Intro

Calculate NJ taxes with our New Jersey Tax Withholding Calculator, featuring income tax brackets, deductions, and exemptions for accurate payroll withholding and tax planning.

The state of New Jersey has a complex tax system, and understanding how to calculate tax withholding is crucial for both employers and employees. The New Jersey tax withholding calculator is a tool designed to help individuals and businesses navigate the state's tax laws and ensure they are withholding the correct amount of taxes from employee wages. In this article, we will delve into the world of New Jersey tax withholding, exploring its importance, how it works, and providing guidance on how to use the calculator effectively.

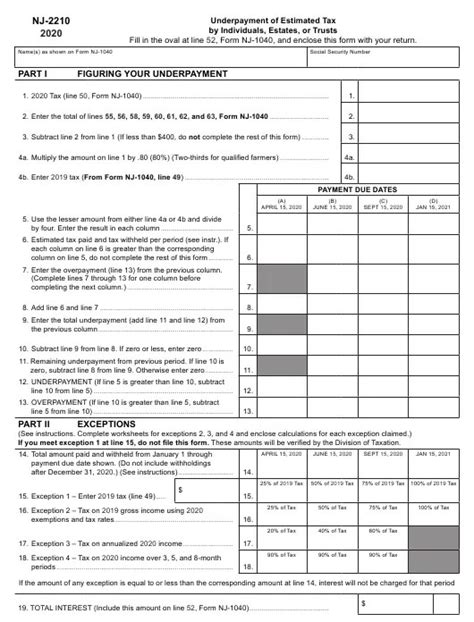

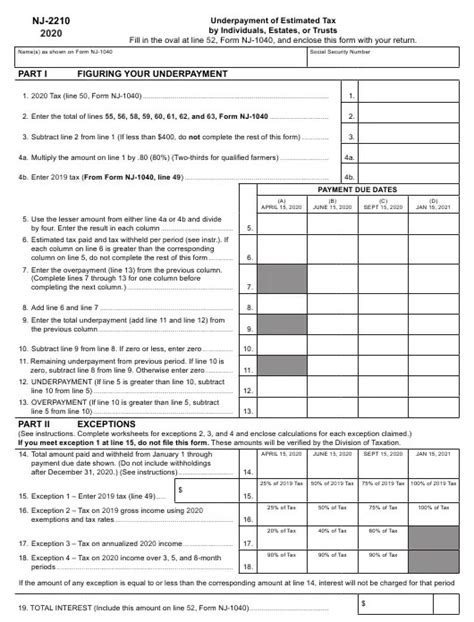

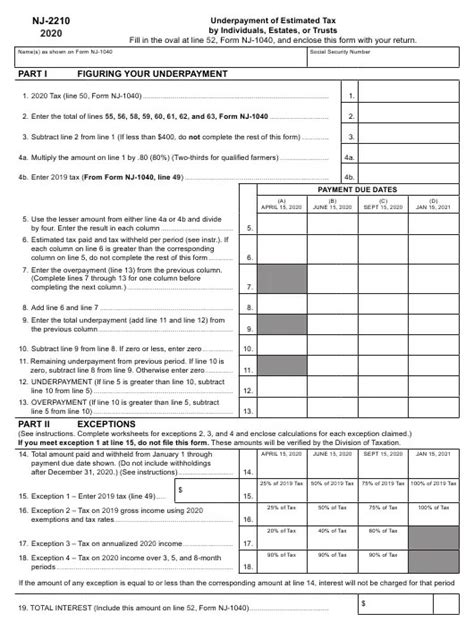

New Jersey tax withholding is a critical aspect of the state's tax system, as it ensures that employees pay their fair share of taxes throughout the year. The state uses a progressive tax system, with rates ranging from 5.525% to 10.75%, depending on the individual's income level. Employers are responsible for withholding the correct amount of taxes from employee wages, and the New Jersey tax withholding calculator is an essential tool in this process. By using the calculator, employers can ensure they are complying with state tax laws and avoiding potential penalties.

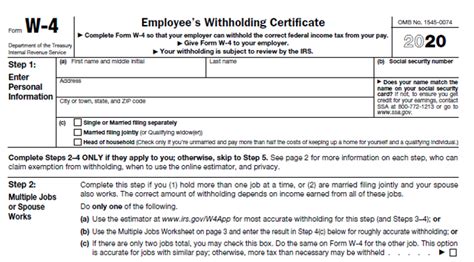

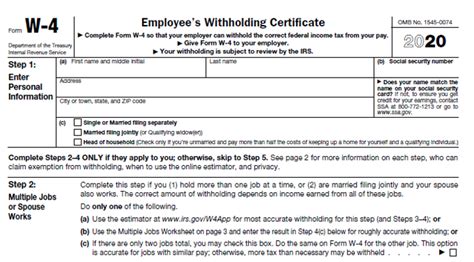

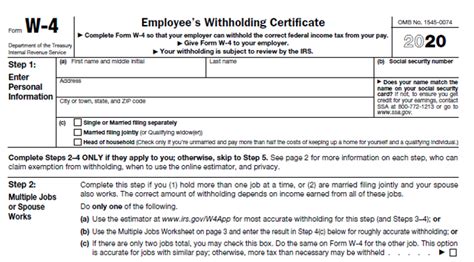

The New Jersey tax withholding calculator takes into account various factors, including the employee's gross income, filing status, and number of exemptions. The calculator uses a formula to determine the correct amount of taxes to withhold, based on the state's tax tables and rates. Employers can use the calculator to determine the correct amount of taxes to withhold from employee wages, and employees can use it to estimate their tax liability and adjust their withholding accordingly. In the following sections, we will explore the calculator in more detail, including its benefits, how to use it, and common mistakes to avoid.

New Jersey Tax Withholding Calculator Benefits

Another benefit of the New Jersey tax withholding calculator is convenience. The calculator is available online, making it easily accessible to employers and employees alike. The calculator is also user-friendly, with a simple and intuitive interface that makes it easy to navigate and use. Employers can use the calculator to determine the correct amount of taxes to withhold from employee wages, and employees can use it to estimate their tax liability and adjust their withholding accordingly.

How to Use the New Jersey Tax Withholding Calculator

Once this information is gathered, employers can enter it into the calculator, which will then determine the correct amount of taxes to withhold. The calculator will also provide an estimate of the employee's tax liability, which can be used to adjust withholding accordingly.

Step-by-Step Guide to Using the Calculator

Here is a step-by-step guide to using the New Jersey tax withholding calculator: 1. Gather the required information, including the employee's gross income, filing status, and number of exemptions. 2. Visit the New Jersey tax withholding calculator website and click on the "Calculate Withholding" button. 3. Enter the required information into the calculator, including the employee's gross income, filing status, and number of exemptions. 4. Click on the "Calculate" button to determine the correct amount of taxes to withhold. 5. Review the results, which will include an estimate of the employee's tax liability and the correct amount of taxes to withhold.New Jersey Tax Withholding Calculator Mistakes to Avoid

Another mistake to avoid is failing to update the calculator with changes in the employee's income or filing status. This can result in an incorrect calculation, which can lead to penalties and fines. Employers should regularly review and update the calculator to ensure accuracy and compliance with state tax laws.

Common Mistakes to Avoid

Here are some common mistakes to avoid when using the New Jersey tax withholding calculator: * Entering incorrect information, such as the employee's gross income or filing status * Failing to update the calculator with changes in the employee's income or filing status * Not using the correct tax tables and rates * Not accounting for other income, such as tips or bonuses * Not accounting for tax credits, such as the Earned Income Tax Credit (EITC)New Jersey Tax Withholding Calculator FAQs

Answers to FAQs

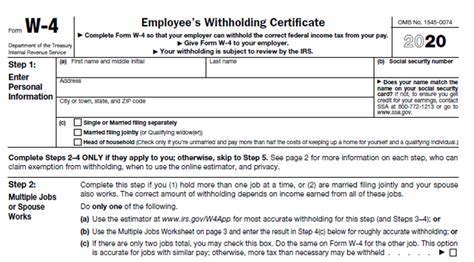

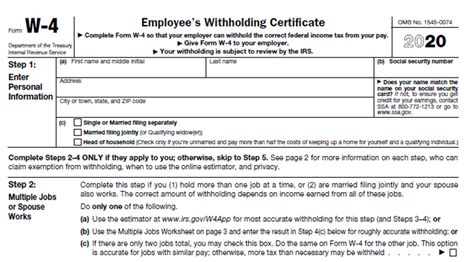

Here are the answers to the FAQs: * The New Jersey tax withholding calculator is a tool designed to help employers and employees calculate the correct amount of taxes to withhold from employee wages. * To use the calculator, simply gather the required information, including the employee's gross income, filing status, and number of exemptions, and enter it into the calculator. * You will need to gather the employee's gross income, filing status, and number of exemptions, as well as other income and tax credits. * You should update the calculator regularly, such as when the employee's income or filing status changes. * The benefits of using the New Jersey tax withholding calculator include accuracy, convenience, and compliance with state tax laws.New Jersey Tax Withholding Calculator Image Gallery

In conclusion, the New Jersey tax withholding calculator is a valuable tool for employers and employees alike. By using the calculator, individuals can ensure they are withholding the correct amount of taxes from employee wages, reducing the risk of errors and potential penalties. We invite you to share your thoughts and experiences with the New Jersey tax withholding calculator in the comments below. Have you used the calculator before? What benefits or challenges have you encountered? Your feedback is essential in helping us create a more informative and engaging article. Additionally, if you found this article helpful, please share it with your friends and colleagues who may benefit from learning more about the New Jersey tax withholding calculator.