Intro

Master Net Present Value (NPV) calculations with our easy-to-use Excel template. Learn how to calculate NPV, Internal Rate of Return (IRR), and Payback Period for investment analysis. Simplify decision-making with our free template and expert guidance on discount rates, cash flows, and profitability. Boost your financial modeling skills now!

When it comes to evaluating the financial viability of a project or investment, one of the most commonly used metrics is the Net Present Value (NPV). NPV is a calculation that takes into account the initial investment, expected future cash flows, and the time value of money to determine whether a project is worth pursuing. While NPV calculations can be complex, using an Excel template can make the process much easier. In this article, we'll explore the basics of NPV, how to create an NPV Excel template, and provide tips for using it effectively.

Understanding Net Present Value (NPV)

NPV is a financial metric that calculates the present value of expected future cash flows from a project or investment, minus the initial investment. It's a widely used metric in capital budgeting and investment analysis. The NPV calculation takes into account the time value of money, which means that it considers the fact that a dollar today is worth more than a dollar in the future.

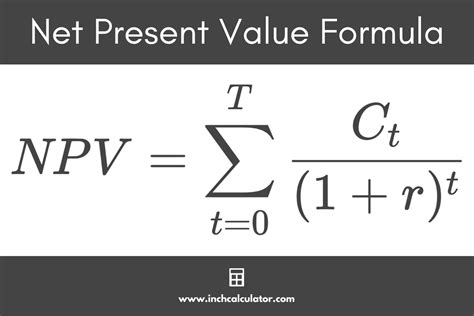

NPV Formula

The NPV formula is as follows:

NPV = Σ (CFt / (1 + r)^t) - Initial Investment

Where:

- CFt = Cash flow at time t

- r = Discount rate (the rate at which the cash flows are discounted)

- t = Time period

- Initial Investment = The initial investment required for the project

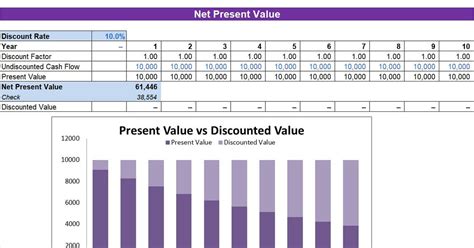

Creating an NPV Excel Template

Creating an NPV Excel template is relatively straightforward. Here's a step-by-step guide to get you started:

- Open a new Excel spreadsheet and create a table with the following columns:

- Period (e.g., Year 1, Year 2, etc.)

- Cash Flow

- Discount Rate

- Present Value

- Enter the initial investment amount in a cell, say B1.

- Enter the expected cash flows for each period in the Cash Flow column.

- Enter the discount rate in a cell, say B2.

- Use the NPV formula to calculate the present value of each cash flow. You can use the following formula:

=PMT / (1 + Discount Rate)^Period

Where PMT is the cash flow amount, Discount Rate is the discount rate, and Period is the time period. 6. Calculate the NPV by summing up the present values of all cash flows and subtracting the initial investment.

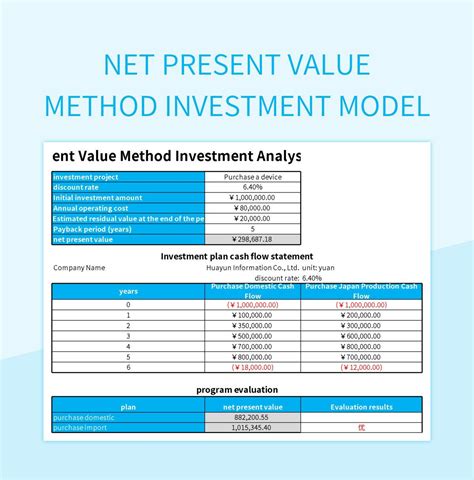

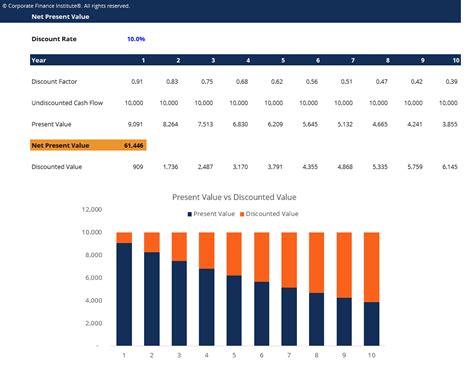

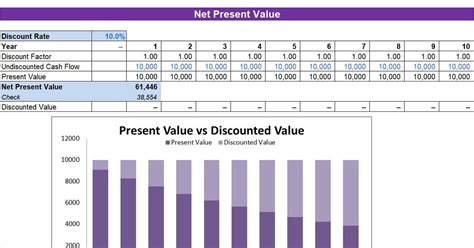

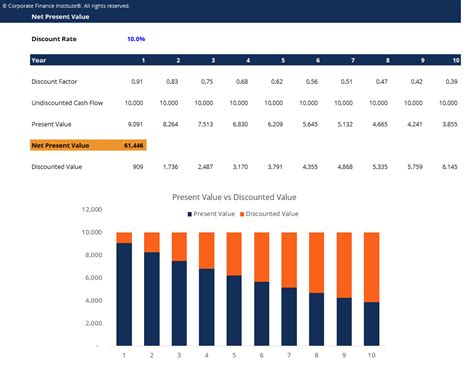

NPV Excel Template Example

Here's an example of an NPV Excel template:

| Period | Cash Flow | Discount Rate | Present Value |

|---|---|---|---|

| Year 1 | $100,000 | 10% | $90,909 |

| Year 2 | $120,000 | 10% | $99,174 |

| Year 3 | $150,000 | 10% | $114,243 |

| Initial Investment | $500,000 |

NPV = $104,326

In this example, the NPV is $104,326, which means that the project is expected to generate a net present value of $104,326.

Tips for Using an NPV Excel Template

Here are some tips for using an NPV Excel template effectively:

- Use a consistent discount rate: Make sure to use a consistent discount rate throughout the calculation.

- Consider multiple scenarios: Use the template to consider multiple scenarios, such as different discount rates or cash flow projections.

- Sensitivity analysis: Use the template to perform sensitivity analysis, such as analyzing how changes in the discount rate or cash flows affect the NPV.

- Use it for comparison: Use the template to compare different projects or investments.

Gallery of NPV Excel Templates

NPV Excel Template Gallery

Final Thoughts

Using an NPV Excel template can make it easy to calculate the net present value of a project or investment. By following the steps outlined in this article, you can create your own NPV template and start using it to evaluate financial opportunities. Remember to use a consistent discount rate, consider multiple scenarios, and perform sensitivity analysis to get the most out of your template.

We hope this article has been helpful in making NPV Excel templates easy to understand and use. If you have any questions or comments, please feel free to share them below.