Intro

Learn how to create a customized Netspend bank statement template with our expert tips. Discover the essential elements, formatting, and design requirements to ensure accurate and professional statements. Master the art of creating a Netspend bank statement template with our 5-step guide, featuring insights on layout, data, and compliance for seamless financial management.

Creating a Netspend bank statement template can help you manage your finances more effectively and keep track of your spending. A well-designed template can also help you identify areas where you can cut back and make adjustments to your budget. Here are five tips for creating a Netspend bank statement template:

Why Create a Netspend Bank Statement Template?

Before we dive into the tips, let's quickly discuss why creating a Netspend bank statement template is important. By using a template, you can easily track your income and expenses, identify patterns in your spending, and make informed decisions about your finances. A template can also help you stay organized and ensure that you never miss a payment or overdraft.

Understanding Your Netspend Account

Before creating a template, it's essential to understand how your Netspend account works. Netspend is a prepaid debit card that allows you to manage your finances online or through the mobile app. You can load funds onto your card, check your balance, and track your spending. Understanding how your account works will help you create a template that accurately reflects your financial situation.

Tip 1: Choose a Template Format

The first step in creating a Netspend bank statement template is to choose a format. You can use a spreadsheet like Google Sheets or Microsoft Excel, or a budgeting app like Mint or Personal Capital. Choose a format that you're comfortable with and that allows you to easily track your income and expenses.

Understanding the Benefits of a Netspend Bank Statement Template

Using a Netspend bank statement template can have numerous benefits. For one, it can help you stay organized and ensure that you never miss a payment or overdraft. A template can also help you identify areas where you can cut back and make adjustments to your budget. Additionally, a template can help you track your spending and make informed decisions about your finances.

Tip 2: Set Up Your Template

Once you've chosen a format, it's time to set up your template. Start by creating columns for your income, fixed expenses, variable expenses, and savings. You can also add columns for specific expenses like groceries, entertainment, and transportation. Make sure to include a column for your balance so you can easily track your spending.

Tip 3: Track Your Income

Tracking your income is an essential part of creating a Netspend bank statement template. Start by identifying all sources of income, including your job, investments, and any side hustles. Make sure to include any regular deposits, like direct deposit or transfers from other accounts.

Tip 4: Track Your Expenses

Tracking your expenses is just as important as tracking your income. Start by identifying all fixed expenses, like rent/mortgage, utilities, and car payments. Then, identify variable expenses like groceries, entertainment, and transportation. Make sure to include any irregular expenses, like car maintenance or property taxes.

Tip 5: Review and Adjust

Finally, review and adjust your template regularly. Start by reviewing your income and expenses to ensure that you're on track with your budget. Make adjustments as needed, and consider using the 50/30/20 rule to allocate your income. By regularly reviewing and adjusting your template, you can ensure that you're making the most of your Netspend account.

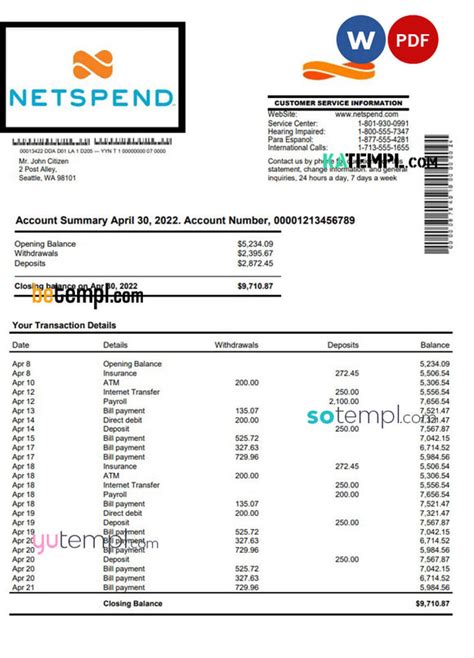

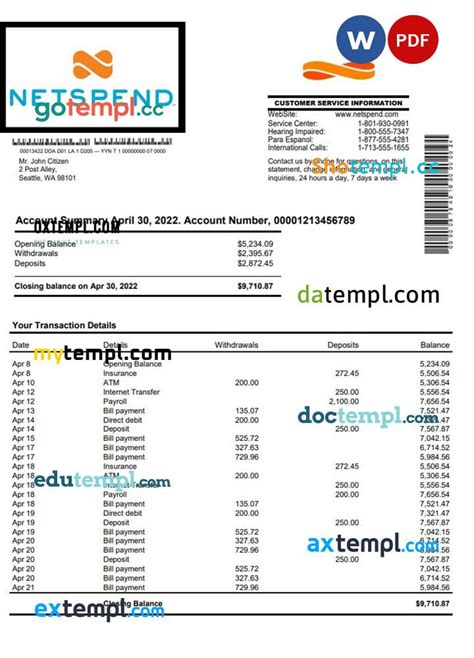

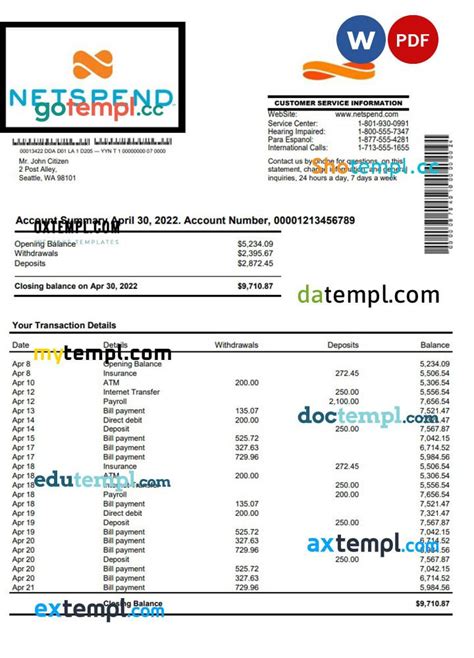

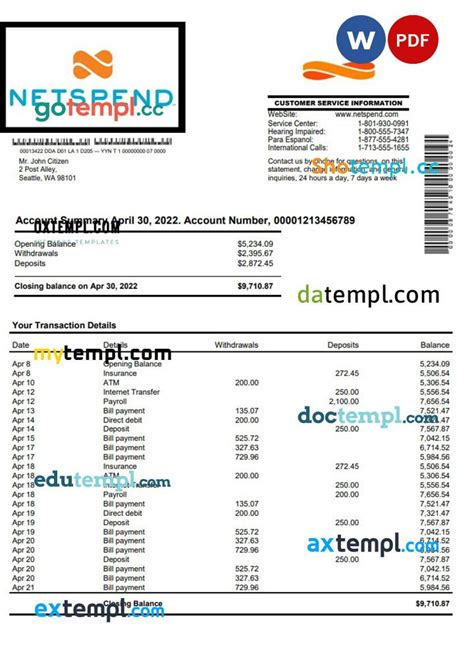

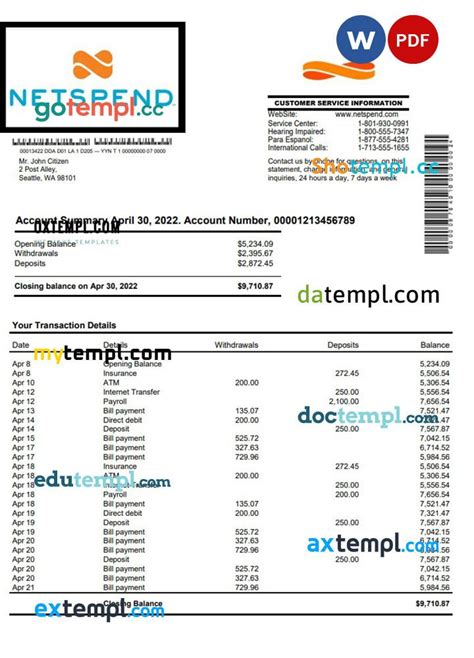

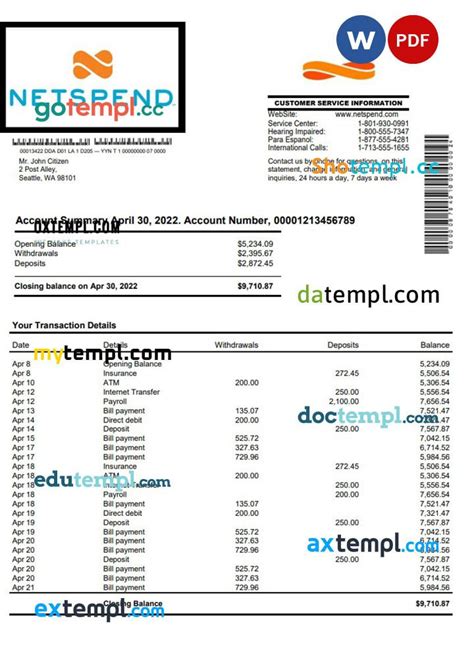

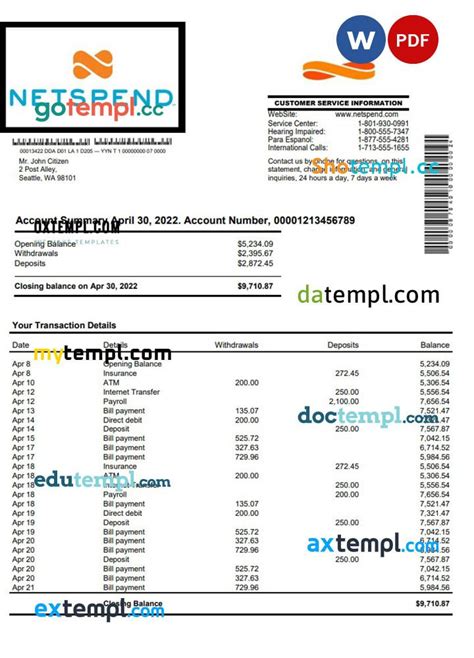

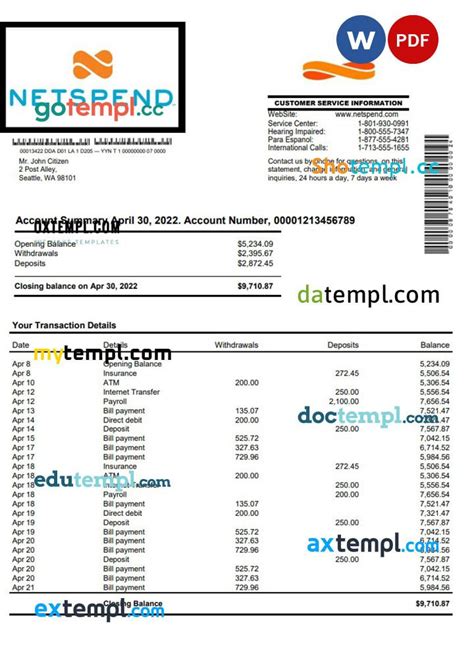

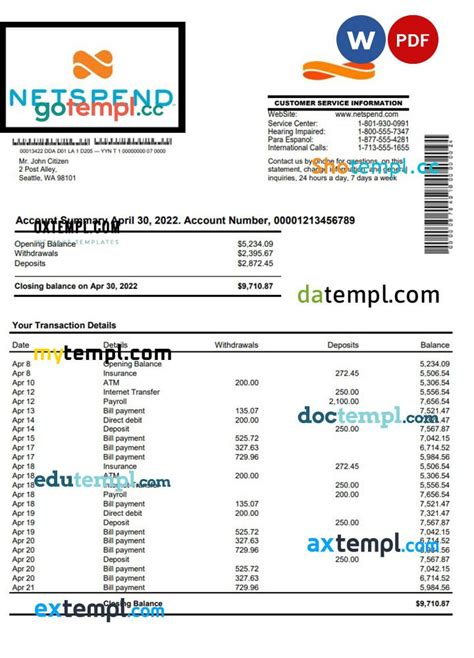

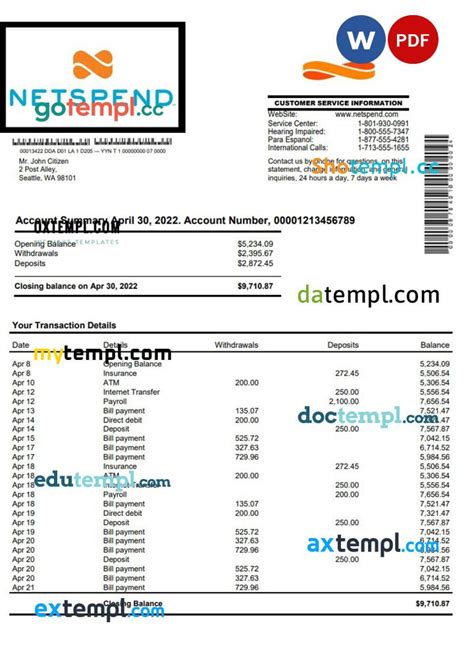

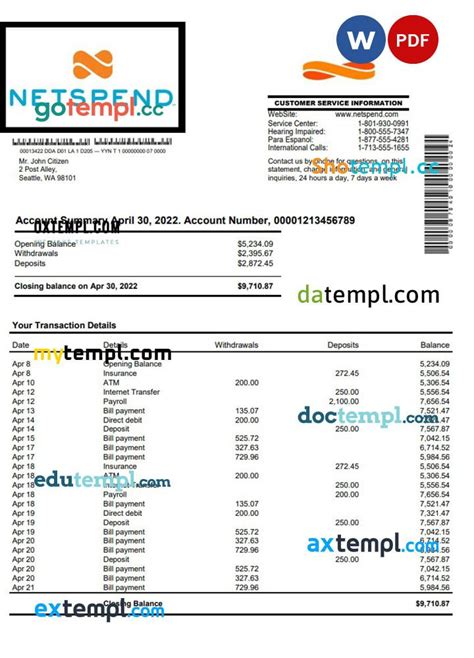

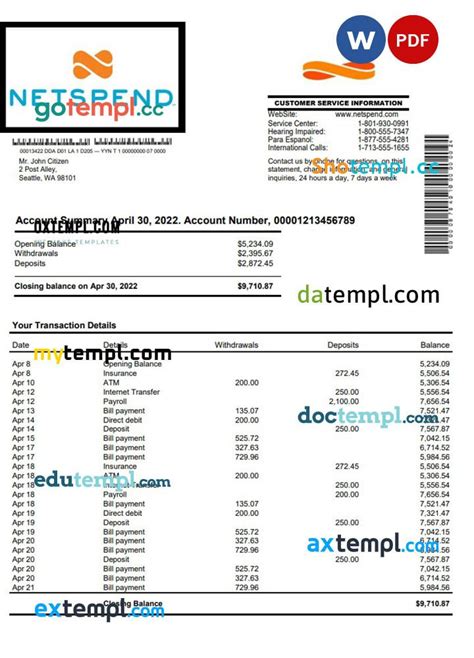

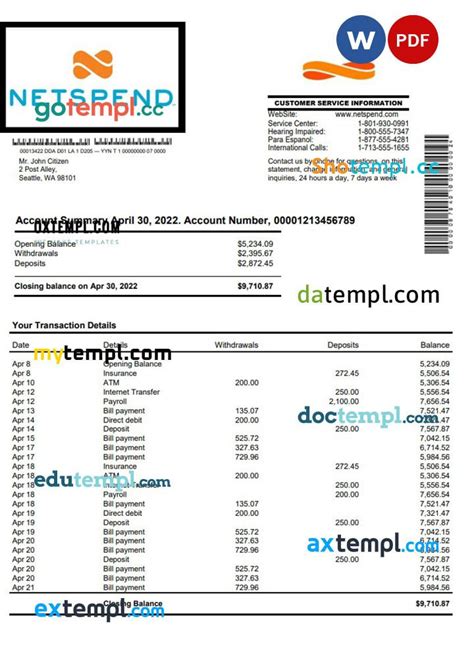

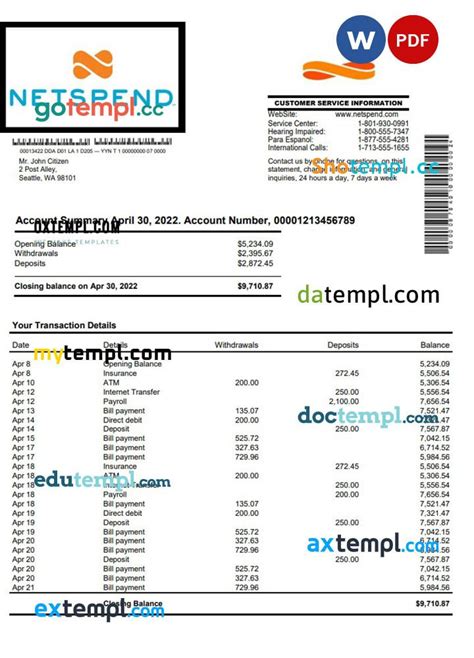

Gallery of Netspend Bank Statement Templates

Netspend Bank Statement Template Examples

Take Control of Your Finances

By following these five tips, you can create a Netspend bank statement template that helps you take control of your finances. Remember to regularly review and adjust your template to ensure that you're making the most of your Netspend account. With a little practice, you'll be able to create a template that helps you manage your finances like a pro.