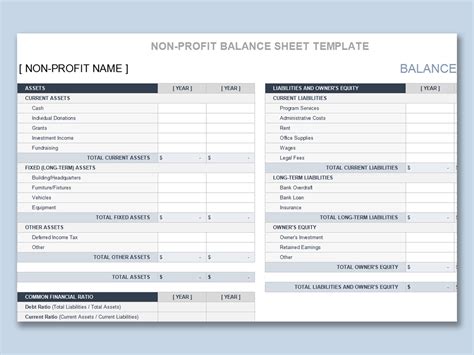

Nonprofit organizations rely heavily on effective financial management to achieve their goals and maintain transparency. A crucial tool in this endeavor is the balance sheet, which provides a snapshot of an organization's financial position at a specific point in time. To help nonprofit organizations create and manage their balance sheets efficiently, utilizing a nonprofit balance sheet template in Excel can be particularly beneficial. Here, we'll explore the components of a nonprofit balance sheet, discuss the importance of each section, and provide an example of how to create a simple nonprofit balance sheet template in Excel.

Understanding the Nonprofit Balance Sheet

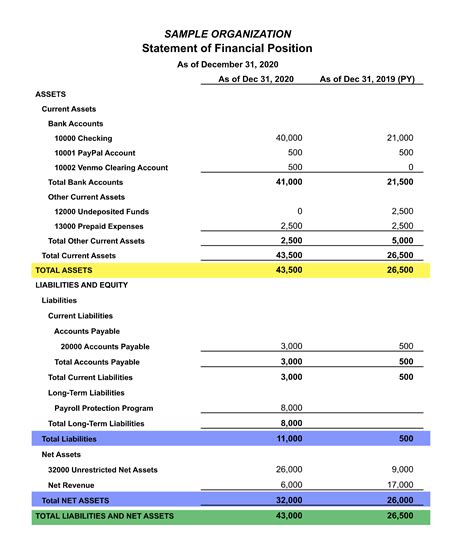

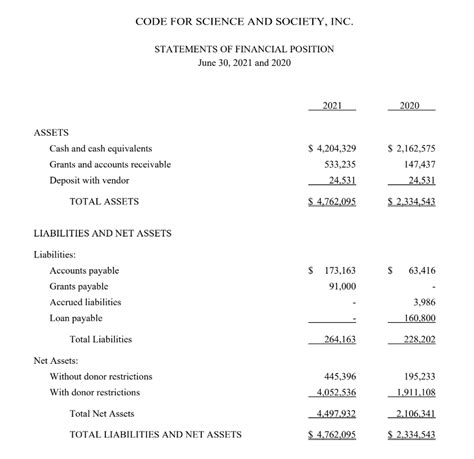

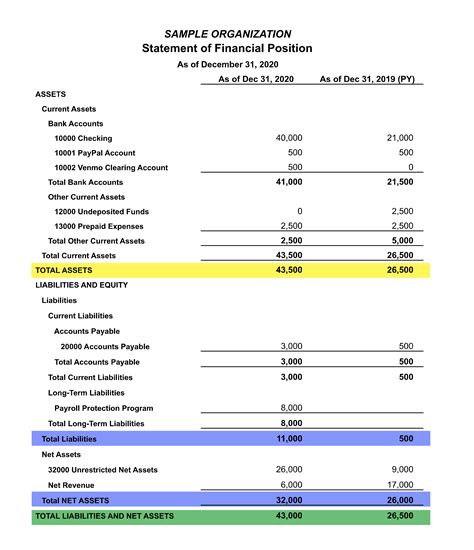

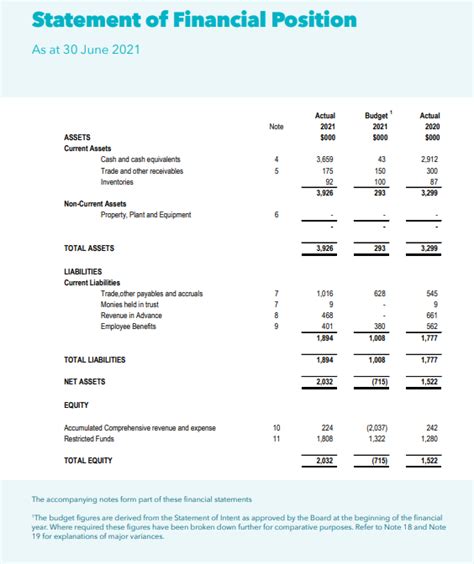

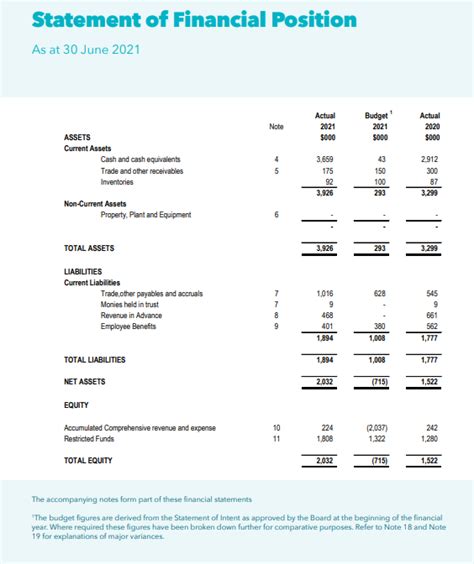

A nonprofit balance sheet, like any other balance sheet, is structured into three main categories: assets, liabilities, and net assets (or equity). Each of these sections provides valuable insights into the financial health and capabilities of the nonprofit organization.

Assets

Assets are resources owned or controlled by the nonprofit organization, expected to provide future economic benefits. Common types of assets include:

- Current Assets: Cash, accounts receivable, inventory, and prepaid expenses. These are assets that can be converted into cash within one year.

- Non-Current Assets: Long-term investments, property and equipment, and intangible assets. These assets take longer than a year to convert into cash.

Liabilities

Liabilities are the organization's debts or obligations. They represent amounts owed to others, which must be paid or settled. Common types of liabilities include:

- Current Liabilities: Accounts payable, short-term loans, and accrued expenses. These are liabilities that must be paid within one year.

- Non-Current Liabilities: Long-term loans and bonds payable. These liabilities take longer than a year to settle.

Net Assets (Equity)

Net assets, often referred to as equity in for-profit entities, represent the residual interest in the nonprofit organization after deducting liabilities from assets. Net assets are classified into two categories:

- Without Donor Restrictions: These are net assets that are not subject to donor-imposed restrictions.

- With Donor Restrictions: These are net assets that are subject to donor-imposed restrictions, which may limit their use to specific purposes.

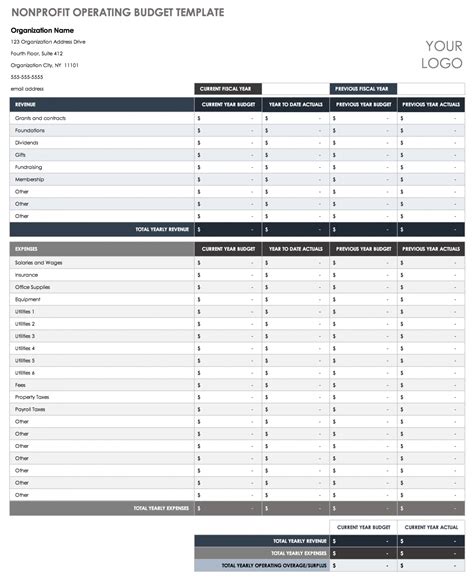

Creating a Nonprofit Balance Sheet Template in Excel

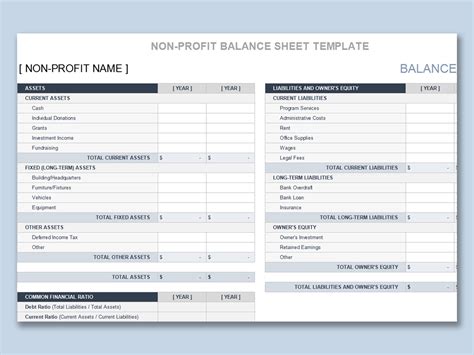

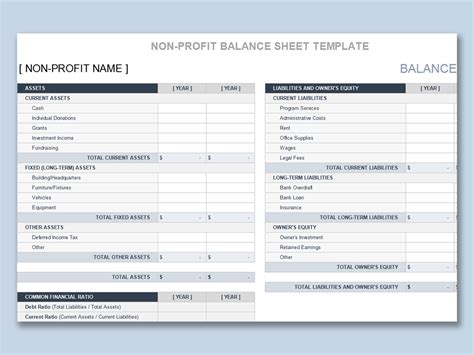

Excel offers a flexible and powerful platform for creating and managing a nonprofit balance sheet template. Here's a step-by-step guide to creating a basic template:

-

Set Up Your Worksheet: Open Excel and create a new workbook. Give your worksheet a title, such as "Nonprofit Balance Sheet."

-

Create Headers: In the first row, create headers for each section: "Assets," "Liabilities," and "Net Assets." Use columns to separate these sections.

-

Detail Assets Section:

- In the "Assets" section, list current assets followed by non-current assets. Use subheadings for each type of asset (e.g., "Cash," "Accounts Receivable," "Property and Equipment").

- Assign a column for each asset type to list the amounts.

-

Detail Liabilities Section:

- Similarly, in the "Liabilities" section, list current liabilities followed by non-current liabilities. Use subheadings for each type of liability (e.g., "Accounts Payable," "Short-term Loans").

- Assign a column for each liability type to list the amounts.

-

Detail Net Assets Section:

- In the "Net Assets" section, list "Without Donor Restrictions" and "With Donor Restrictions." Provide columns for the amounts of each.

-

Calculate Totals:

- Use Excel formulas to calculate the totals for each section. For example, use the

SUMfunction to add up all the assets, liabilities, and net assets. - Ensure that the totals for assets equal the totals for liabilities plus net assets, as per the accounting equation: Assets = Liabilities + Net Assets.

- Use Excel formulas to calculate the totals for each section. For example, use the

-

Format for Readability:

- Use Excel's formatting options to make your balance sheet more readable. This includes using borders, shading, and font sizes to distinguish between sections and totals.

-

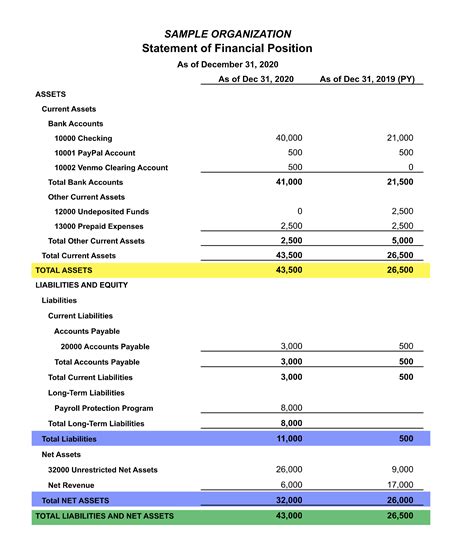

Example of a Simple Nonprofit Balance Sheet Template:

| **Assets** | **Amount** |

|------------|------------|

| **Current Assets** | |

| Cash | $10,000 |

| Accounts Receivable | $5,000 |

| **Non-Current Assets** | |

| Property and Equipment | $50,000 |

| **Total Assets** | **$65,000** |

| **Liabilities** | **Amount** |

|----------------|------------|

| **Current Liabilities** | |

| Accounts Payable | $5,000 |

| **Non-Current Liabilities** | |

| Long-term Loans | $20,000 |

| **Total Liabilities** | **$25,000** |

| **Net Assets** | **Amount** |

|----------------|------------|

| Without Donor Restrictions | $30,000 |

| With Donor Restrictions | $10,000 |

| **Total Net Assets** | **$40,000** |

Gallery of Nonprofit Balance Sheet Templates

Nonprofit Balance Sheet Template Images

Invitation to Engage

Creating and managing a nonprofit balance sheet template in Excel is a valuable skill for any nonprofit professional. It not only enhances financial transparency and accountability but also aids in making informed decisions that drive the organization towards its mission. Whether you're an experienced accountant or new to nonprofit finance, there's always room to improve your skills and knowledge. Share your experiences or ask questions about creating and using nonprofit balance sheet templates in the comments below.