Discover 5 tips for NC car tax, including exemption rules, registration fees, and tax deductions, to minimize your vehicle tax liability in North Carolina.

In North Carolina, vehicle owners are required to pay an annual tax on their vehicles. This tax, commonly referred to as the NC car tax, can be a significant expense for many residents. Understanding how the tax is calculated and how to minimize the amount owed can help vehicle owners save money and avoid any potential penalties. The importance of staying informed about the NC car tax cannot be overstated, as it directly affects the budget of vehicle owners across the state. By grasping the fundamentals of the tax and exploring strategies to reduce the financial burden, individuals can better manage their vehicle-related expenses.

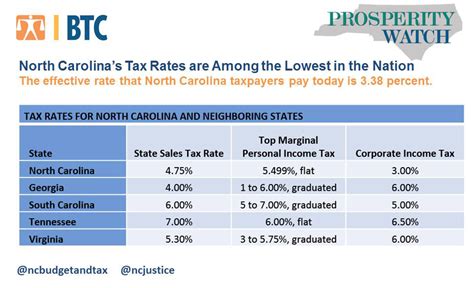

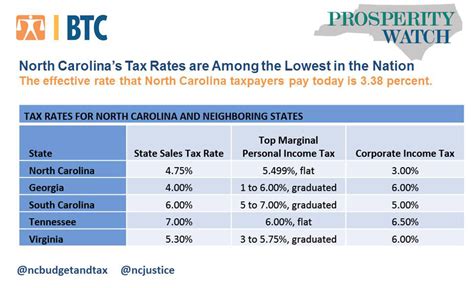

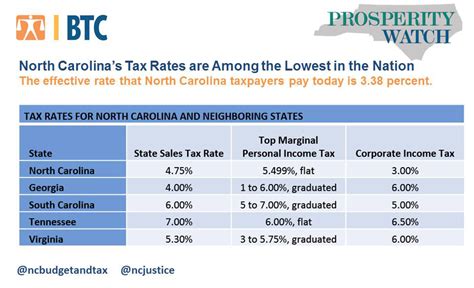

The NC car tax is a critical component of the state's revenue stream, contributing significantly to the funding of public services and infrastructure. However, for many vehicle owners, the tax can be a source of confusion, particularly when it comes to understanding the calculation methods and the various factors that influence the final amount owed. The tax is typically calculated based on the vehicle's value, with higher-valued vehicles resulting in higher tax payments. Furthermore, the tax rate can vary depending on the location within the state, adding another layer of complexity to the calculation. By delving into the specifics of the NC car tax and exploring available tips and strategies, vehicle owners can navigate this complex system more effectively.

Navigating the NC car tax system requires a thorough understanding of its intricacies, including how the tax is assessed, the payment deadlines, and the potential consequences of late payments. The tax is usually paid alongside the vehicle's registration renewal, making it essential for owners to plan ahead and budget accordingly. Moreover, the state offers various exemptions and deductions that can significantly reduce the tax liability for eligible vehicle owners. These exemptions can include discounts for military personnel, historic vehicles, or vehicles used for specific purposes, such as farming or non-profit activities. By familiarizing themselves with these aspects of the NC car tax, vehicle owners can ensure compliance with state regulations while minimizing their tax burden.

Understanding the NC Car Tax

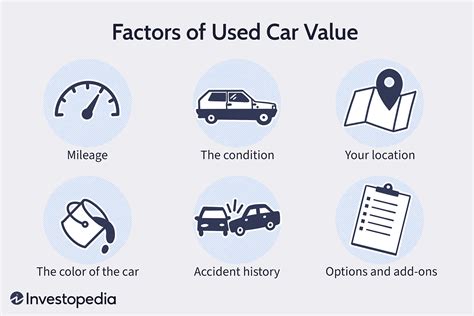

To effectively manage the NC car tax, it's crucial to understand the factors that influence the tax amount. The tax is primarily based on the vehicle's registered value, which is determined by the North Carolina Department of Motor Vehicles (DMV). The registered value is typically a percentage of the vehicle's manufacture's suggested retail price (MSRP) or the vehicle's blue book value, depending on the vehicle's age. Newer vehicles are taxed based on a higher percentage of their MSRP, while older vehicles are taxed based on a lower percentage of their blue book value. This method aims to reflect the vehicle's depreciation over time.

Factors Influencing the NC Car Tax

The NC car tax is influenced by several key factors, including the vehicle's age, value, and location within the state. The tax rate can vary significantly from one county to another, with some areas imposing higher tax rates due to local needs and budget requirements. Additionally, the state may offer various incentives or exemptions that can affect the final tax amount. For instance, vehicles that are powered by alternative fuels or are classified as historic may be eligible for reduced tax rates or exemptions. Understanding these factors is essential for vehicle owners seeking to minimize their tax liability.5 Tips to Minimize NC Car Tax

-

Understand the Tax Calculation: The first step in minimizing the NC car tax is to understand how the tax is calculated. By knowing the factors that influence the tax amount, such as the vehicle's value and age, vehicle owners can make informed decisions about their vehicle purchases and maintenance.

-

Explore Exemptions and Deductions: North Carolina offers several exemptions and deductions that can significantly reduce the tax liability for eligible vehicle owners. These can include exemptions for military personnel, vehicles used for specific purposes like farming, and historic vehicles. Vehicle owners should research these exemptions to determine if they qualify.

-

Maintain Accurate Vehicle Records: Keeping accurate and detailed records of the vehicle's maintenance, repairs, and mileage can be beneficial in disputing the assessed value if it seems too high. This documentation can serve as evidence to support a claim for a reduced tax assessment.

-

Consider the Timing of Vehicle Purchases: The timing of a vehicle purchase can impact the tax amount. Purchasing a vehicle later in the year may result in a lower tax payment for the first year, as the tax is prorated based on the number of months the vehicle is owned during the year.

-

Review and Appeal the Tax Assessment: If the assessed value of the vehicle seems incorrect, vehicle owners have the right to appeal the assessment. This involves providing evidence to support a claim for a lower vehicle value, which could result in a reduced tax amount. The appeal process typically involves submitting a formal request to the county tax office, along with supporting documentation.

Importance of Timely Payments

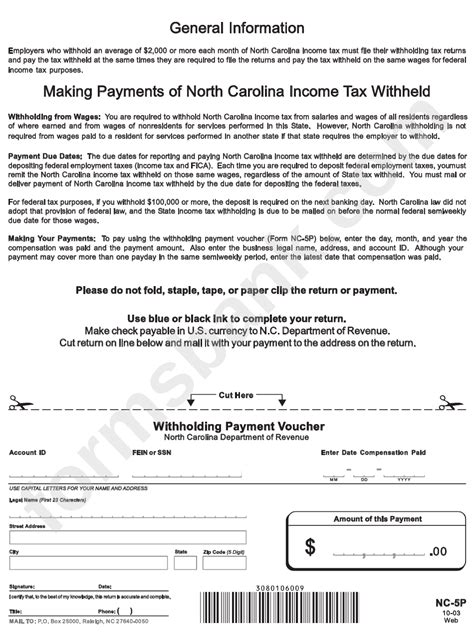

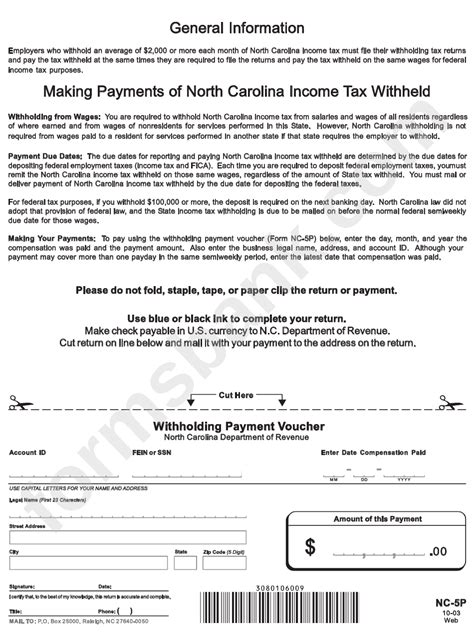

Making timely payments is crucial to avoid penalties and interest on the NC car tax. The state imposes late fees and interest on unpaid taxes, which can significantly increase the overall amount owed. Vehicle owners should ensure they pay their taxes by the deadline to avoid these additional costs. Moreover, paying on time helps in maintaining a good standing with the DMV and avoids any potential issues with vehicle registration.NC Car Tax Payment Options

The state of North Carolina provides several payment options for the car tax, aiming to make the process as convenient as possible for vehicle owners. These options include online payments, mail-in payments, and in-person payments at local tax offices. Online payments are particularly convenient, allowing vehicle owners to pay their taxes securely and efficiently from the comfort of their own homes. Additionally, some counties may offer payment plans for individuals who are unable to pay the full tax amount by the deadline, helping to avoid penalties and interest.

Benefits of Online Payments

Online payments offer several benefits, including convenience, speed, and security. Vehicle owners can make payments 24/7, without the need to visit a physical location or wait in line. This method also provides an immediate confirmation of payment, reducing the risk of lost or delayed payments. Furthermore, online payments can help reduce errors, as the payment process is automated and less prone to human mistake.Gallery of NC Car Tax Related Images

NC Car Tax Image Gallery

In conclusion, navigating the NC car tax system requires a blend of understanding the tax calculation, exploring available exemptions, and utilizing convenient payment options. By grasping these aspects and implementing strategies to minimize the tax burden, vehicle owners in North Carolina can better manage their expenses and comply with state regulations. As the state continues to evolve its tax policies and services, staying informed will remain key for vehicle owners seeking to optimize their financial situation. We invite readers to share their experiences and tips regarding the NC car tax, and to explore the resources provided for a more detailed understanding of this critical aspect of vehicle ownership in North Carolina.