Unlock tax savings with the Necessary Expense Doctrine. Learn 5 key strategies to maximize deductions, optimize business expenses, and boost your bottom line. Discover how to apply this vital tax principle to reduce liabilities, enhance financial reporting, and ensure compliance with IRS regulations.

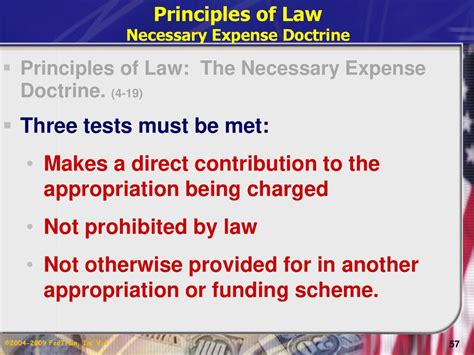

Understanding the Necessary Expense Doctrine

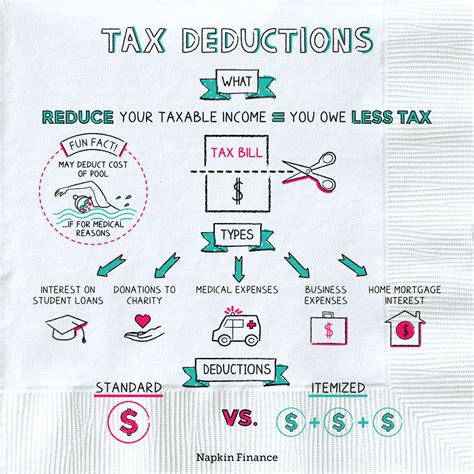

The necessary expense doctrine is a fundamental concept in taxation that allows individuals and businesses to deduct expenses that are necessary and ordinary for their trade or business. This doctrine is essential in ensuring that taxpayers are not unfairly taxed on income that is not truly theirs. In this article, we will explore the necessary expense doctrine in depth and provide five ways to apply it to minimize your tax liability.

The necessary expense doctrine is rooted in the idea that taxpayers should only be taxed on their net income, not their gross income. This means that expenses that are necessary and ordinary for a trade or business should be deductible, as they are not part of the taxpayer's true income. The doctrine is applied in various areas of taxation, including individual and business income tax, payroll tax, and sales tax.

History of the Necessary Expense Doctrine

The necessary expense doctrine has its roots in the early days of taxation in the United States. In the 19th century, the Supreme Court established the principle that taxpayers should only be taxed on their net income, not their gross income. This principle was later codified in the Internal Revenue Code, which allows taxpayers to deduct necessary and ordinary expenses from their gross income.

Over the years, the necessary expense doctrine has been applied in various court cases and IRS rulings. The doctrine has been expanded to include not only expenses that are necessary and ordinary but also expenses that are reasonable and not excessive. Today, the necessary expense doctrine is a cornerstone of taxation, and its application is crucial in ensuring that taxpayers are fairly taxed.

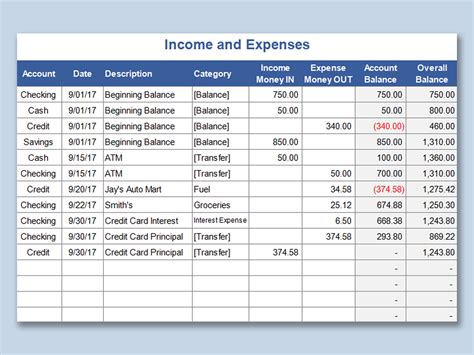

5 Ways to Apply the Necessary Expense Doctrine

Here are five ways to apply the necessary expense doctrine to minimize your tax liability:

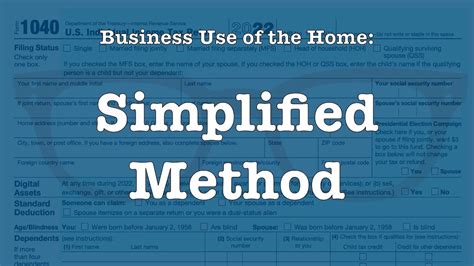

1. Business Use of Your Home

If you use a part of your home regularly and exclusively for business, you may be able to deduct expenses related to that use. This can include mortgage interest, property taxes, insurance, and utilities. To qualify for this deduction, you must use a part of your home as your principal place of business or as a place where you meet with clients or customers.

To calculate the business use percentage, you can use the square footage method or the number of rooms method. You can then apply this percentage to your total expenses to determine the amount of your deduction.

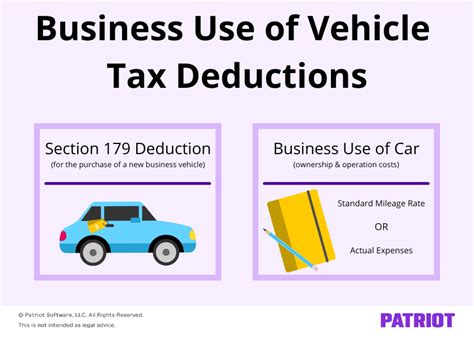

2. Business Use of Your Car

If you use your car for business, you may be able to deduct expenses related to that use. This can include gas, oil, maintenance, insurance, and registration. To qualify for this deduction, you must use your car for business purposes, such as traveling to client meetings or transporting business equipment.

To calculate the business use percentage, you can use a log or calendar to track your business miles. You can then apply this percentage to your total expenses to determine the amount of your deduction.

3. Meals and Entertainment

If you entertain clients or customers, you may be able to deduct expenses related to meals and entertainment. This can include the cost of food, drinks, and tickets to events. To qualify for this deduction, you must entertain clients or customers for business purposes, such as discussing business or building relationships.

To calculate the amount of your deduction, you can use the 50% rule, which allows you to deduct 50% of your total expenses.

4. Travel Expenses

If you travel for business, you may be able to deduct expenses related to that travel. This can include the cost of transportation, lodging, and meals. To qualify for this deduction, you must travel for business purposes, such as attending conferences or meeting with clients.

To calculate the amount of your deduction, you can use a log or calendar to track your expenses. You can then apply this amount to your total expenses to determine the amount of your deduction.

5. Business Equipment and Supplies

If you use equipment or supplies for business, you may be able to deduct expenses related to that use. This can include the cost of computers, printers, and software. To qualify for this deduction, you must use the equipment or supplies for business purposes, such as preparing documents or communicating with clients.

To calculate the amount of your deduction, you can use the straight-line method or the accelerated method. You can then apply this amount to your total expenses to determine the amount of your deduction.

Necessary Expense Doctrine Image Gallery

By applying the necessary expense doctrine, you can minimize your tax liability and ensure that you are not unfairly taxed on income that is not truly yours. Remember to keep accurate records of your expenses and to consult with a tax professional to ensure that you are taking advantage of all the deductions available to you.