Intro

Create a comprehensive non-profit budget template in 7 essential steps. Learn how to allocate resources, manage finances, and achieve fiscal transparency. Discover the importance of budgeting for grants, donations, and fundraising events, and ensure long-term sustainability for your organization with a well-structured budget plan.

Creating a non-profit budget template is a crucial step in managing the financial resources of a non-profit organization. A well-crafted budget template helps non-profits track income and expenses, make informed decisions, and ensure sustainability. In this article, we will guide you through the 7 essential steps to create a non-profit budget template.

Understanding the Importance of a Non-Profit Budget Template

A non-profit budget template serves as a roadmap for financial management. It helps non-profits allocate resources effectively, prioritize spending, and achieve their mission. Without a budget template, non-profits may struggle to manage their finances, leading to financial instability and decreased effectiveness.

Benefits of a Non-Profit Budget Template

A non-profit budget template offers numerous benefits, including:

- Improved financial management and planning

- Enhanced transparency and accountability

- Better decision-making and resource allocation

- Increased donor trust and confidence

- Reduced financial risk and uncertainty

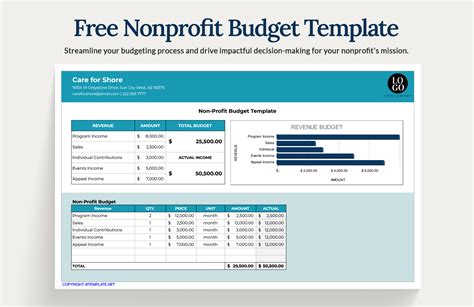

Step 1: Identify Income Sources

The first step in creating a non-profit budget template is to identify all income sources. This includes:

- Donations and grants

- Fundraising events and campaigns

- Membership fees and dues

- Sales of goods and services

- Interest income and investments

Types of Income Sources

Non-profits may have various types of income sources, including:

- Unrestricted income: available for general use

- Restricted income: designated for specific purposes or programs

- Temporary income: one-time or short-term funding

Step 2: Categorize Expenses

The second step is to categorize expenses into different categories. This includes:

- Program expenses: direct costs related to programs and services

- Administrative expenses: indirect costs related to management and operations

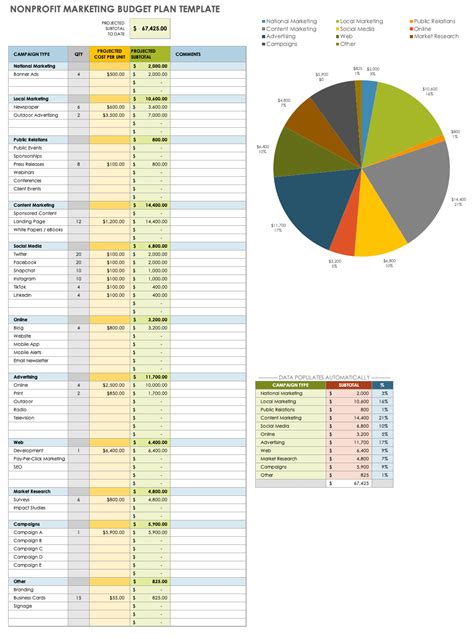

- Fundraising expenses: costs associated with fundraising events and campaigns

- Capital expenses: costs related to assets and infrastructure

Expense Categories

Non-profits may have various expense categories, including:

- Salaries and benefits

- Rent and utilities

- Travel and training

- Marketing and advertising

- Equipment and supplies

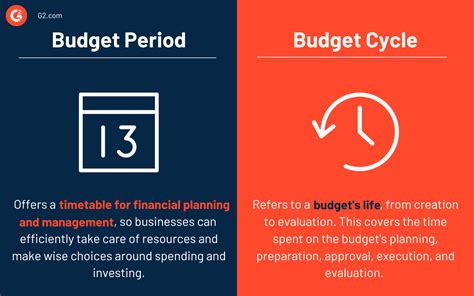

Step 3: Determine Budget Period

The third step is to determine the budget period, which is the timeframe for the budget. This can be:

- Annual budget: covers a 12-month period

- Quarterly budget: covers a 3-month period

- Monthly budget: covers a 1-month period

Budget Period Considerations

When determining the budget period, consider:

- Funding cycles and grant periods

- Program and project timelines

- Financial reporting requirements

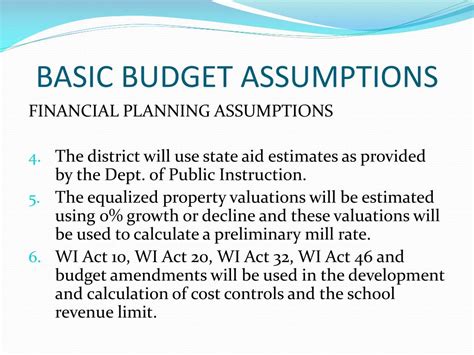

Step 4: Establish Budget Assumptions

The fourth step is to establish budget assumptions, which are the underlying assumptions that guide the budgeting process. This includes:

- Economic assumptions: inflation rates, interest rates, and market trends

- Program assumptions: program growth, participation rates, and service delivery

- Funding assumptions: funding levels, grant awards, and donor support

Budget Assumption Considerations

When establishing budget assumptions, consider:

- Historical data and trends

- Industry benchmarks and best practices

- Stakeholder input and feedback

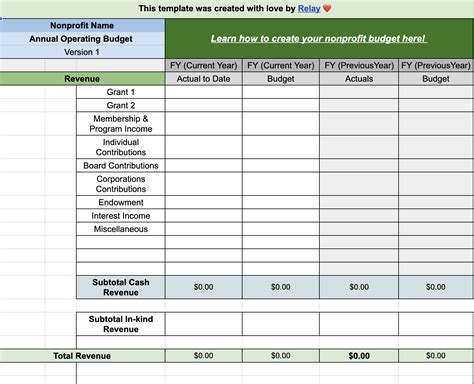

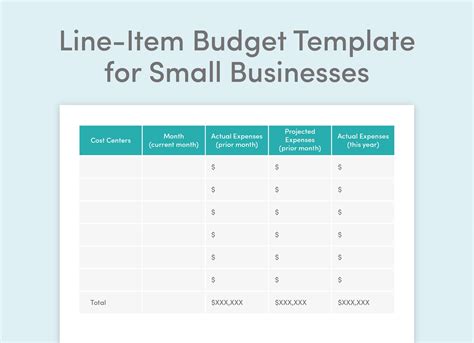

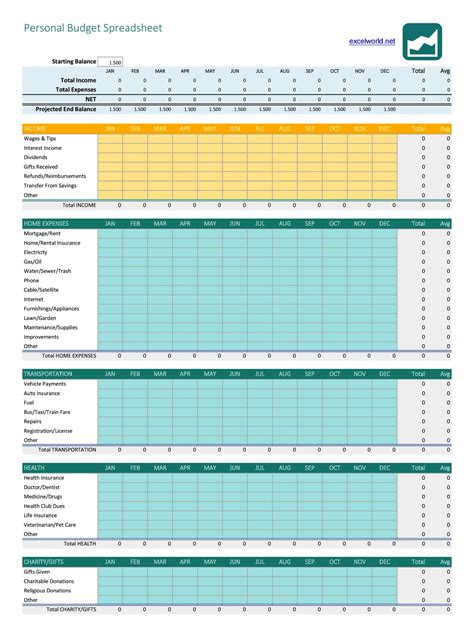

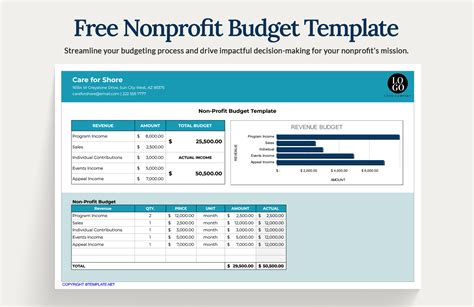

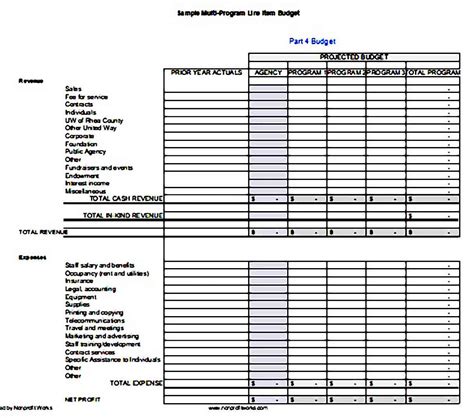

Step 5: Create Budget Line Items

The fifth step is to create budget line items, which are the specific budget categories and accounts. This includes:

- Income line items: donations, grants, and fundraising revenue

- Expense line items: salaries, rent, and program expenses

Budget Line Item Considerations

When creating budget line items, consider:

- Account structure and coding

- Budget categorization and classification

- Financial reporting requirements

Step 6: Assign Budget Amounts

The sixth step is to assign budget amounts to each line item. This involves:

- Allocating income and expenses to specific budget categories

- Establishing budget targets and goals

- Identifying budget variances and adjustments

Budget Amount Considerations

When assigning budget amounts, consider:

- Historical data and trends

- Program and project requirements

- Funding levels and grant awards

Step 7: Review and Revise Budget Template

The seventh and final step is to review and revise the budget template. This involves:

- Reviewing budget assumptions and line items

- Revising budget amounts and targets

- Ensuring budget accuracy and completeness

Budget Template Review Considerations

When reviewing and revising the budget template, consider:

- Stakeholder input and feedback

- Financial reporting requirements

- Budgeting best practices and industry standards

Non-Profit Budget Template Gallery

By following these 7 essential steps, non-profits can create a comprehensive and effective budget template that helps them manage their finances, achieve their mission, and make a positive impact in their communities.