Discover 5 Navy insurance tips to navigate military coverage, including veteran benefits, USAA insurance, and naval service protection plans, ensuring secure futures for servicemen and families with tailored insurance solutions.

As a member of the Navy, it's essential to have the right insurance coverage to protect yourself and your family from unforeseen circumstances. Whether you're serving on active duty or as a veteran, having the right insurance can provide peace of mind and financial security. In this article, we'll explore five Navy insurance tips that can help you make informed decisions about your insurance needs.

Insurance is a crucial aspect of financial planning, and it's especially important for Navy personnel who face unique risks and challenges. From deployment to training exercises, Navy personnel are exposed to a range of hazards that can affect their health, well-being, and financial stability. By having the right insurance coverage, you can ensure that you and your loved ones are protected in the event of an accident, illness, or other unforeseen circumstance.

The importance of insurance for Navy personnel cannot be overstated. Not only can it provide financial protection, but it can also offer a sense of security and peace of mind. When you're serving in the Navy, you're not just protecting your country; you're also protecting your family and your future. By investing in the right insurance coverage, you can ensure that your loved ones are taken care of, no matter what happens.

Understanding Navy Insurance Options

When it comes to Navy insurance, there are several options to choose from. These include Servicemembers' Group Life Insurance (SGLI), Veterans' Group Life Insurance (VGLI), and Traumatic Injury Protection (TSGLI). Each of these options provides different levels of coverage and benefits, so it's essential to understand what's available and what's right for you. SGLI, for example, provides life insurance coverage to active duty personnel, while VGLI provides coverage to veterans.

Types of Navy Insurance

There are several types of Navy insurance, including: * Life insurance: This type of insurance provides a death benefit to your beneficiaries in the event of your death. * Disability insurance: This type of insurance provides income replacement if you're unable to work due to injury or illness. * Health insurance: This type of insurance provides medical coverage for you and your family. * Traumatic injury insurance: This type of insurance provides coverage for traumatic injuries, such as loss of limbs or eyesight.Tip 1: Review Your SGLI Coverage

If you're an active duty member of the Navy, you're automatically enrolled in SGLI. This type of insurance provides life insurance coverage to active duty personnel, and it's an essential benefit that can provide financial protection for your loved ones. However, it's essential to review your SGLI coverage regularly to ensure that it's adequate and up-to-date. You can increase or decrease your coverage as needed, and you can also add or remove beneficiaries.

How to Review Your SGLI Coverage

To review your SGLI coverage, follow these steps: 1. Log in to your online account: You can log in to your online account through the Navy's website or through the SGLI website. 2. Check your coverage amount: Make sure that your coverage amount is adequate and reflects your current financial situation. 3. Review your beneficiaries: Ensure that your beneficiaries are up-to-date and reflect your current wishes. 4. Consider increasing your coverage: If you've experienced a change in your financial situation, such as a promotion or the birth of a child, you may want to consider increasing your coverage.Tip 2: Consider VGLI Coverage

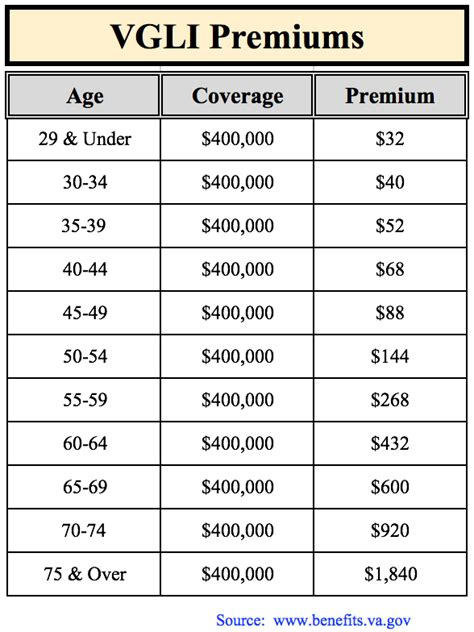

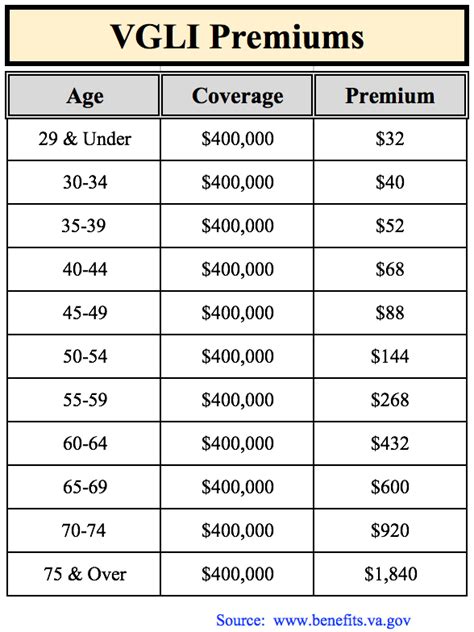

If you're a veteran, you may be eligible for VGLI coverage. This type of insurance provides life insurance coverage to veterans, and it's an essential benefit that can provide financial protection for your loved ones. VGLI coverage is available to veterans who have been discharged from the military, and it's a great option for those who want to maintain their life insurance coverage after they've left the service.

Benefits of VGLI Coverage

VGLI coverage offers several benefits, including: * Life insurance coverage: VGLI provides life insurance coverage to veterans, which can provide financial protection for your loved ones. * Portability: VGLI coverage is portable, which means that you can take it with you wherever you go. * Flexibility: VGLI coverage offers flexible payment options, which can help you manage your premiums.Tip 3: Take Advantage of TSGLI

TSGLI is a type of insurance that provides coverage for traumatic injuries, such as loss of limbs or eyesight. This type of insurance is essential for Navy personnel who are at risk of traumatic injuries, and it's a great option for those who want to ensure that they're protected in the event of an accident. TSGLI coverage is available to active duty personnel, and it's a great way to supplement your SGLI coverage.

How TSGLI Works

TSGLI works by providing a lump-sum payment to you or your beneficiaries in the event of a traumatic injury. The payment amount varies depending on the type and severity of the injury, and it's designed to help you or your loved ones cope with the financial consequences of a traumatic injury.Tip 4: Review Your Health Insurance Options

As a member of the Navy, you're eligible for health insurance coverage through the military's health insurance program, TRICARE. TRICARE offers several health insurance options, including Prime, Extra, and Standard, and it's essential to review your options to ensure that you're getting the best coverage for your needs. You can also consider purchasing supplemental health insurance to fill any gaps in your coverage.

TRICARE Health Insurance Options

TRICARE offers several health insurance options, including: * Prime: This option provides comprehensive coverage, including doctor visits, hospital stays, and prescriptions. * Extra: This option provides additional coverage, including dental and vision care. * Standard: This option provides basic coverage, including doctor visits and hospital stays.Tip 5: Consider Disability Insurance

Disability insurance is an essential benefit that can provide income replacement if you're unable to work due to injury or illness. As a member of the Navy, you're at risk of injury or illness, and disability insurance can help you maintain your financial stability. You can consider purchasing disability insurance through the military's disability insurance program or through a private insurer.

Benefits of Disability Insurance

Disability insurance offers several benefits, including: * Income replacement: Disability insurance provides income replacement if you're unable to work due to injury or illness. * Financial stability: Disability insurance can help you maintain your financial stability, even if you're unable to work. * Peace of mind: Disability insurance can provide peace of mind, knowing that you're protected in the event of an accident or illness.Gallery of Navy Insurance Images

Navy Insurance Image Gallery

In conclusion, having the right insurance coverage is essential for Navy personnel. By reviewing your SGLI coverage, considering VGLI coverage, taking advantage of TSGLI, reviewing your health insurance options, and considering disability insurance, you can ensure that you and your loved ones are protected in the event of an accident, illness, or other unforeseen circumstance. We invite you to share your thoughts and experiences with Navy insurance in the comments below. Have you had any positive or negative experiences with Navy insurance? Do you have any questions or concerns about Navy insurance options? Share your story and help others make informed decisions about their insurance needs.