Discover Navy Federal Savings Account benefits, including high-yield interest rates, low fees, and flexible terms, offering convenient online banking and mobile management for secure savings and investment growth.

The world of personal finance can be overwhelming, with numerous options available for managing one's money. Among the various financial institutions, Navy Federal Credit Union stands out for its exceptional services, particularly its savings account offerings. For those who are part of the military community or related to someone who is, Navy Federal provides a range of benefits that make it an attractive choice for saving and managing finances. The importance of having a reliable savings account cannot be overstated, as it serves as the foundation for achieving financial stability and security.

In today's economy, where financial uncertainty is a constant concern, having a savings account that offers flexibility, security, and growth opportunities is crucial. Navy Federal Savings Account benefits cater to these needs, providing members with a comprehensive financial solution. Whether you're looking to save for a short-term goal, build an emergency fund, or plan for long-term financial objectives, Navy Federal's savings accounts are designed to meet these diverse needs. The benefits of these accounts extend beyond mere savings, offering a suite of features and services that enhance the overall financial well-being of its members.

The military community faces unique financial challenges, from frequent relocations to the uncertainties of deployment. In response, Navy Federal has tailored its savings account benefits to address these specific needs, ensuring that members can manage their finances effectively, regardless of their location or situation. From competitive interest rates to flexible account management options, Navy Federal's savings accounts are equipped with features that make saving easier, more rewarding, and accessible to all members. Understanding the intricacies of these benefits and how they can be leveraged to improve one's financial situation is key to making the most out of what Navy Federal has to offer.

Navy Federal Savings Account Overview

Key Features of Navy Federal Savings Accounts

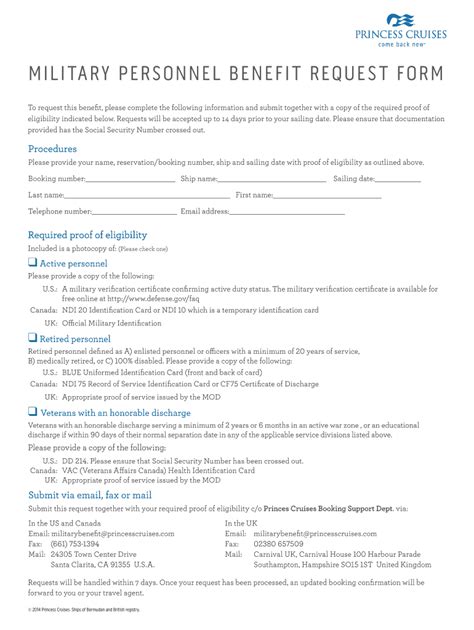

Some of the key features that make Navy Federal Savings Accounts stand out include: - **Competitive Interest Rates**: Navy Federal offers competitive interest rates on its savings accounts, helping members grow their savings over time. - **No Monthly Service Fees**: Unlike many traditional banks, Navy Federal does not charge monthly service fees on its savings accounts, making it a cost-effective option for savers. - **Low Minimum Balance Requirements**: The credit union keeps minimum balance requirements low, making it easier for members to open and maintain a savings account. - **Flexible Account Management**: Members can manage their accounts through various channels, including online banking, mobile banking apps, and physical branches. - **Security**: Savings accounts at Navy Federal are insured by the National Credit Union Administration (NCUA), providing members with peace of mind regarding the safety of their deposits.Benefits for Military Personnel and Their Families

Financial Education and Counseling

Navy Federal recognizes the importance of financial education in empowering its members to make informed decisions about their money. The credit union offers a range of financial education resources, including workshops, webinars, and personal counseling sessions. These resources cover a broad spectrum of financial topics, from basic budgeting and saving to more complex issues like investing and retirement planning. By providing these educational resources, Navy Federal aims to equip its members with the knowledge and skills necessary to achieve their financial goals, whether that's saving for a down payment on a home, planning for retirement, or simply managing day-to-day expenses more effectively.Managing Savings Accounts Effectively

Automating Savings

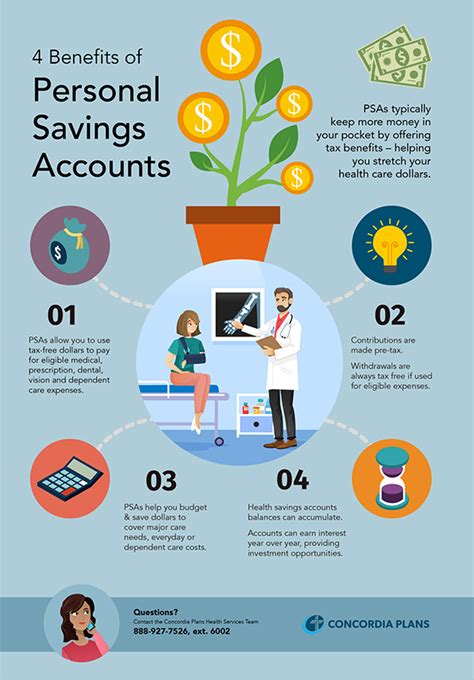

Automating savings is a powerful strategy for building wealth over time. By setting up automatic transfers from a checking account to a savings account, members can ensure that they save a fixed amount regularly, without having to think about it. This approach helps in developing a savings habit and can be particularly effective for achieving long-term financial goals, such as saving for a car, a down payment on a house, or retirement. Navy Federal's banking tools make it easy to set up and manage these automatic transfers, providing members with a simple yet effective way to build their savings over time.Security and Insurance

Protecting Against Fraud

Protecting savings accounts from fraud is an ongoing effort that requires vigilance from both the financial institution and its members. Navy Federal employs a range of security measures to safeguard accounts, including alerts for suspicious transactions, secure mobile banking apps, and education on how to avoid phishing scams and other forms of financial fraud. Members are also encouraged to monitor their accounts regularly and report any unusual activity promptly. By working together, Navy Federal and its members can effectively prevent fraud and ensure the security of their savings.Conclusion and Next Steps

Final Thoughts on Maximizing Savings

To maximize the benefits of a Navy Federal Savings Account, members should focus on developing a consistent savings habit, leveraging the credit union's financial education resources, and taking advantage of the flexibility and security that these accounts offer. By doing so, members can not only grow their savings but also improve their overall financial well-being. As you consider your savings options, remember that Navy Federal is committed to helping you achieve your financial goals, providing the tools, support, and guidance you need to succeed.Navy Federal Savings Account Image Gallery

We hope this comprehensive overview of Navy Federal Savings Account benefits has been informative and helpful in your financial planning journey. Whether you're a current member of Navy Federal or considering joining, the credit union's commitment to its members' financial well-being is evident in the range of benefits and services it offers. If you have any questions, feedback, or would like to share your experiences with Navy Federal's savings accounts, please don't hesitate to comment below. Your insights can help others make more informed decisions about their financial futures. Additionally, if you found this article helpful, consider sharing it with friends, family, or colleagues who might benefit from learning more about Navy Federal's savings account benefits. Together, we can work towards achieving financial stability and security for all.