Intro

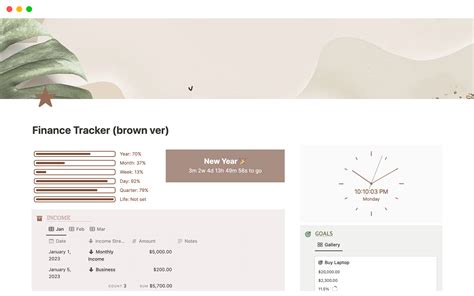

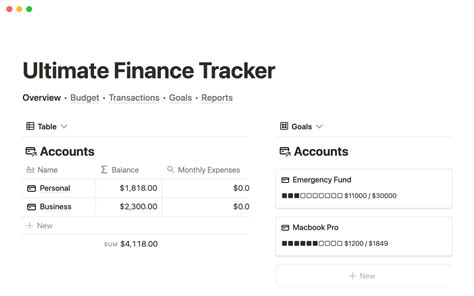

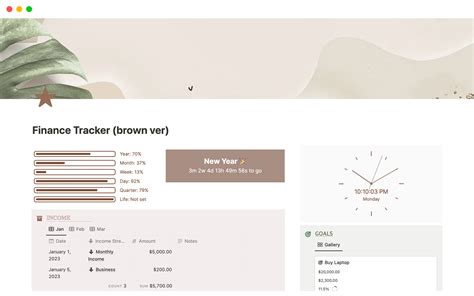

Streamline your financial management with a customizable Notion template for finance tracking. Easily track expenses, income, and budgets in one intuitive dashboard. Perfect for personal finance, budgeting, and expense tracking, this template simplifies financial organization and analysis, making it easy to stay on top of your money and achieve financial clarity.

In today's digital age, managing one's finances effectively has become more crucial than ever. With the rise of online banking, mobile payments, and digital wallets, keeping track of expenses, income, and savings can be overwhelming. This is where a well-designed Notion template for finance tracking can make a significant difference. By leveraging the power of Notion, individuals can create a personalized financial dashboard that streamlines their money management process.

Creating a financial tracking system from scratch can be a daunting task, especially for those without prior experience. However, with a pre-designed Notion template, users can jumpstart their financial organization journey without needing to start from a blank slate. A well-crafted template can help individuals set financial goals, monitor spending, and make informed decisions about their money.

Benefits of Using a Notion Template for Finance Tracking

Using a Notion template for finance tracking offers numerous benefits, including:

- Streamlined financial management: A Notion template provides a structured framework for organizing financial data, making it easier to track income, expenses, and savings.

- Customization: Notion templates can be tailored to suit individual financial needs, allowing users to focus on specific areas, such as budgeting, investing, or debt management.

- Increased productivity: By automating financial tracking, users can save time and reduce stress associated with manual data entry and spreadsheet management.

- Improved financial literacy: A Notion template can help individuals better understand their financial situation, identify areas for improvement, and make data-driven decisions.

Key Components of a Notion Template for Finance Tracking

A comprehensive Notion template for finance tracking should include the following key components:

- Income tracking: A section for recording income from various sources, including salaries, investments, and freelance work.

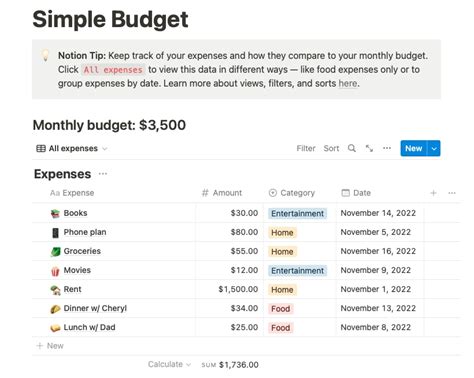

- Expense tracking: A section for logging expenses, including categories for housing, transportation, food, and entertainment.

- Budgeting: A section for setting financial goals and allocating funds to specific categories.

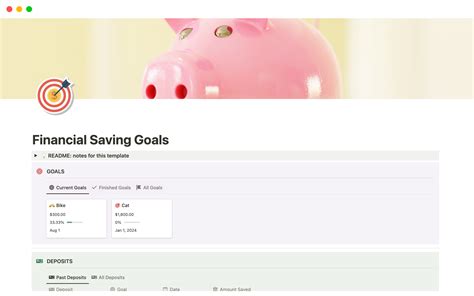

- Savings tracking: A section for monitoring savings progress and setting targets for short-term and long-term goals.

- Investment tracking: A section for tracking investments, including stocks, bonds, and retirement accounts.

Step-by-Step Guide to Creating a Notion Template for Finance Tracking

Creating a Notion template for finance tracking is a straightforward process that can be completed in a few steps:

- Sign up for Notion: If you haven't already, create a Notion account and familiarize yourself with the platform's interface.

- Choose a template: Browse Notion's template gallery or search for pre-made finance tracking templates to use as a starting point.

- Customize the template: Tailor the template to suit your financial needs by adding or removing sections, pages, and fields.

- Set up tracking pages: Create separate pages for income, expenses, budgeting, savings, and investments, using tables, Kanban boards, or calendars to visualize data.

- Link pages and databases: Connect pages and databases to create a seamless workflow and enable effortless data transfer.

- Test and refine: Test your template, identify areas for improvement, and refine the system as needed.

Best Practices for Using a Notion Template for Finance Tracking

To get the most out of your Notion template for finance tracking, follow these best practices:

- Regularly update data: Make it a habit to log income, expenses, and savings regularly to maintain an accurate picture of your financial situation.

- Review and adjust: Periodically review your financial progress, adjust budgeting allocations, and make adjustments as needed.

- Use automation: Leverage Notion's automation features to streamline tasks, such as automatically logging recurring expenses or transferring funds to savings accounts.

- Explore integrations: Consider integrating your Notion template with other financial tools, such as budgeting apps or investment platforms, to expand its capabilities.

Conclusion

A well-designed Notion template for finance tracking can revolutionize the way individuals manage their finances. By providing a structured framework for organizing financial data, automating tasks, and enabling data-driven decision-making, a Notion template can help users achieve financial stability, reduce stress, and achieve their long-term financial goals.

Finance Tracking Notion Template Image Gallery