Boost credit with Navy Federal Secured Card tips, including credit building, secured credit cards, and credit score management, to achieve financial stability.

Building credit can be a challenging and daunting task, especially for those who are new to the world of credit or have experienced financial difficulties in the past. However, with the right tools and strategies, it is possible to establish a strong credit foundation and achieve long-term financial stability. One such tool is the Navy Federal Secured Card, a credit-building option designed for members of the Navy Federal Credit Union. In this article, we will delve into the world of secured credit cards, exploring the benefits and features of the Navy Federal Secured Card, as well as providing valuable tips for making the most of this financial resource.

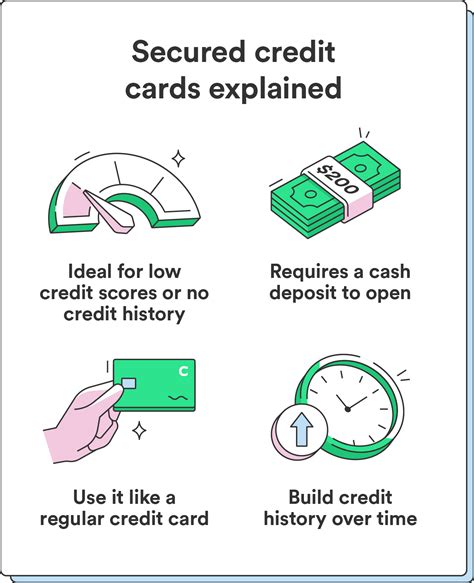

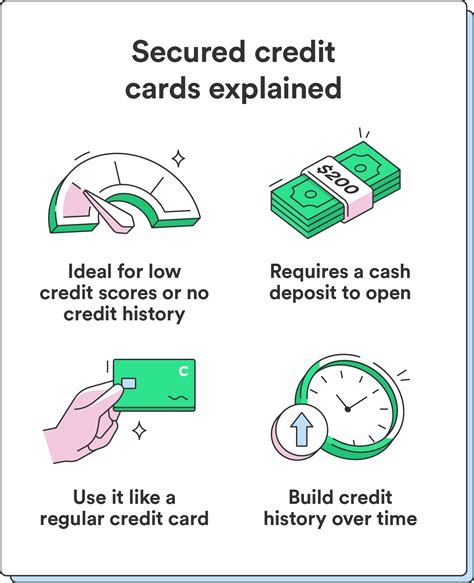

The Navy Federal Secured Card is a type of credit card that requires a security deposit, which becomes the card's credit limit. This deposit is refundable, and the card can be used to make purchases, pay bills, and build credit. The key benefit of a secured card is that it allows individuals to establish or rebuild their credit history, even if they have been denied for traditional credit cards in the past. By using the Navy Federal Secured Card responsibly, cardholders can demonstrate their creditworthiness and potentially qualify for better credit terms in the future.

For those who are considering the Navy Federal Secured Card, it is essential to understand the card's features and benefits. The card offers a competitive interest rate, no annual fee, and the opportunity to earn rewards on purchases. Additionally, the card is backed by the Navy Federal Credit Union, a reputable financial institution with a long history of serving its members. By taking advantage of the Navy Federal Secured Card, individuals can take the first step towards building a strong credit profile and achieving their financial goals.

Understanding the Navy Federal Secured Card

To get the most out of the Navy Federal Secured Card, it is crucial to understand how it works. The card requires a security deposit, which can range from $200 to $5,000, depending on the cardholder's creditworthiness. This deposit is refundable and becomes the card's credit limit. The card can be used to make purchases, pay bills, and build credit, and it offers a competitive interest rate and no annual fee. By using the card responsibly, cardholders can demonstrate their creditworthiness and potentially qualify for better credit terms in the future.

Key Features of the Navy Federal Secured Card

The Navy Federal Secured Card offers several key features that make it an attractive option for those looking to build credit. These features include: * Competitive interest rate * No annual fee * Opportunity to earn rewards on purchases * Refundable security deposit * Credit limit ranges from $200 to $5,000 * Backed by the Navy Federal Credit UnionBenefits of the Navy Federal Secured Card

The Navy Federal Secured Card offers several benefits that make it an excellent option for those looking to build credit. These benefits include:

- Opportunity to establish or rebuild credit history

- Competitive interest rate and no annual fee

- Refundable security deposit

- Credit limit ranges from $200 to $5,000

- Backed by the Navy Federal Credit Union

- Opportunity to earn rewards on purchases

How to Use the Navy Federal Secured Card

To get the most out of the Navy Federal Secured Card, it is essential to use it responsibly. This means making on-time payments, keeping credit utilization low, and avoiding unnecessary purchases. By using the card in this way, cardholders can demonstrate their creditworthiness and potentially qualify for better credit terms in the future.Navy Federal Secured Card Tips

Here are five valuable tips for making the most of the Navy Federal Secured Card:

- Make on-time payments: Making on-time payments is crucial for building credit and avoiding late fees. Set up automatic payments to ensure that you never miss a payment.

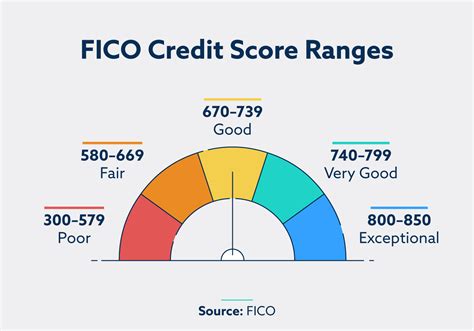

- Keep credit utilization low: Keeping credit utilization low is essential for maintaining a healthy credit profile. Aim to use less than 30% of your available credit to avoid negatively impacting your credit score.

- Monitor your credit report: Monitoring your credit report is essential for ensuring that your credit information is accurate and up-to-date. Check your report regularly to detect any errors or inaccuracies.

- Avoid unnecessary purchases: Avoiding unnecessary purchases is crucial for maintaining a healthy credit profile. Only use your card for essential purchases, and avoid buying things that you don't need.

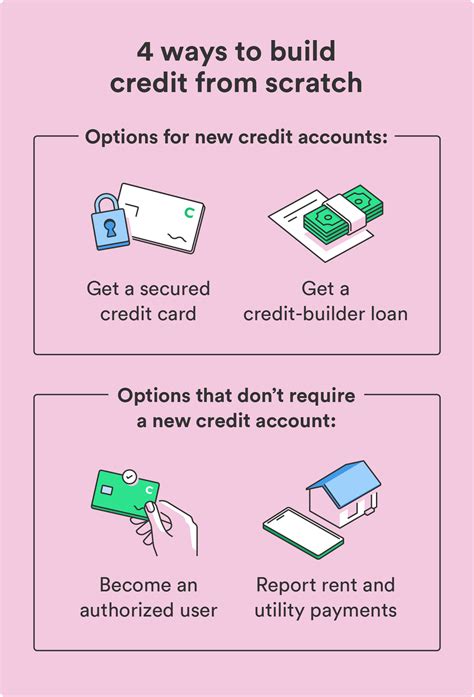

- Consider upgrading to an unsecured card: If you have used your secured card responsibly for a period of time, you may be eligible to upgrade to an unsecured card. This can provide you with more credit flexibility and better terms.

Additional Tips for Building Credit

In addition to using the Navy Federal Secured Card responsibly, there are several other strategies that you can use to build credit. These include: * Making on-time payments on other credit accounts * Keeping credit utilization low on other credit accounts * Monitoring your credit report regularly * Avoiding unnecessary credit inquiries * Considering a credit-builder loanConclusion and Next Steps

In conclusion, the Navy Federal Secured Card is a valuable tool for building credit and achieving financial stability. By using the card responsibly and following the tips outlined in this article, you can establish a strong credit foundation and achieve your long-term financial goals. Remember to make on-time payments, keep credit utilization low, and monitor your credit report regularly to ensure that your credit information is accurate and up-to-date.

Final Thoughts

Building credit takes time and effort, but it is a crucial step towards achieving financial stability. By using the Navy Federal Secured Card and following the tips outlined in this article, you can take the first step towards building a strong credit profile and achieving your long-term financial goals. Remember to stay disciplined, patient, and informed, and you will be on your way to financial success.Navy Federal Secured Card Image Gallery

We hope that this article has provided you with valuable insights and tips for making the most of the Navy Federal Secured Card. By following these tips and using the card responsibly, you can establish a strong credit foundation and achieve your long-term financial goals. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family who may be interested in building credit, and let's work together to achieve financial stability and success.