Maximize your naval career with 5 Navy Retirement Tips, including pension planning, veterans benefits, and transition strategies for a smooth military-to-civilian shift.

Transitioning into retirement can be a challenging and overwhelming experience, especially for those who have dedicated their careers to serving in the Navy. The shift from a highly structured and disciplined environment to a more relaxed and flexible lifestyle requires careful planning and consideration. For Navy personnel approaching retirement, it's essential to be prepared to make the most of this significant life change.

Retirement from the Navy offers a unique opportunity for individuals to pursue new passions, spend quality time with loved ones, and enjoy the fruits of their labor. However, it's crucial to navigate the transition smoothly to ensure a comfortable and secure post-military life. This involves making informed decisions about finances, healthcare, education, and personal relationships. By taking a proactive and strategic approach, retiring Navy personnel can set themselves up for success and create a fulfilling retirement experience.

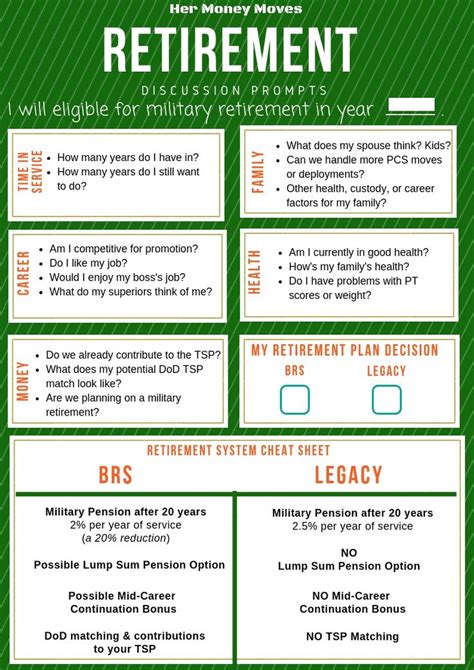

The Navy retirement process can be complex, with various factors to consider, including pension plans, healthcare benefits, and education assistance. It's vital for retiring personnel to understand their entitlements and options to make the most of their retirement package. Furthermore, retirees must also think about their personal and professional goals, whether it's starting a new business, pursuing further education, or simply enjoying leisure activities. With careful planning and consideration, Navy retirees can create a retirement plan that aligns with their values, interests, and aspirations.

Understanding Navy Retirement Benefits

Types of Navy Retirement Benefits

The types of Navy retirement benefits available to personnel include: * Pension: A monthly payment based on the individual's rank, years of service, and final pay grade. * Healthcare benefits: Comprehensive medical, dental, and pharmacy coverage through the TRICARE program. * Education assistance: Financial support for further education and training through the GI Bill and other programs. * Home loan guarantees: Assistance with purchasing or refinancing a home through the VA loan guarantee program. * Disability compensation: Tax-free compensation for service-related disabilities or injuries.Planning for Financial Security

Strategies for Financial Security

Strategies for achieving financial security in retirement include: * Creating a budget: Tracking income and expenses to ensure that the retirement income is sufficient. * Investing wisely: Diversifying investments to minimize risk and maximize returns. * Managing debt: Paying off high-interest debt and minimizing credit card balances. * Building an emergency fund: Saving 3-6 months' worth of expenses in a readily accessible savings account. * Reviewing and updating the financial plan: Regularly reviewing the financial plan to ensure that it remains aligned with the individual's goals and circumstances.Staying Healthy and Active

Tips for Staying Healthy

Tips for staying healthy in retirement include: * Creating a fitness plan: Engaging in regular exercise, such as walking, swimming, or weight training. * Eating a balanced diet: Focusing on whole foods, fruits, vegetables, and lean proteins. * Getting enough sleep: Aiming for 7-9 hours of sleep per night to help regulate stress and energy levels. * Staying connected: Maintaining social connections with friends, family, and community to prevent loneliness and isolation. * Managing stress: Engaging in stress-reducing activities, such as meditation, yoga, or deep breathing exercises.Pursuing New Opportunities

Ideas for Pursuing New Opportunities

Ideas for pursuing new opportunities in retirement include: * Starting a new business: Leveraging skills and experience to create a successful entrepreneurial venture. * Pursuing further education: Taking online courses, attending workshops, or pursuing a degree to enhance knowledge and skills. * Taking on a part-time job: Engaging in part-time work to stay active, earn extra income, and maintain social connections. * Volunteering: Giving back to the community through volunteering, mentoring, or coaching. * Traveling: Exploring new destinations, experiencing different cultures, and broadening horizons.Building a Support Network

Ways to Build a Support Network

Ways to build a support network in retirement include: * Staying connected with friends and family: Regularly scheduling social activities, phone calls, and video chats. * Joining social clubs: Participating in hobbies, interests, and group activities to meet like-minded individuals. * Attending community events: Engaging in local events, festivals, and gatherings to expand social connections. * Participating in online communities: Joining online forums, social media groups, and discussion boards to connect with others. * Volunteering: Giving back to the community through volunteering, mentoring, or coaching to meet new people and build relationships.Navy Retirement Image Gallery

As Navy retirees embark on this new chapter in their lives, it's essential to remember that retirement is a journey, not a destination. By being proactive, flexible, and open-minded, individuals can create a fulfilling and purposeful retirement experience. Whether it's pursuing new passions, spending time with loved ones, or giving back to the community, Navy retirees have the opportunity to make a meaningful impact and leave a lasting legacy. We invite you to share your thoughts, experiences, and advice on Navy retirement in the comments below. Let's work together to create a supportive community that empowers and inspires Navy retirees to thrive in their post-military lives.