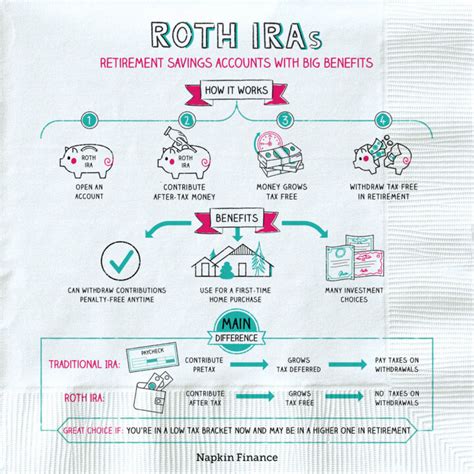

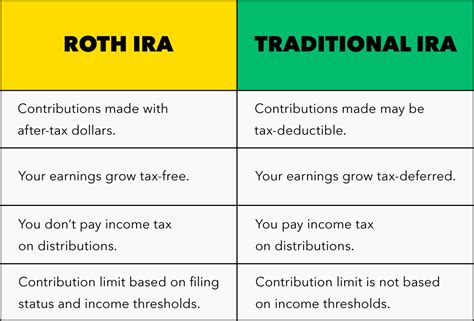

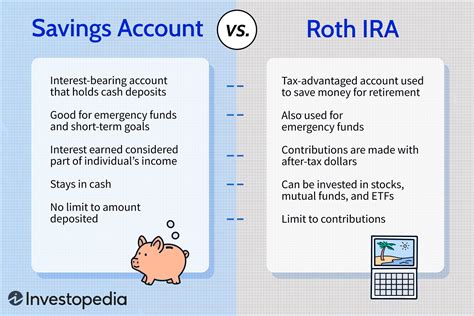

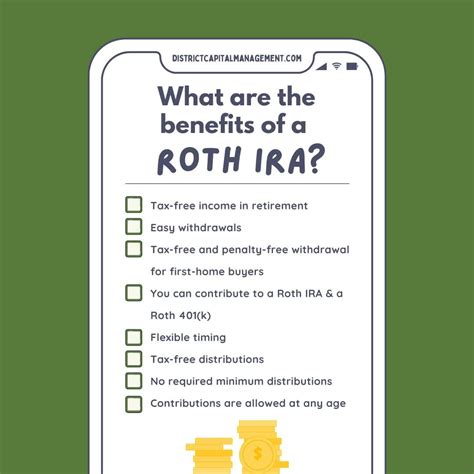

Roth IRAs are attractive because they allow you to contribute after-tax dollars, which can then grow tax-free. This means you won't have to pay taxes on the investment earnings, providing you follow the rules. Furthermore, qualified withdrawals are tax-free, making Roth IRAs an excellent choice for those who anticipate being in a higher tax bracket in retirement. Navy Federal, with its member-centric approach and competitive rates, can be an ideal institution for those looking to start or manage their Roth IRA.

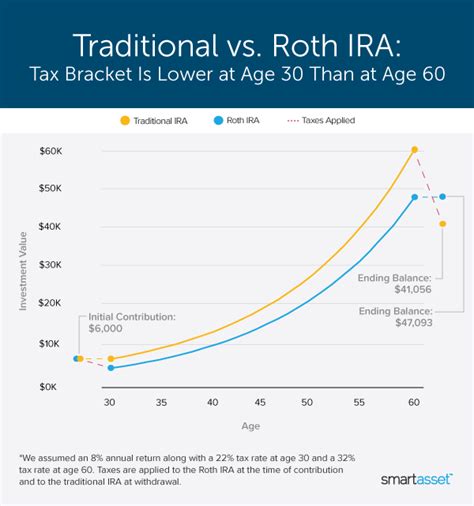

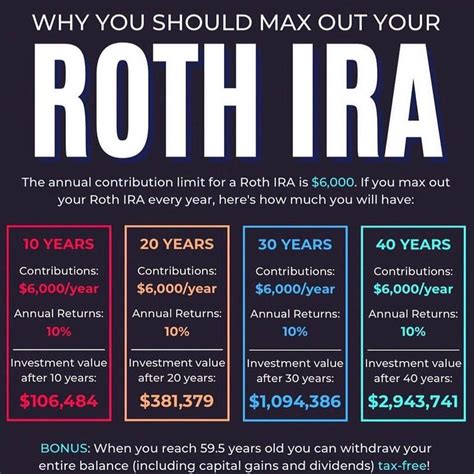

The importance of starting early cannot be overstated. Compound interest is a powerful tool that can significantly grow your savings over time. Even small, consistent contributions to a Roth IRA can add up, especially when given decades to mature. Navy Federal's Roth IRA options are designed to be accessible, allowing members to start saving with relatively low contribution requirements. This makes it easier for anyone, regardless of their current financial situation, to begin planning for their future.

Understanding Navy Federal Roth IRA

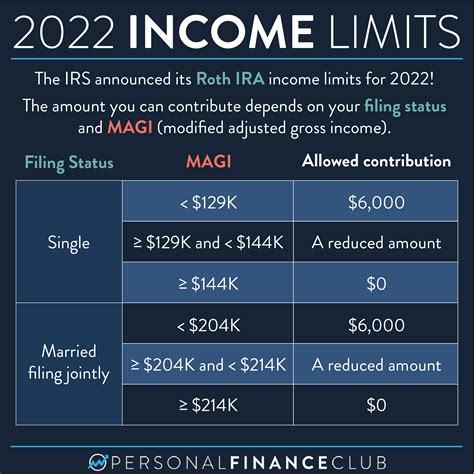

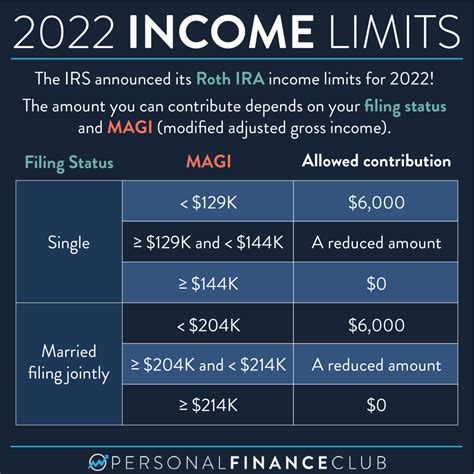

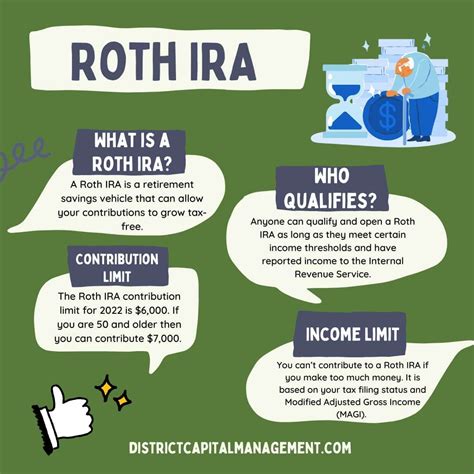

To make the most of a Navy Federal Roth IRA, it's essential to understand the contribution limits, eligibility criteria, and the rules governing withdrawals. For instance, there are income limits on who can contribute to a Roth IRA, and these limits can affect how much you can contribute annually. Additionally, while Roth IRAs offer flexibility, there are specific rules about when and how you can withdraw funds without penalty, especially concerning the five-year rule and the age 59 1/2 threshold.

Benefits of Navy Federal Roth IRA

The benefits of a Navy Federal Roth IRA are multifaceted. Not only do you get to enjoy tax-free growth and potentially tax-free withdrawals, but you also have the flexibility to contribute at your own pace. This flexibility, combined with Navy Federal's competitive interest rates, makes a Roth IRA an attractive option for those seeking to diversify their retirement savings portfolio. Moreover, Navy Federal's membership benefits and financial tools can provide additional support in managing your IRA effectively.Managing Your Navy Federal Roth IRA

Effective management of your Navy Federal Roth IRA involves regular monitoring of your investments, ensuring your contributions are maximized within the allowed limits, and making informed decisions about withdrawals. It's also crucial to review and adjust your investment portfolio periodically to ensure it remains aligned with your retirement goals and risk tolerance. Navy Federal offers resources and tools to help with this process, making it easier for members to stay on top of their IRA management.

Investment Options for Navy Federal Roth IRA

Navy Federal provides a variety of investment options for Roth IRA holders, including certificates, savings accounts, and potentially other investment vehicles. The choice of investment depends on your personal financial goals, risk tolerance, and time horizon. For those looking for low-risk investments, certificates or savings accounts might be appealing, offering a fixed return with minimal risk. On the other hand, for those willing to take on more risk in pursuit of higher returns, other investment options might be more suitable.Navy Federal Roth IRA Contribution Limits

Understanding the contribution limits to a Navy Federal Roth IRA is vital for maximizing your retirement savings. These limits are set by the IRS and can change annually, so it's essential to stay informed. Additionally, the ability to contribute to a Roth IRA is income-dependent, with higher income levels potentially reducing or eliminating your ability to contribute. Navy Federal can provide guidance on these limits and help you navigate the contribution process.

Navy Federal Roth IRA Withdrawal Rules

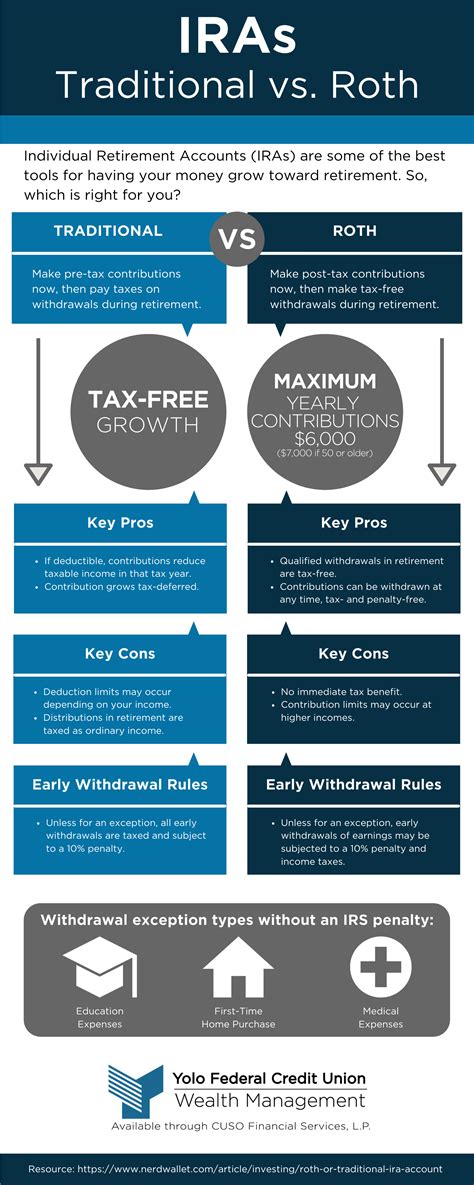

Withdrawal rules are a critical aspect of Roth IRA management. Generally, to avoid penalties, you must wait until you are 59 1/2 or meet specific conditions such as using the funds for a first-time home purchase or qualified education expenses. Additionally, there's a five-year rule that applies to Roth IRA contributions and conversions, which dictates when you can withdraw earnings without penalty. Understanding these rules can help you plan your retirement income strategy effectively.Navy Federal Roth IRA vs. Traditional IRA

When deciding between a Navy Federal Roth IRA and a Traditional IRA, it's essential to consider your current tax situation, anticipated tax bracket in retirement, and personal preferences regarding tax payments. Roth IRAs offer tax-free growth and withdrawals, which can be beneficial if you expect to be in a higher tax bracket in retirement. On the other hand, Traditional IRAs provide a tax deduction for contributions, which can be advantageous for reducing your current taxable income.

Opening a Navy Federal Roth IRA

Opening a Navy Federal Roth IRA is a straightforward process, especially for existing members. You can typically apply online, by phone, or in person at a branch. You'll need to provide identification and funding information, and you may need to answer questions about your income and investment experience. Navy Federal's customer service can guide you through the application process, ensuring you understand all the terms and conditions of your new account.Navy Federal Roth IRA Fees and Charges

It's crucial to understand the fees associated with a Navy Federal Roth IRA. While Navy Federal is known for its competitive rates and low fees, there may still be charges for certain services, such as investment management fees, maintenance fees (though these are less common), and potential penalties for early withdrawal. Being aware of these fees can help you make informed decisions about your IRA and potentially save you money in the long run.

Navy Federal Roth IRA Customer Service

Navy Federal is renowned for its member-centric approach, offering robust customer service to support its members in managing their accounts, including Roth IRAs. Whether you have questions about contributions, withdrawals, investment options, or any other aspect of your Roth IRA, Navy Federal's customer service team is available to provide assistance. This level of support can be invaluable in ensuring you maximize the benefits of your Roth IRA and achieve your retirement savings goals.Gallery of Navy Federal Roth IRA Images

Navy Federal Roth IRA Image Gallery

In conclusion, a Navy Federal Roth IRA can be a valuable tool in your retirement savings strategy, offering tax-free growth, flexibility, and competitive rates. By understanding the contribution limits, withdrawal rules, investment options, and fees associated with a Roth IRA, you can make informed decisions that help you achieve your long-term financial goals. Whether you're just starting to save for retirement or looking to optimize your existing savings, Navy Federal's Roth IRA options and customer service can provide the support you need. We invite you to share your thoughts on Roth IRAs, ask questions, or explore how a Navy Federal Roth IRA can fit into your overall financial plan. Your journey to securing a comfortable retirement starts with taking the first step, and Navy Federal is here to help you every step of the way.