Intro

Boost your non-profits financial stability with accurate cash flow projections. Learn 5 expert tips to create reliable forecasts, manage liquidity, and mitigate funding gaps. Discover how to leverage financial modeling, budgeting, and donor analytics to drive informed decisions and ensure long-term sustainability for your organization.

Non-profit organizations rely heavily on donations, grants, and other forms of funding to achieve their mission and objectives. However, managing cash flow is crucial to ensure the sustainability and success of these organizations. Cash flow projections are essential tools that help non-profits anticipate and prepare for future financial challenges. In this article, we will discuss the importance of cash flow projections for non-profits and provide five valuable tips to improve their financial planning.

Non-profit organizations face unique financial challenges, such as limited resources, uncertain funding, and high operational costs. Without accurate cash flow projections, non-profits may struggle to make informed decisions about budgeting, investments, and resource allocation. Effective cash flow management enables non-profits to respond to unexpected expenses, take advantage of new opportunities, and achieve their long-term goals.

Tip 1: Develop a Comprehensive Budget

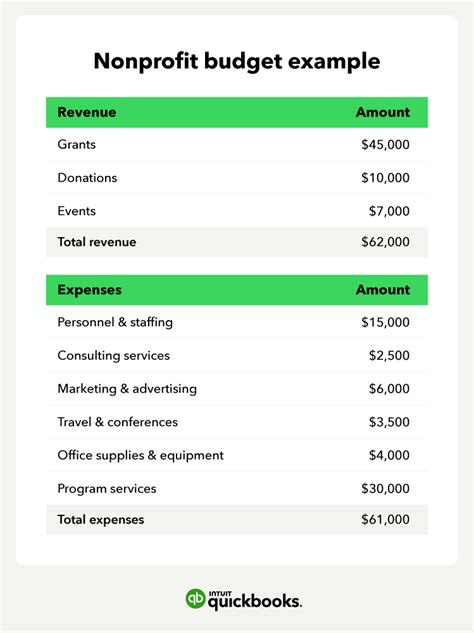

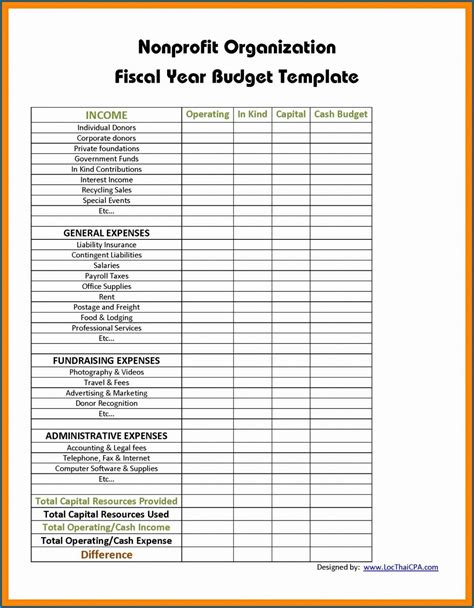

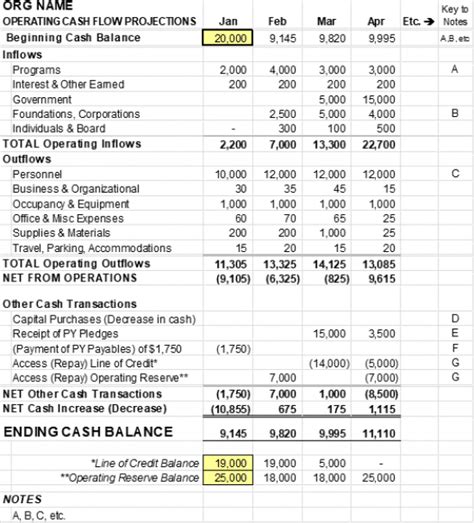

A comprehensive budget is the foundation of accurate cash flow projections. Non-profits should start by creating a detailed budget that includes all sources of income, expenses, and capital expenditures. This budget should be based on historical data, current trends, and future projections. It's essential to involve all stakeholders, including board members, staff, and volunteers, in the budgeting process to ensure that everyone is aligned with the organization's financial goals.

Tip 2: Identify and Manage Cash Flow Risks

Non-profits face various cash flow risks, such as delayed funding, unexpected expenses, and economic downturns. To mitigate these risks, non-profits should identify potential risks and develop strategies to manage them. This may include diversifying funding sources, building an emergency fund, and implementing cost-saving measures. By proactively managing cash flow risks, non-profits can reduce their financial vulnerability and ensure long-term sustainability.

Cash Flow Risk Management Strategies

- Diversify funding sources to reduce dependence on a single donor or grant

- Build an emergency fund to cover 3-6 months of operational expenses

- Implement cost-saving measures, such as reducing energy consumption or renegotiating contracts

- Develop a contingency plan to respond to unexpected expenses or revenue shortfalls

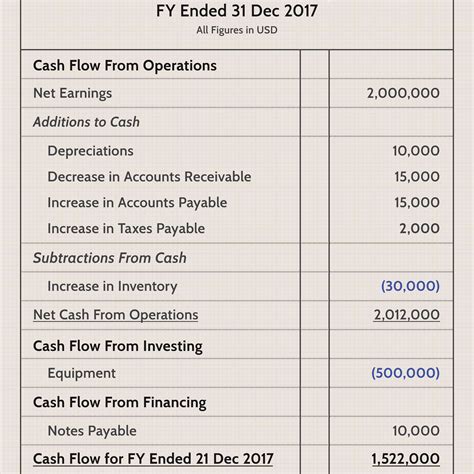

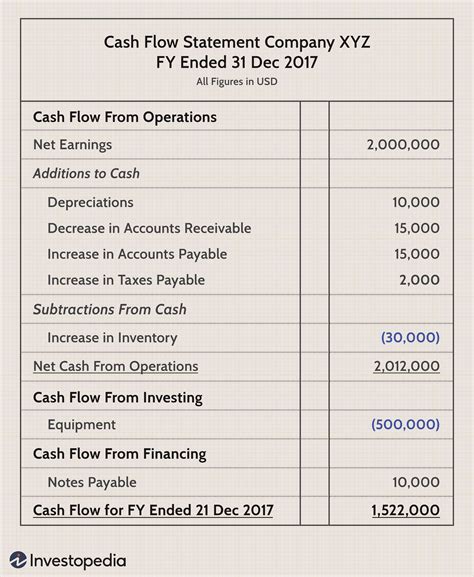

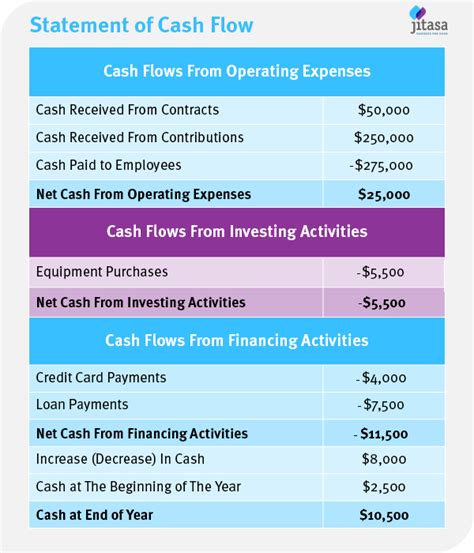

Tip 3: Monitor and Analyze Cash Flow Statements

Regularly monitoring and analyzing cash flow statements is crucial to understanding a non-profit's financial performance. Cash flow statements provide valuable insights into an organization's ability to generate cash, pay bills, and invest in new opportunities. Non-profits should review their cash flow statements regularly to identify trends, detect potential problems, and make informed decisions about budgeting and resource allocation.

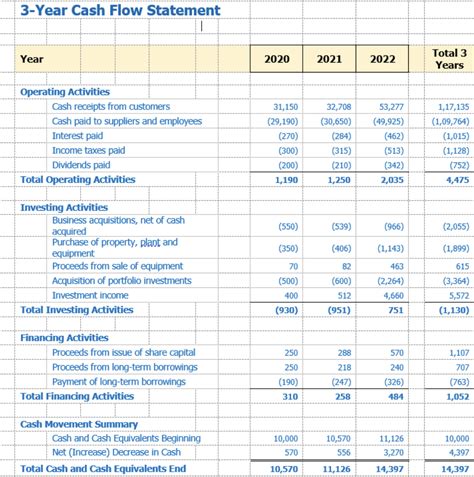

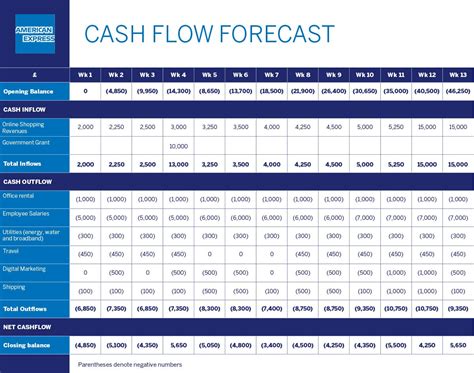

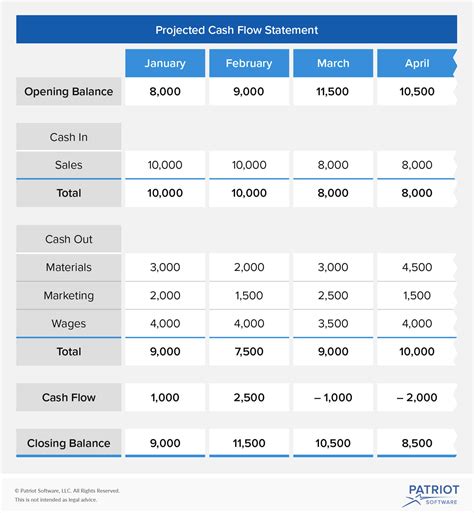

Tip 4: Forecast Cash Flow Using Different Scenarios

Forecasting cash flow using different scenarios can help non-profits prepare for various financial outcomes. This may include creating best-case, worst-case, and most-likely-case scenarios to anticipate potential cash flow challenges. By forecasting cash flow using different scenarios, non-profits can develop strategies to manage risks, capitalize on opportunities, and achieve their financial goals.

Cash Flow Forecasting Scenarios

- Best-case scenario: assumes optimal funding, low expenses, and high investment returns

- Worst-case scenario: assumes reduced funding, high expenses, and low investment returns

- Most-likely-case scenario: assumes moderate funding, average expenses, and moderate investment returns

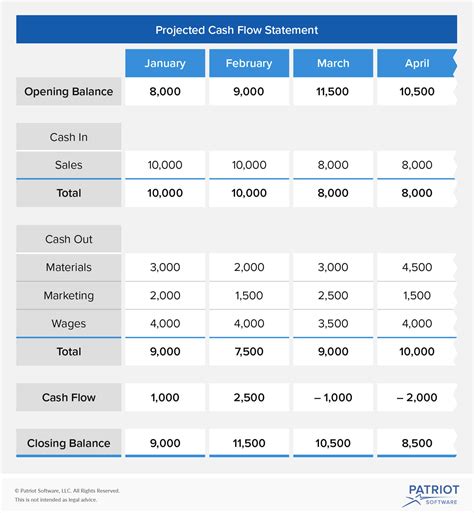

Tip 5: Review and Update Cash Flow Projections Regularly

Cash flow projections should be reviewed and updated regularly to reflect changes in a non-profit's financial situation. This may include updating budget assumptions, revising funding projections, and adjusting for changes in expenses or capital expenditures. By regularly reviewing and updating cash flow projections, non-profits can ensure that their financial plans remain relevant and effective.

Gallery of Non-Profit Cash Flow Management

Non-Profit Cash Flow Management Image Gallery

By following these five tips, non-profits can improve their cash flow projections and achieve long-term financial sustainability. Remember to regularly review and update your cash flow projections to reflect changes in your organization's financial situation. With accurate and reliable cash flow projections, non-profits can make informed decisions, manage risks, and achieve their mission and objectives.