Discover 5 Navy Federal wire transfer tips, including routing numbers, transfer limits, and fees, to ensure secure and efficient transactions with online banking and mobile banking services.

The world of financial transactions can be complex and overwhelming, especially when it comes to wire transfers. For members of Navy Federal Credit Union, understanding the ins and outs of wire transfers is crucial for managing their finances effectively. In this article, we will delve into the realm of Navy Federal wire transfers, exploring the benefits, mechanisms, and essential tips to ensure a smooth and secure transaction process.

Wire transfers are a convenient way to move money from one account to another, whether domestically or internationally. They offer a fast and reliable method for sending and receiving funds, making them a popular choice for various financial needs. However, navigating the wire transfer process can be daunting, especially for those new to banking and financial transactions. This is where Navy Federal comes in, providing its members with a comprehensive and user-friendly wire transfer service.

The importance of understanding Navy Federal wire transfers cannot be overstated. By grasping the fundamentals of how wire transfers work and the benefits they offer, members can better manage their financial obligations, send money to loved ones, and even conduct business transactions with ease. Moreover, being aware of the potential pitfalls and security measures in place can help prevent errors and protect against fraud. In the following sections, we will explore these aspects in greater detail, providing readers with a thorough understanding of Navy Federal wire transfers and how to utilize them effectively.

Introduction to Navy Federal Wire Transfers

Navy Federal Credit Union offers its members a robust wire transfer service, designed to facilitate quick and secure transactions. This service allows members to send and receive funds both domestically and internationally, catering to a wide range of financial needs. Whether it's paying bills, sending money to family members, or conducting business transactions, Navy Federal's wire transfer service provides a convenient and reliable solution.

Benefits of Navy Federal Wire Transfers

The benefits of using Navy Federal wire transfers are numerous. They include: - Fast Transaction Times: Wire transfers are processed quickly, ensuring that funds are available to the recipient in a timely manner. - Security: Navy Federal implements robust security measures to protect transactions from fraud and unauthorized access. - Convenience: The ability to send and receive funds from anywhere in the world makes wire transfers a highly convenient option. - Reliability: Wire transfers are a reliable method for moving money, reducing the risk of transaction failures.How Navy Federal Wire Transfers Work

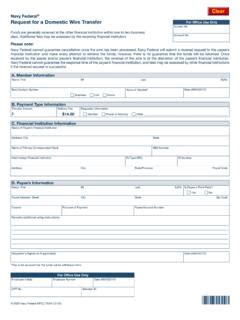

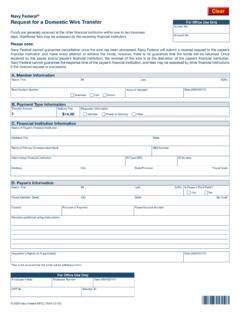

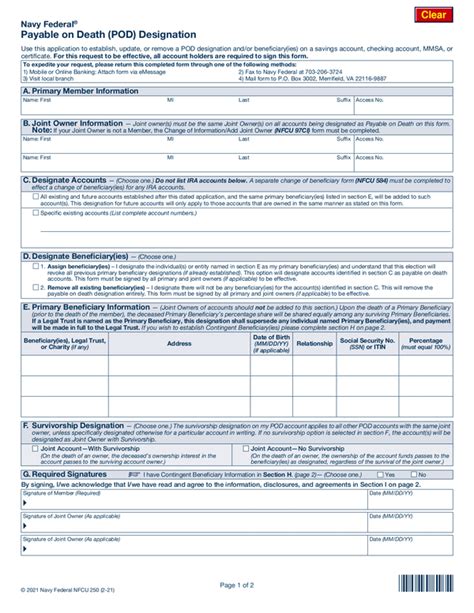

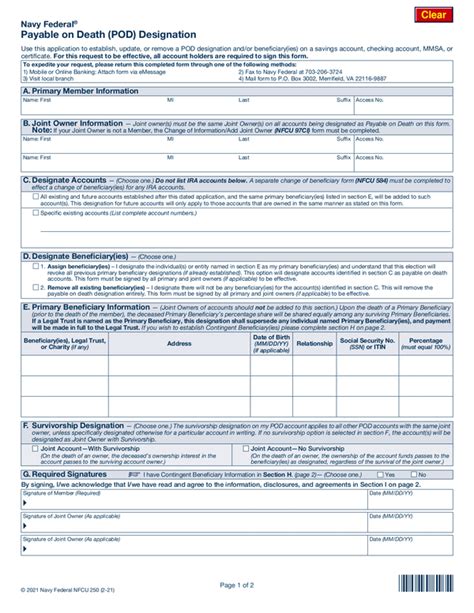

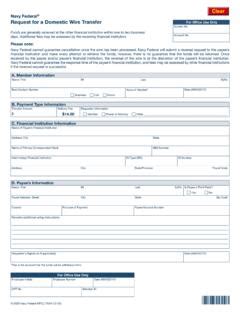

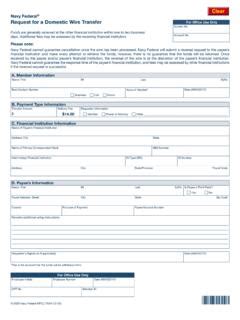

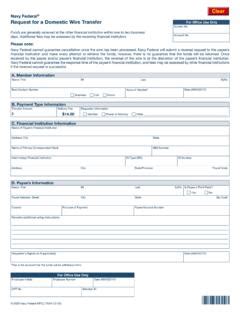

Understanding the mechanism behind Navy Federal wire transfers is essential for utilizing the service effectively. The process involves several key steps:

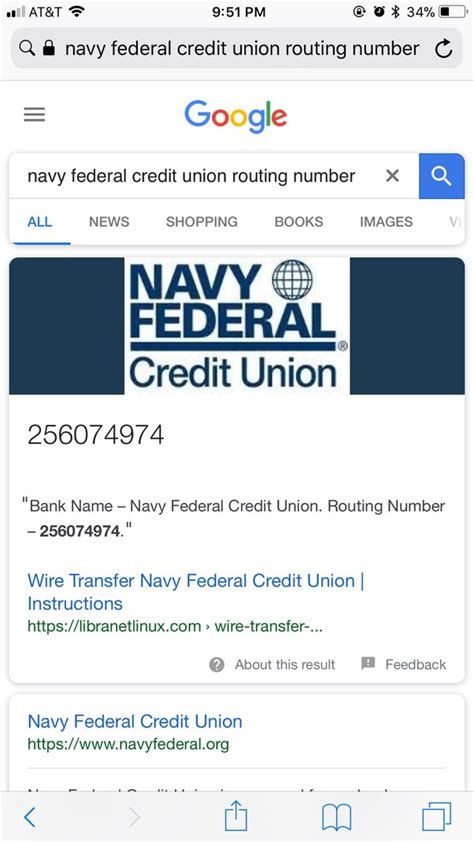

- Initiation: The sender initiates the wire transfer by providing the necessary details, including the recipient's name, account number, and the amount to be transferred.

- Verification: Navy Federal verifies the transaction details to ensure accuracy and security.

- Processing: The wire transfer is processed, and the funds are deducted from the sender's account.

- Delivery: The funds are delivered to the recipient's account, completing the transaction.

Security Measures for Navy Federal Wire Transfers

Security is a top priority when it comes to financial transactions. Navy Federal implements several security measures to protect wire transfers, including: - Encryption: Transactions are encrypted to prevent unauthorized access. - Authentication: Senders and recipients are authenticated to ensure that transactions are legitimate. - Monitoring: Transactions are monitored for suspicious activity to prevent fraud.Tips for Using Navy Federal Wire Transfers

To ensure a smooth and secure wire transfer experience with Navy Federal, consider the following tips:

- Verify Details: Always verify the recipient's account details to avoid errors.

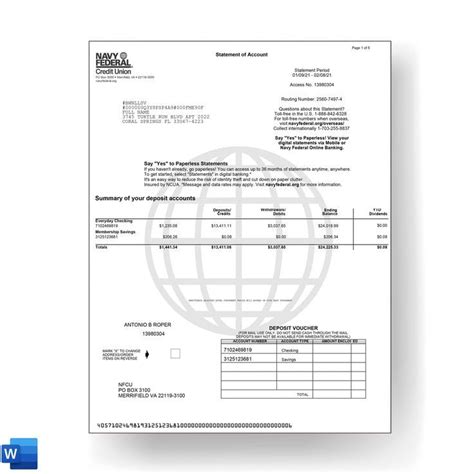

- Check Fees: Be aware of any fees associated with wire transfers.

- Monitor Transactions: Keep track of your transactions to detect any suspicious activity.

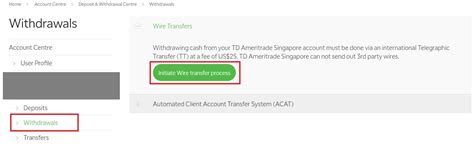

- Use Secure Channels: Only initiate wire transfers through secure, official channels.

Common Mistakes to Avoid

When using Navy Federal wire transfers, it's essential to avoid common mistakes that can lead to errors or security breaches. These include: - Providing incorrect recipient details - Ignoring transaction fees - Not monitoring account activityInternational Navy Federal Wire Transfers

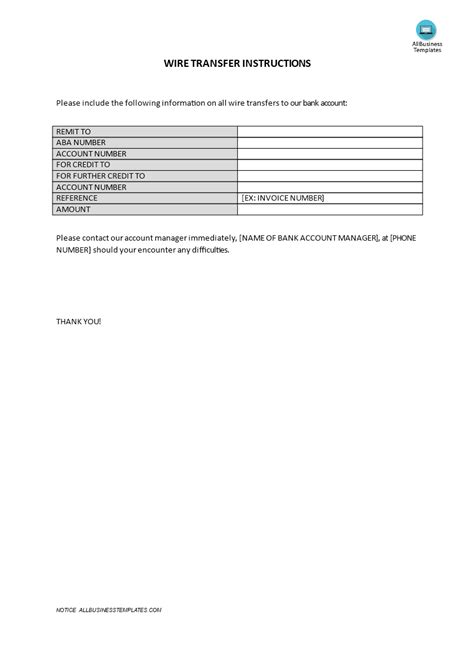

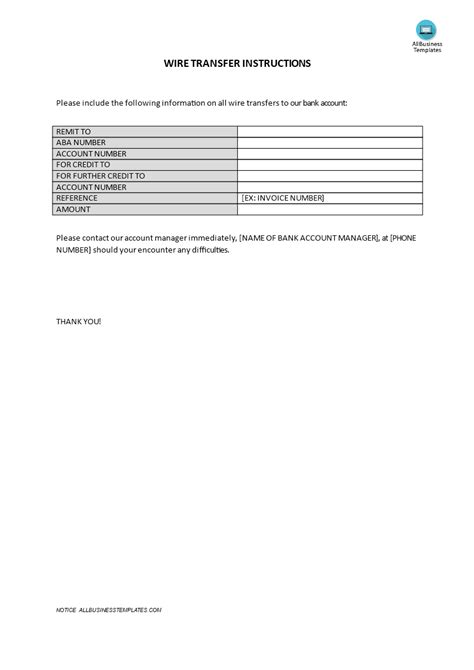

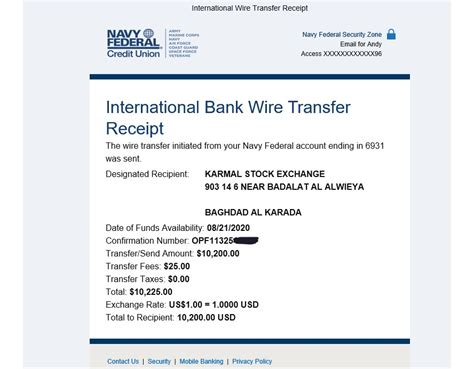

For members who need to send money internationally, Navy Federal's wire transfer service offers a convenient solution. International wire transfers follow a similar process to domestic transfers but may involve additional steps and requirements, such as:

- SWIFT Codes: Recipient banks may require SWIFT codes for international transactions.

- Currency Exchange: Funds may need to be converted to the recipient's local currency.

- International Fees: Additional fees may apply for international transactions.

International Transaction Fees

When conducting international wire transfers, it's crucial to understand the fees involved. These can include: - Transfer fees - Currency conversion fees - Recipient bank feesNavy Federal Wire Transfer Limits

Navy Federal imposes limits on wire transfers to protect members from fraud and ensure the security of transactions. These limits can vary based on the type of account, the destination of the transfer, and other factors. Members should check with Navy Federal for the most current information on wire transfer limits.

Exceeding Transfer Limits

In cases where members need to exceed the standard wire transfer limits, they may need to: - Contact Navy Federal directly to request a limit increase - Provide additional verification or documentation - Use alternative transfer methodsGallery of Navy Federal Wire Transfer Images

Navy Federal Wire Transfer Image Gallery

In conclusion, Navy Federal wire transfers offer a convenient, secure, and reliable way for members to manage their financial transactions. By understanding the benefits, mechanisms, and essential tips for using this service, members can navigate the world of wire transfers with confidence. Whether it's sending money domestically or internationally, Navy Federal's wire transfer service is designed to meet the diverse financial needs of its members. We invite you to share your experiences with Navy Federal wire transfers, ask questions, or explore more topics related to financial management and security. Your engagement and feedback are invaluable in helping us provide the most relevant and useful information for our readers.