Discover Navy Federal Zelle daily limit, transfer limits, and sending guidelines. Learn about peer-to-peer payments, transaction limits, and online banking security.

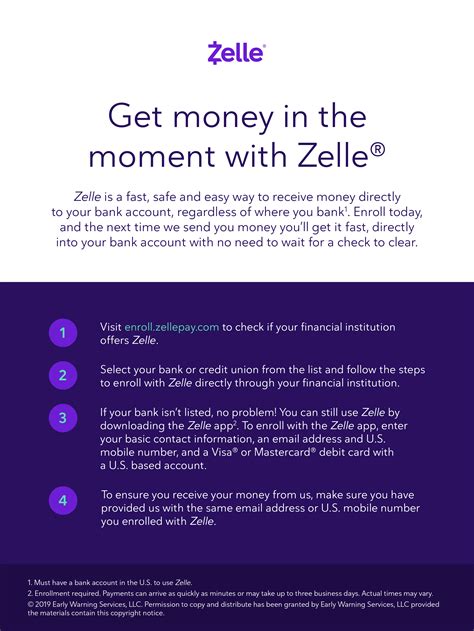

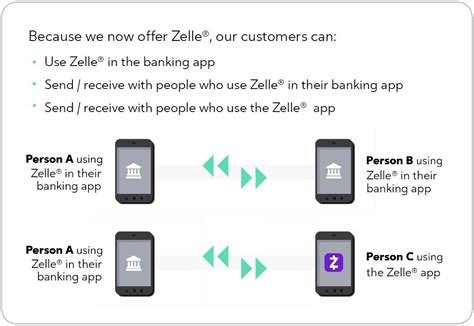

The rise of digital payment systems has revolutionized the way we transfer money, making it faster, more convenient, and secure. One such popular service is Zelle, which allows users to send and receive money directly from their bank accounts. For members of Navy Federal Credit Union, using Zelle for transactions is a common practice. However, like all financial transactions, there are limits to how much you can send or receive via Zelle in a day. Understanding these limits is crucial for managing your finances efficiently.

Navy Federal Credit Union, being one of the largest credit unions in the world, offers a wide range of financial services to its members, including access to Zelle. The daily limit for Zelle transactions can vary based on several factors, including the type of account you have with Navy Federal and your history with the credit union. Generally, the limits are in place to protect both the sender and the recipient from potential fraud and to comply with financial regulations.

For most Navy Federal members, the daily limit for sending money via Zelle is $2,500. However, this amount can be lower for new accounts or if you're using the service for the first time. It's also worth noting that receiving money through Zelle typically doesn't have a limit, but there might be restrictions based on the sender's limits and the type of account they have. Understanding these limits is essential to avoid any inconvenience when making transactions.

Navy Federal Zelle Limits Explained

The Zelle daily limits at Navy Federal are designed to balance convenience with security. While these limits can be restrictive for some transactions, they are an essential part of protecting members' funds. If you need to send more than the daily limit allows, you might consider alternative methods, such as wire transfers, although these may incur additional fees.

How to Increase Your Zelle Limit

If you find that the standard Zelle limit is too restrictive for your needs, there are steps you can take to potentially increase it. Navy Federal may offer higher limits for members who have a longer history with the credit union or for those who use certain types of accounts. Contacting Navy Federal directly to inquire about the possibility of increasing your Zelle limit is the best course of action. They can assess your account history and provide guidance on any additional requirements or steps needed to increase your limit.

Zelle Transaction Fees

One of the benefits of using Zelle for transactions is that it typically doesn't charge fees for sending or receiving money, especially when the transaction is between two accounts that are both eligible for Zelle. However, it's always a good idea to check with Navy Federal and your recipient's bank to confirm their policies, as some transactions might incur small fees, especially if they involve debit or credit cards.

Security Measures with Zelle

Zelle and Navy Federal implement robust security measures to protect transactions. These include encryption, two-factor authentication, and monitoring for suspicious activity. Despite these measures, it's crucial for users to be vigilant and only send money to people they trust, as transactions via Zelle are typically irreversible.

Common Issues with Zelle Transactions

While Zelle is designed to be a straightforward and reliable service, issues can arise. These might include delays in transaction processing, errors in recipient information, or hitting the daily send limit. If you encounter any problems, the first step is to check the status of your transaction and ensure that the recipient's information is correct. If the issue persists, contacting Navy Federal's customer support can provide assistance and resolve the problem.

Alternatives to Zelle

For transactions that exceed Zelle's daily limits or for those who prefer alternative methods, several options are available. These include wire transfers, PayPal, Venmo, and Cash App, among others. Each of these services has its own set of limits, fees, and security measures, so it's essential to compare them based on your specific needs.

Benefits of Using Alternatives

Using alternatives to Zelle can offer several benefits, including higher transaction limits, the ability to send money internationally, and additional features such as the ability to split bills or request money from friends. However, these services might also come with fees, especially for instant transfers or cross-border transactions.Best Practices for Zelle Transactions

To ensure safe and successful transactions via Zelle, follow best practices such as verifying the recipient's information carefully, only sending money to trusted individuals, and keeping your device and banking app up to date with the latest security patches.

Tips for Secure Transactions

- Always verify the recipient's email address or mobile number. - Be cautious of scams where someone might ask you to send them money via Zelle. - Keep your account information confidential. - Monitor your account activity regularly for any suspicious transactions.Zelle Transaction Gallery

In conclusion, understanding the daily limits and best practices for using Zelle through Navy Federal is crucial for a smooth and secure transaction experience. Whether you're sending money to family, friends, or for business purposes, being aware of the limits, fees, and security measures in place can help you navigate the process with confidence. If you have any questions or need further clarification on any aspect of Zelle transactions, don't hesitate to reach out to Navy Federal's customer support. Share your experiences or tips for using Zelle in the comments below, and consider sharing this article with others who might benefit from this information.