Intro

Secure your business transactions with a comprehensive NC promissory note template. Discover the 5 key elements that ensure enforceability, including repayment terms, interest rates, and borrower obligations. Learn how to create a legally binding document that protects your interests and fosters successful lending relationships in North Carolina.

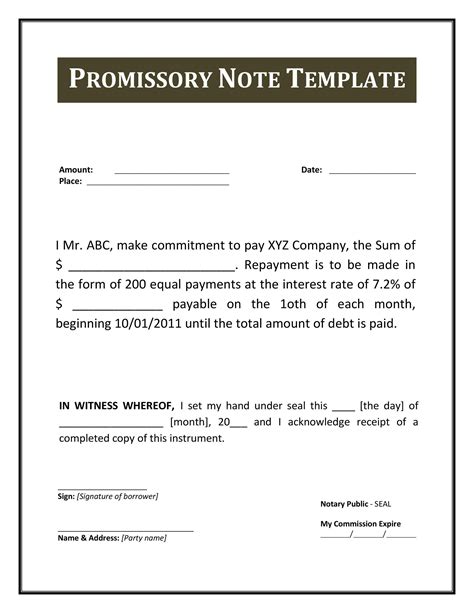

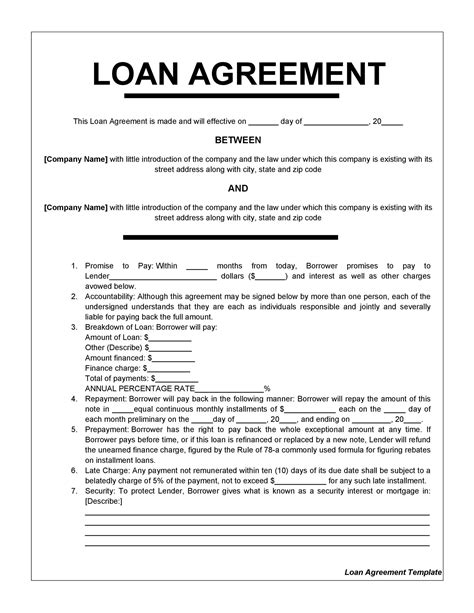

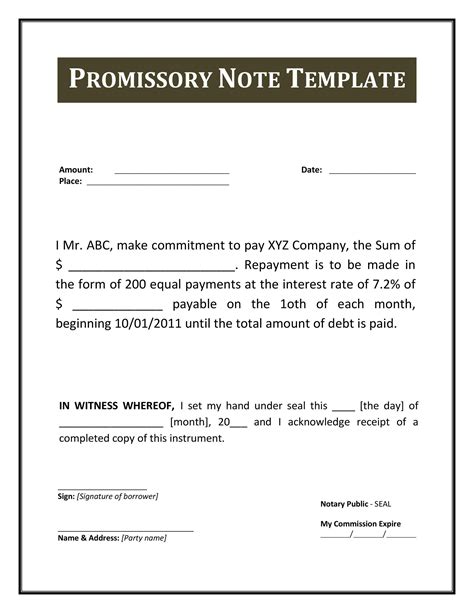

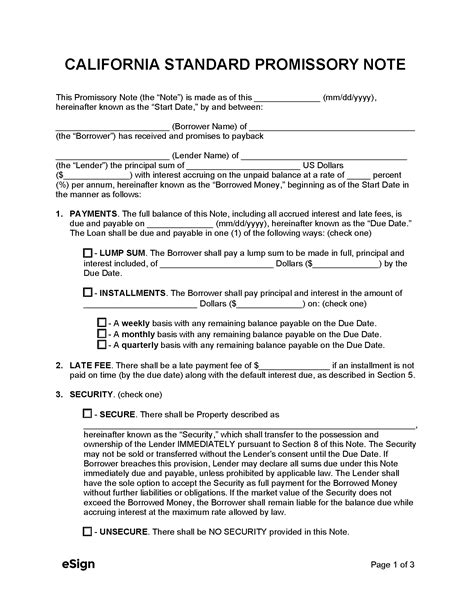

A promissory note is a crucial document in any loan transaction, outlining the terms of the agreement between the lender and the borrower. In North Carolina, a promissory note template is used to formalize the loan agreement, ensuring that both parties understand their obligations. Here, we'll explore the 5 key elements of a North Carolina promissory note template.

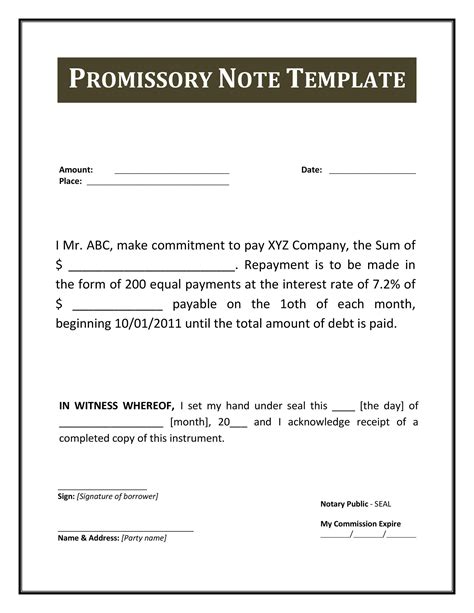

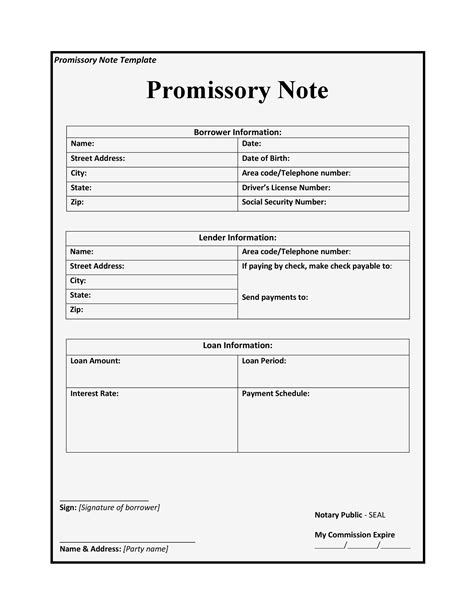

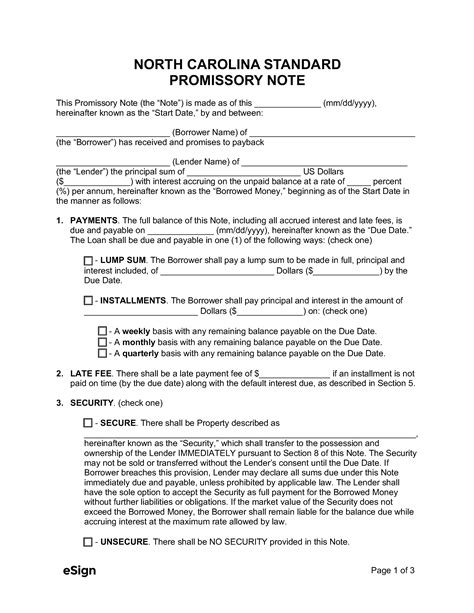

Element 1: Identification of Parties

A promissory note must clearly identify the parties involved in the loan agreement. This includes the borrower (the person or entity receiving the loan) and the lender (the person or entity providing the loan). The template should include the following information:

- Borrower's name and address

- Lender's name and address

- The borrower's and lender's signatures

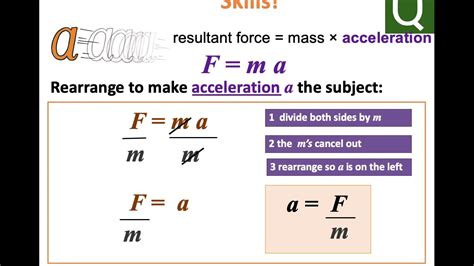

Element 2: Loan Terms

The promissory note template should outline the terms of the loan, including:

- The loan amount (principal)

- The interest rate (if applicable)

- The repayment terms (e.g., monthly payments, due date, and payment amount)

- The loan duration (e.g., the number of years or months)

- Any fees or charges associated with the loan

Element 3: Payment Provisions

The payment provisions section outlines the details of how the borrower will repay the loan. This includes:

- The payment amount and frequency (e.g., monthly, quarterly, or annually)

- The payment method (e.g., check, bank transfer, or online payment)

- Any late payment fees or penalties

- The consequences of defaulting on the loan

Element 4: Default and Acceleration

The default and acceleration section explains what happens if the borrower fails to meet their payment obligations. This includes:

- The definition of default (e.g., missing a payment or failing to comply with loan terms)

- The consequences of default (e.g., late fees, penalties, or acceleration of the loan)

- The lender's rights in the event of default (e.g., accelerating the loan or taking possession of collateral)

Element 5: Governing Law

The governing law section specifies which state's laws will govern the loan agreement. In this case, the promissory note template should indicate that North Carolina law applies.

By including these 5 key elements, a North Carolina promissory note template provides a comprehensive and enforceable agreement between the lender and borrower.

Benefits of Using a Promissory Note Template

Using a promissory note template offers several benefits, including:

- Ensures compliance with North Carolina law

- Provides clarity and understanding of the loan terms

- Protects both the lender and borrower by outlining their obligations and responsibilities

- Saves time and effort in drafting a loan agreement from scratch

Conclusion

In conclusion, a North Carolina promissory note template is a vital document in any loan transaction. By including the 5 key elements outlined above, lenders and borrowers can ensure a clear and enforceable agreement. We encourage you to use this template as a starting point for your loan agreements and to seek professional advice if needed.

Promissory Note Templates Gallery

We hope this article has provided you with a comprehensive understanding of the key elements of a North Carolina promissory note template. If you have any questions or need further clarification, please don't hesitate to ask.